Fundamental Analysis: ECB Rate Decision Ahead

Good Morning, E8 Markets traders! Welcome to your weekly deep dive into fundamental analysis, where we dissect the economic events and data that shaped the FX market last week and shine a spotlight on what lies ahead. Prepare to uncover how these developments could potentially influence your trading strategies and sway currency movements.

Last Week’s Highlight

The euro, after a brief stumble following right-wing election wins in the EU, regained its bullish momentum. This rebound was catalyzed by Macron’s win of the snap election, reassuring markets and returning the euro to its pre-election strength. It was a testament to how quickly political events can shift market sentiment and currency valuations.

Meanwhile, across the Atlantic, the US dollar experienced a mid-term reversal as US inflation showed signs of cooling down, exceeding market expectations. June’s price index unexpectedly declined, marking the first drop since May 2020. This significant shift in the inflation landscape has heightened the probability of a rate cut in September to an impressive 90%, according to the FED watch tool. As a result, the dollar depreciated as investors adjusted their expectations for future monetary policy.

Shifting our focus to the UK, we witnessed a remarkable turn of events as the British economy outperformed expectations. May’s economic growth figures exceeded forecasts, primarily fueled by robust performances in the retail, wholesale, and construction sectors. This positive economic data served as a significant tailwind for the pound, propelling it to become the strongest currency of the week. It’s a clear demonstration of how economic fundamentals can drive currency strength and create opportunities for traders.

Now, let’s delve into the economic events on the horizon this week and explore how they could shape the currency market landscape in the coming days.

FED Chair Jerome Powell Discussion (Monday)

While today’s economic calendar might seem relatively light, with important data from China already released, traders will be keenly attuned to FED Chair Jerome Powell’s participation in a discussion at the Economic Club of Washington, D.C. This event, scheduled for 5:30 pm London time, could provide valuable insights into the Chairman’s thoughts on the US economy and the future trajectory of FED policy actions. While the discussion itself promises to be engaging, traders will be particularly interested in any nuanced commentary that could offer clues about potential interest rate decisions and other monetary policy maneuvers.

Canadian Inflation and US Retail Sales (Tuesday)

Tuesday will bring forth crucial data regarding inflation developments in Canada. The annual inflation rate in Canada rose to 2.9% in May, exceeding market expectations of a slowdown to 2.6%. This unexpected rise in inflation poses a challenge to earlier predictions of continued monetary policy easing by the Bank of Canada. While there are currently no signals of an immediate rate cut in the upcoming bank meeting, a substantial slowdown in inflation below 2.5% could rekindle speculation about further easing in the second half of the year. Such a move could trigger further depreciation of the Canadian dollar. Conversely, if inflation climbs back above 3%, signaling stickiness, the market might anticipate a more cautious approach from the BoC, potentially leading to a short-term upside volatility in the Canadian dollar.

Simultaneously, the latest data on retail sales in the United States will be unveiled, providing a snapshot of consumer behavior in the world’s largest economy. These figures are among the few indicators that offer hints about potential GDP data. A strong showing in retail sales could bolster confidence in the US economy and potentially strengthen the dollar.

UK Consumer Price Index and Labor Market Data (Wednesday and Thursday)

The development of prices in the UK will be of paramount importance to the Bank of England for several reasons. First, the BoE has yet to deliver a rate cut to provide relief for the economy and its consumers, especially considering that the annual inflation rate in the UK slowed to 2% in May, the lowest since July 2021. In its last meeting, the Bank of England decided to maintain the Bank Rate at 5.25%, with some policymakers noting that the decision not to cut was “finely balanced.”

With recent economic indicators showing a return of inflation to the 2% target and GDP growth exceeding expectations, the BoE may have room to keep rates unchanged at their next meeting on August 1st. Such a scenario would be even more likely if this week’s inflation data significantly exceeds the market consensus of 2%, potentially pushing the pound even higher. Conversely, more stable inflation figures could lead to expectations of more dovish members advocating for a rate cut, potentially reversing the pound’s recent promising performance.

