The Pros and Cons of Automated Forex Trading: Is It Right for You?

Watching the screen constantly and battling emotions like fear and greed can drain you. You can change this by choosing automated Forex trading. This method relies on software or Forex robots that handle trades based on set rules. They follow your instructions precisely and make split-second decisions without hesitation. Many traders like it because it is fast and allows you to stick to your plan without letting feelings get in the way. However, traders who like full control still prefer manual trading. E8 Markets will show you the pros and cons of automated Forex trading to help you decide whether it is the right approach for you.

What are Automated Forex Trading Systems?

Automated trading is a method where software handles buying and selling in the Forex market based on pre-set rules. Instead of trading manually, you use the Forex automation system to execute trades and follow your chosen strategy. This way, trading happens automatically without constant input from you.

Automated Forex trading systems come in different types, each with unique features. Here are the main types to know:

- Fully automated systems – These systems handle everything from start to finish. Once you set the rules, the algorithmic trading Forex system executes trades entirely on its own. You don’t need to intervene.

- Semi-automated systems – With semi-automated systems, the software gives you trading signals or suggestions, but you still have to decide whether to act on them. This gives you more control, but it’s less hands-off than fully automated Forex trading systems.

- Trading Forex robots – These programs, also called Forex expert advisors (EAs), execute trades based on your pre-set instructions. Forex robots let you automate specific strategies without needing to monitor the market 24/7.

- Social and copy trading platforms – Social and copy trading platforms allow you to copy the trades of experienced traders automatically. These systems don’t require you to create your own strategy, as they follow the actions of another trader.

How Automated Forex Trading Systems Operate

There are some steps you will take to make automated Forex trading systems work. You will:

- Input your strategy. You start by choosing a trading strategy. This strategy sets the rules that tell the system when to buy or sell.

- Code the strategy. Next, the strategy is coded into the trading software. Some platforms offer tools that make this easier, so you don’t need advanced programming skills.

- Backtest the strategy. Before going live, test your strategy on past market data in a step called backtesting. This shows how the strategy might have performed in real situations.

- Implement live trading. Once you’re satisfied with the backtesting, the algorithmic trading Forex system is ready to trade live. It watches the market and makes trades based on the rules you set.

Advantages of Automated Forex Trading

There are many benefits of automated Forex trading. Some of the most important are:

- Continuous 24/7 operation

- Emotion-free decision-making

- Backtesting capabilities

- Faster reaction to market changes

- Scalability and diversification

Continuous 24/5 Operation

The Forex market is open 24 hours a day, five days a week, with trading sessions in different time zones across the globe. These sessions include the Asian, European, and North American markets, each with unique trading opportunities. Automated trading systems take advantage of this by staying active around the clock. Once your trading rules are set up, the Forex trading robots will monitor the market and execute trades at any hour, whether you’re asleep, at work, or simply away from your computer.

Also, automated trading provides you with a hands-free approach. You don’t have to be tied to your screen to monitor the market constantly. This is among the main benefits of automated Forex trading. After you design a trading plan, the Forex expert advisors (EAs) do that for you. This means it places trades whenever the conditions match your strategy. This feature is helpful not only for busy traders but also for those who may find it difficult to react quickly in a fast-moving market. By allowing the automated Forex trading system to handle trades for you, you can avoid the stress and time commitment often associated with manual trading.

Emotion-Free Decision-Making

Emotions like fear, greed, or impatience can affect your decisions. They often lead to inconsistent results. For example, fear might cause you to exit a profitable trade too early. Greed might lead you to stay in a losing trade too long, as you hope it will turn around. Automated trading removes these emotional responses and executes trades strictly based on your pre-set rules. The algorithmic trading Forex system does not react to market fluctuations with anxiety or excitement. Instead, it relies purely on data. You will not have to deal with trading psychology and handle your emotions. Rather, you will stick to a clear plan. This way, you are less likely to second-guess yourself or panic during unexpected market shifts.

Backtesting Capabilities

Backtesting is a powerful tool that uses historical data to show how your strategy might have worked in the past. Automated trading systems make this easy by running your strategy through years of past price movements. For instance, if you are testing a breakout strategy, backtesting shows how it would have responded to previous market conditions. Backtesting also helps identify flaws or weaknesses in a strategy. If a strategy performs poorly during backtesting, it’s a sign that adjustments are needed before going live.

Also, backtesting lets you tweak specific parts of your strategy for better performance. For example, you can adjust parameters like stop-loss orders, trade size, or entry points to see which settings produce the most favorable results.

