The Trader’s Toolbox: Mastering the Economic Calendar

In the previous episode, we discussed the basics of Fundamental Analysis in Forex Trading, exploring the core principles of this approach and the significance of monitoring the economic calendar. Now, we’re set to delve further into the calendar, a critical tool favored by traders for obtaining insights on forthcoming data and events that influence the markets.

By the end of this article, you will gain a comprehensive understanding of how to leverage the economic calendar to enhance your trading strategies. You’ll learn to track vital economic events and analyze the data to make decisions based on well-informed evaluations of how these releases might sway market trends.

What is an Economic Calendar?

An economic calendar is a tool that outlines important economic events likely to affect the financial markets, such as stock, forex, and commodities. It provides essential information on when these events will occur, what they entail, and how much they might influence the market.

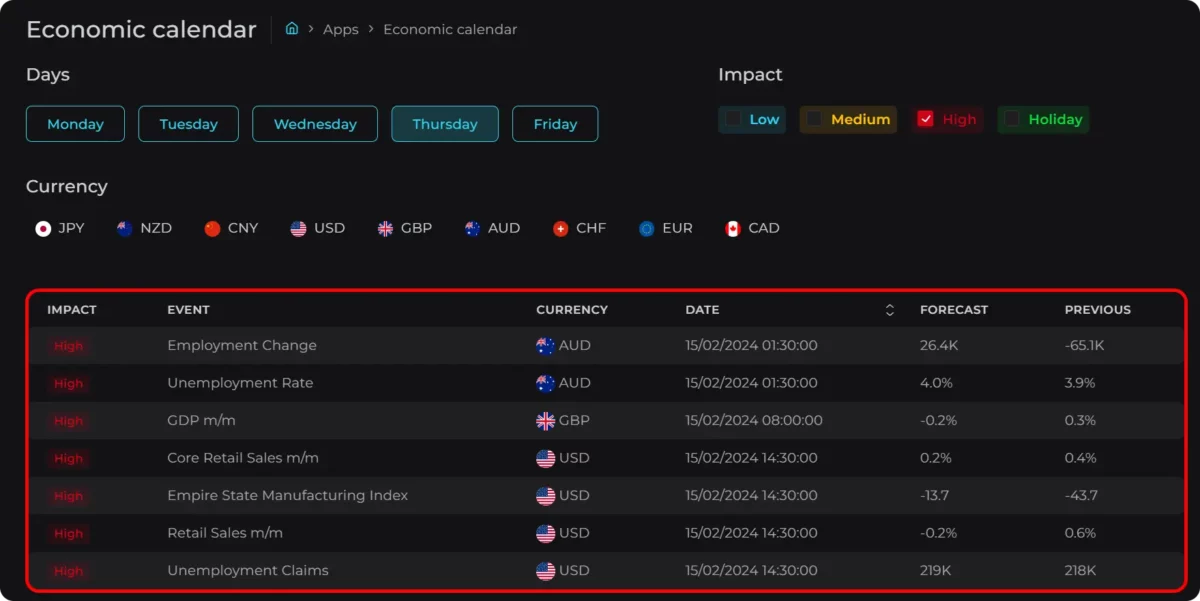

A standard economic calendar includes common features, but specific details can differ according to the provider. The E8X Economic Calendar equips traders with the following information:

Impact – Provides insights into the significance of each event, categorizing them by their potential impact. Certain events might trigger significant market shifts due to their monumental importance, while others may not immediately influence market dynamics but could have implications for long-term developments.

The E8X Economic Calendar organizes market impact levels into three distinct categories: Low (Blue), Medium (Yellow), and High (Red).

Event – The nature of upcoming events, such as economic data releases, monetary policy updates, or significant announcements, provides clarity and context for traders.

Currency – The classification of events in our calendar is based on the currency impacted by the data release, rather than the country itself. This approach is due to the direct influence such releases have on the respective currency’s value, leading to our decision to focus on currencies for a more targeted filtering.

Date & Time – Arrange key events chronologically, detailing their specific dates and times. This feature enables traders to organize and align their strategies with upcoming economic releases.

Forecasted & Previous Value – Presents both the historical figures from the last announcement and the forecasts (also known as the Consensus), which are the expectations set by analysts and experts for the upcoming release.

Economic Calendar in E8X Dashboard

What Do Economic Calendars Include?