Further insights into the UK economy will be provided by labor market data on Thursday. The unemployment rate rose to 4.4% from February to April 2024, exceeding market forecasts. While the MPC acknowledges a looser labor market, it remains committed to maintaining a restrictive monetary policy until inflation risks diminish sustainably.

ECB Interest Rate Decision (Thursday)

While the ECB is expected to maintain its benchmark rate unchanged at 4.25% in its upcoming monetary policy meeting, market participants will be paying close attention to the bank’s commentary for clues about future policy direction. In their last meeting, ECB policymakers expressed doubts about the pace of the Euro Area recovery and the convergence of inflation to the 2% target by 2025.

Given the recent flash inflation rate data at the start of this month, it’s highly anticipated that the ECB will maintain a slightly hawkish stance on monetary policy and refrain from delivering a rate cut in this meeting. The ECB is also likely to keep a watchful eye on the FED’s monetary decisions, aiming to avoid the depreciation of the euro against the dollar. If Christine Lagarde delivers a speech similar in tone to the last one, the euro might continue its current bullish momentum fueled by the re-election in France.

In conclusion, this week promises a wealth of economic data and events that could significantly impact the FX market. By staying informed about these fundamental developments and their potential impacts, you’ll be well-prepared to navigate the complexities of the currency landscape and optimize your trading strategies. Keep an eye on the evolving economic narrative, and as always, successful trading!

E8X Dashboard

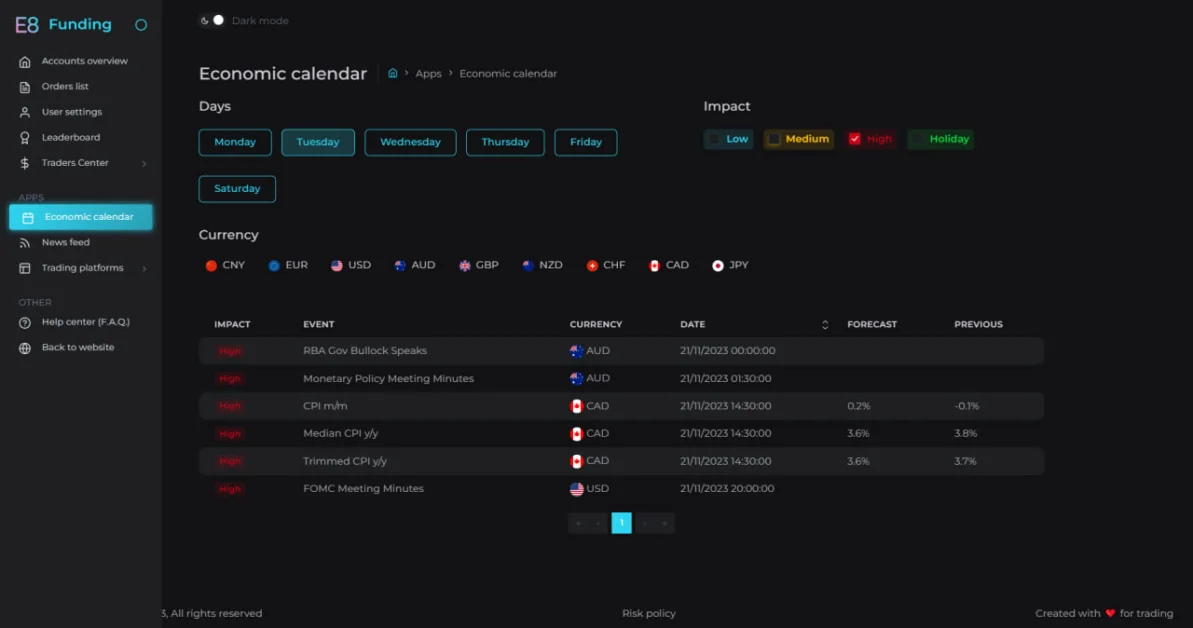

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.