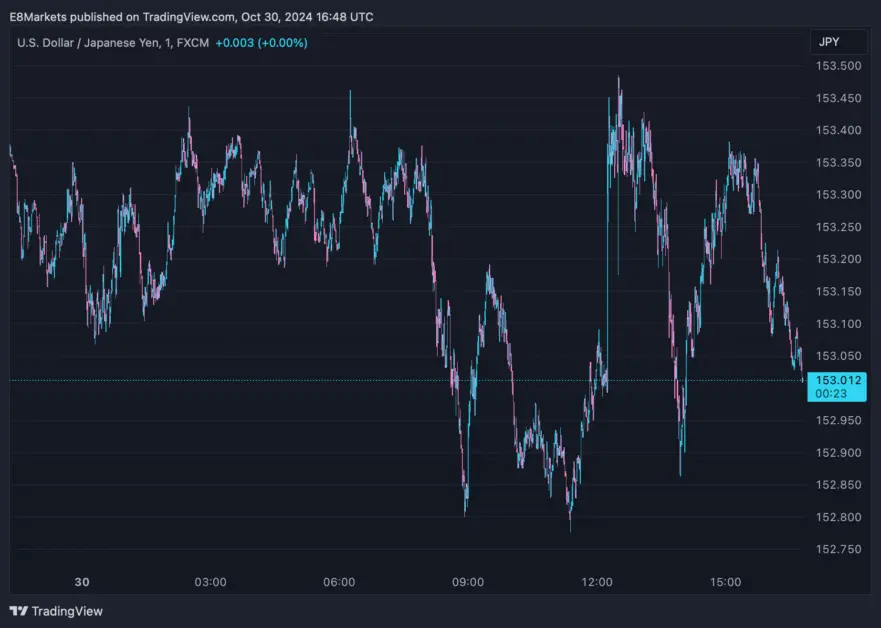

Faster Reaction to Market Changes

Automated systems execute trades in milliseconds. This is one of the key benefits of automated Forex trading. It responds instantly to any changes in the market. This is particularly valuable when trading currencies during volatile events like economic reports or interest rate changes, where prices can shift dramatically in seconds. This speed is also useful when trading multiple pairs. If your strategy involves quick entries and exits across different pairs, automated trading handles all of them simultaneously.

Also, you will have advantages in high-volatility situations. For example, when prices swing rapidly, you might hesitate and miss an opportunity. On the other hand, Forex expert advisors (EAs) trade at predefined levels without hesitation. Automated Forex trading systems are particularly well-suited for news-based or event-driven strategies, where market reactions to events like central bank announcements or geopolitical developments can be sudden. In high-volatility conditions, this instant response can capture short-term movements that you might miss manually.

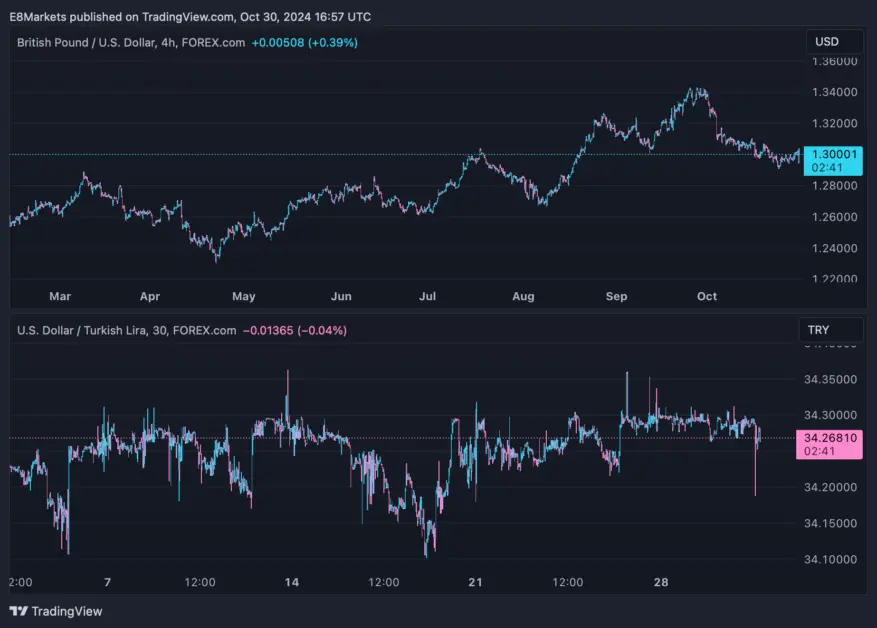

Scalability and Diversification

Automated Forex trading systems allow you to diversify your trading by running multiple strategies at once. For example, you could use a trend-following strategy on one currency pair while using a scalping strategy on another. By diversifying strategies, you are not relying solely on one approach, which reduces the impact of losses if a single strategy underperforms. This approach is ideal if you want to spread your trades across multiple pairs.