Economic calendars provide schedules and details on various influential events and announcements. They typically feature several main data categories, such as:

- Economic Indicators: This section includes essential analyses like GDP growth, unemployment figures, inflation rates, consumer spending patterns, industrial outputs, and housing market trends. Such indicators shed light on the overall economic health and prospects, potentially leading to significant movements in the financial markets.

- Central Bank Policy Decisions: Insights into changes in interest rates, adjustments in fiscal and monetary policy, and perspectives on economic forecasts issued by major central banks, including the Federal Reserve, European Central Bank, and Bank of England, play a critical role. Such announcements can influence market movements on a worldwide scale.

- Speeches by Central Bankers: Public addresses and comments made by authorities like central banks’ leaders, board members, and finance ministers are anticipated for insights into upcoming policy shifts. The market pays close attention to their economic assessments.

- Geopolitical Events: Factors such as elections, major international meetings, legislative amendments, and geopolitical tensions play a crucial role in shaping global market sentiment and asset flow.

Regularly monitoring these influential categories through economic calendars provides valuable insights, allowing for strategic actions against market volatility linked to these crucial events. By effectively managing risk, your strategy is positioned to seize opportunities from swift market movements.

For a deeper dive into the core principles of Fundamental Analysis, check out the first part of our FA Series.

Why To Use E8X Economic Calendar?

Taking a moment each day to review the Economic Calendar is a small investment of time that can significantly enhance your trading strategy. Here’s a look at several advantages to underline its importance.

- Planning for Future Events. To maximize your chances of success in trading, you should stay updated with key announcements and global events through the economic calendar, ideally starting each day with a review. Active engagement with the calendar, especially if trading specific currency pairs, alerts you to potential market-moving events impacting those currencies. This tool offers a broad view of the market’s macroeconomic landscape, highlighting critical factors like inflation and employment figures that influence central bank decisions, aiding in anticipation of possible rate changes.

- Risk Management: This fundamental component of trading, should be integrated into every trader’s strategy. The economic calendar serves as a critical tool for identifying potential high-volatility events before they occur, enabling you to tailor your trading plan without unnecessary complexity. Implementing a well-defined exit strategy can eventually reduce risk exposure. Therefore, in the event of a significant market event leading to a high momentum, your approach would have already locked in some profits, protecting your trading performance.

- Learn About Economic Indicators. These indicators represent the macroeconomic factors that provide insights into a country’s economic status, including GDP growth, Consumer Price Index (CPI), Producer Price Index (PPI), and jobless rates. They play a pivotal role in shaping price movements, particularly in the Forex Market. Enhancing your understanding of these indicators brings you closer to comprehending the dynamics of market fluctuations and the reasons behind them.

Furthermore, you’ll acquire an understanding of economic mechanics, a knowledge that few have mastered.

- Understanding of How the Market Works. One significant advantage of using an economic calendar for those new to investing is the ability to grasp how global markets function. By simply observing the calendar and real-time charts, even without executing any trades, novice investors can start to see how different economic events influence various markets. This observational practice can enhance their understanding of market dynamics, guiding them on when might be an opportune moment to enter or exit a particular market.

- Building FA Trading Strategy. As you gain more knowledge and experience in fundamental analysis, you can refine your trading strategy, potentially discovering the missing piece you’ve needed for success in Forex Trading. You might even develop a new strategy based on your experiences observing how specific releases and events impact the markets in real-time.

How to Read Economic Calendar?

Now, whether you’ve been regularly checking the economic calendar as part of your trading strategy or you’re considering integrating it based on previously discussed advantages, it’s important to know how to effectively review the calendar whether at the start of a new week, day, or trading session.

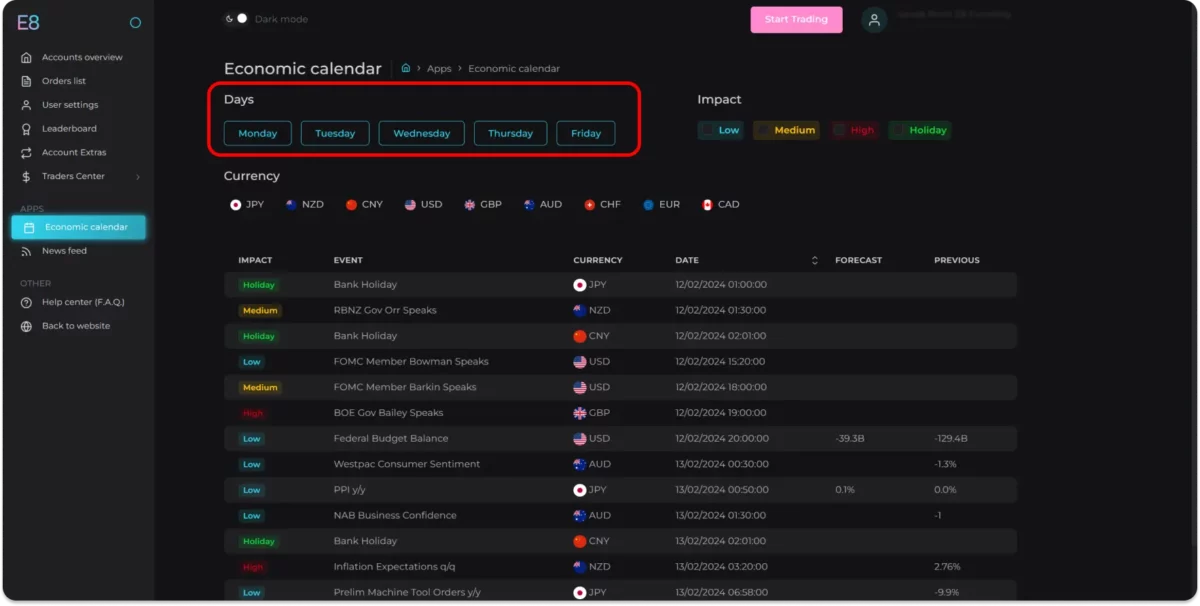

Step 1: Log in to your E8X account [Link]

Step 2: Open an Economic Calendar from the menu on the left.

Step 3: Select the specific day or range of days for which you wish to view the scheduled events.

Step 4: Select the specific currencies you are interested in monitoring to view their event schedules. If you prefer a comprehensive overview, simply leave the settings as default to see events for all.

Step 5: Select the level of impact. It’s highly advised to at least review events marked as High (red) impact since these typically have the most significant effect on market volatility at the time of their announcement.

Step 6: Perfect! You can now review all relevant events listed below, tailored to the filters you’ve applied.

How To Use E8X Economic Calendar?

Now that we understand what an economic calendar is and how to read it let’s delve into how traders can use this tool effectively:

1. Plan Ahead

Organize your trading actions by taking into account major upcoming events to minimize surprises from sudden market changes. For example, certain Forex traders might avoid major currency pairs during central bank rate updates, while others may speculate on potential price movements.

2. Analyzing Market Forecast

Keep a keen eye on the forecasted figures in the calendar, as they sum up the collective expectations of market analysts and the consensus view. If the actual value of an economic indicator significantly deviates from its forecasted value, it could cause swift and significant price fluctuations, thereby increasing market volatility.

3. Analyzing Post-Data Release

After the release of economic data, observe the resulting market response. Should the released figures meet or exceed market forecasts, a positive, or bullish, sentiment is likely to prevail. On the other hand, data that falls short of expectations can foster a negative, or bearish, market outlook.

4. Strategy Integration

Integrate data from the economic calendar directly into your trading strategy. For instance, those engaged in swing trading may opt to delay opening new positions close to key economic updates, thereby lowering the potential for adverse impacts from sudden shifts in the market.

5. Stay Informed and Adapt

Financial markets are ever-changing, and unexpected developments can arise without warning. Therefore, it is crucial to regularly review the economic calendar and remain flexible, adjusting your trading approach as needed to respond effectively to new circumstances.

Wrapping up, we’ve journeyed through using the Economic Calendar and its critical importance in Forex trading. By leveraging its insights and strategic advantages, traders can navigate market dynamics with confidence and precision. Equipped with a deeper understanding of economic events and their impact, we aim to empower you to make informed decisions that drive success in the trading landscape. Through continuous learning, adaptation, and strategic planning, you’ll seize new opportunities and achieve trading objectives with greater efficacy and resilience.

Stay tuned for the next part of our Fundamental Analysis Series where we dive into the influence of central bank policies on the FX Market. Gaining insights into the operations of central banks, their effect on currency values, and strategies to foresee and react to these key factors.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.