When you trade multiple currency pairs and strategies, you are less exposed to the risks associated with any one currency or approach. If one strategy faces losses due to specific market conditions, the others might still perform well. This will balance out your portfolio.

Disadvantages of Automated Forex Trading

There are both pros and cons of Forex robots. The cons

- Potential over-optimization (curve-fitting)

- Need for regular monitoring

- Technical complexity and setup requirements

- Reduced flexibility in market adaptation

Potential Over-Optimization (Curve-Fitting)

Over-optimization, or curve-fitting, happens when you adjust your strategy excessively to perform well on historical data. This might mean tweaking parameters to the point where the strategy “fits” past price movements perfectly. While this can make the strategy look highly successful in backtesting, it often leads to failure in live trading because the strategy has been tailored so specifically to past conditions that it can’t adapt to new market changes.

A highly optimized strategy may give you a false sense of security, as backtesting can make the strategy appear foolproof. However, good results in historical data don’t guarantee success in live markets. When a strategy performs perfectly on past data, it’s often because it has been adjusted to match those specific conditions.

Need for Regular Monitoring

Despite its automatic nature, automated trading is not a “set-and-forget” approach. Market conditions change constantly, and a strategy that works well one day may perform poorly the next due to factors like shifts in volatility or economic uncertainty. Therefore, you still need to monitor it. For instance, if market conditions suddenly become highly volatile, your automated system might need manual adjustments to avoid losses.

Technical Complexity and Setup Requirements

To perform well, automated Forex trading systems need a reliable setup. This often includes a stable server connection and ongoing software maintenance. You need regular updates to keep it running smoothly. Setting up and using an Algorithmic trading Forex system involves more than simply plugging in a strategy. Also, you need a good grasp of how to configure settings, apply trading rules, and monitor performance. If you are new to trading, this learning curve can feel steep as you are managing both technical and strategic aspects.

Reduced Flexibility in Market Adaptation

Automated systems rely on data and rules, so they lack the intuition that human traders might have in unpredictable situations. For example, Forex expert advisors (EAs) may not recognize sudden market changes caused by unexpected news or global events, which could impact prices drastically. You might use economic indicators, interpret these events quickly, and adjust your approach, but an automated system will continue to follow its set rules without adapting. For instance, if a sudden spike or dip in the market occurs, Forex trading robots may react according to the predefined settings, even if it’s not the best decision at that moment.

Is Automated Forex Trading Right for You?

Automated Forex trading is not suitable for everybody. Are you asking, “Is automated Forex trading right for me?” These questions will help you determine if it aligns with your needs and goals:

- Are you comfortable with technology? Forex automation involves using software, configuring settings, and sometimes even troubleshooting technical issues. If you enjoy working with technology and learning new tools, automation might be a good fit.

- Do you have a clear trading plan? Automated Forex trading systems rely on well-defined strategies. If you’re confident in your trading plan and understand how it performs in various conditions, Forex robots can execute it consistently.

- Can you stay disciplined with manual trading? You need discipline to be a successful trader. If sticking to a strategy is difficult due to emotional trading, Forex automation can help by removing emotions from decisions.

- Are you ready for ongoing learning and system maintenance? Automated trading requires monitoring and adapting to new market conditions and updates. If you’re willing to keep learning, you’re likely to find success with automation.

- Are you comfortable letting the system make decisions on its own? With automated trading, you won’t have hands-on control over every trade. If you’re comfortable trusting the system to follow your plan without constant adjustments, Forex automation could work well for you.

Choose Your Trading Style and Hit Your Targets

If you prefer a hands-off approach, have a clear trading plan, and want a system that runs around the clock without emotion, automated trading might be right for you. Forex automation can help you stick to your strategy, trade multiple pairs, and free up your time. However, if you value flexibility and want to make adjustments based on market news, manual trading could be a better fit. If you choose automated trading, remember that it’s not a “set-and-forget” solution. Be sure to monitor your system regularly and use solid risk management practices. With a reliable plan, ongoing maintenance, and sound risk control, automated trading can help you reach your trading goals.

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.