Trade Smart: Choose Your Spread, Control Your Costs

As a Forex trader, you’ve undoubtedly encountered the term “spread” countless times. It’s whispered in trading forums, flashed across broker platforms, and even casually mentioned in market analysis. But have you ever stopped to truly grasp its meaning and the profound impact it has on your trading?

The spread isn’t just another piece of Forex jargon; it’s the silent cost behind every trade you execute. It’s the difference between the price you pay to buy a currency and the price you receive when you sell it – a seemingly small gap that can significantly impact your profits over time.

In the world of Forex, where few pips can make or break a trade, understanding the spread is not just beneficial, it’s essential. It’s about knowing the true cost of doing business in the market, recognizing its influence on your trading strategies, and ultimately, empowering yourself to make more informed entry decisions.

So, let’s dive deeper into the spreads, unraveling their complexities and uncovering their hidden impact. Whether you’re a seasoned pro or a novice trader, this exploration promises to shed new light on what often goes unnoticed.

What is a spread?

At its core, a spread in Forex trading is simply the difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy a currency). It’s essentially the cost your broker charges you for executing your trade. Think of it like buying and selling a car – the dealer will offer you a lower price to buy your car (bid) and a higher price to sell you a car (ask). The difference between these two prices is their profit margin, similar to how the spread is the broker’s profit in Forex.

Types of spreads

There are two primary types of spreads you’ll encounter in Forex trading:

- Fixed spreads: As the name suggests, these spreads remain constant regardless of market conditions. They offer predictability, which can be beneficial for traders, especially in volatile markets.

- Variable spreads: These spreads fluctuate depending on market liquidity and volatility. During periods of high activity or news releases, variable spreads can widen significantly, increasing your trading costs.

Each type of spread has its pros and cons. Fixed spreads provide stability and predictability, which can be particularly beneficial for traders who prefer to know their trading costs upfront, especially in volatile markets. However, it’s important to note that brokers offering fixed spreads often compensate for this by also charging commissions alongside the fixed spread. On the other hand, variable spreads can offer lower costs during calm periods, potentially saving you money on your trades. However, they can widen significantly during periods of high market volatility or low liquidity, increasing your trading costs unexpectedly.

Understanding these nuances is key to selecting the right type of spread that aligns with your trading style and risk tolerance. If you value predictability and are willing to accept potentially slightly higher costs, fixed spreads might be a good fit. If you’re comfortable with some level of uncertainty and are seeking potentially lower costs during normal market conditions, variable spreads could be a suitable option. Remember, it’s crucial to factor in both spreads and commissions when evaluating the overall cost of trading with a particular broker.

In the next section, we’ll explore how these spreads directly impact your profitability and the various factors that influence their size. Stay tuned to gain a deeper understanding of this critical aspect of Forex trading!

Direct Impact on Trading Costs

In Forex trading, spreads represent the initial cost you incur every time you open a position. Think of it as a toll you pay to enter the market. The wider the spread, the higher the toll, and the more your potential profit is reduced.

Let’s illustrate this with a simple example. Suppose you want to buy the EUR/USD currency pair, and the current bid price is 1.1000, while the ask price is 1.1002. This means the spread is 2 pips (0.0002). If you buy 1 lot (100,000 units) of EUR/USD, you’ll immediately incur a cost of $20 (2 pips x 100,000 units x 0.0001 USD/pip).

Impact on Trade Execution

Spreads can also indirectly impact your profitability through their influence on trade execution. In fast-moving markets or during periods of high volatility, spreads can widen significantly. This can lead to a phenomenon called ‘slippage,’ where your order is executed at a price different from the one you intended.

For instance, if you place a market order to buy EUR/USD at 1.1002, but the spread suddenly widens to 4 pips, your order might be filled at 1.1004. This slippage of 2 pips eats into your potential profit, even before the trade has begun.

Influence on Trading Strategies

The size of the spread can also significantly influence your choice of trading strategies. Traders who employ frequent, short-term strategies, such as scalpers and day traders, are particularly sensitive to spreads. Since they open and close multiple positions throughout the day, even small differences in spreads can add up to substantial costs over time.

On the other hand, traders who adopt longer-term strategies, such as swing traders or position traders, are less affected by spreads. Their holding periods are typically longer, allowing them to absorb the initial cost of the spread more easily.

In conclusion, understanding the multifaceted impact of spreads on profitability is crucial for any Forex trader. By carefully considering spreads when choosing a broker, planning your trades, and selecting your strategies, you can optimize your trading outcomes and increase your chances of success in the Forex market.

Factors Influencing Spreads

Understanding what causes spreads to widen or narrow is key to managing their impact on your trading. Several factors come into play, each contributing to the dynamic nature of spreads in the Forex market.

Currency Pair

The currency pair you’re trading significantly influences the spread you’ll encounter. Major currency pairs, like EUR/USD or GBP/USD, typically have the tightest spreads due to their high liquidity and trading volume. Minor pairs, such as EUR/JPY or GBP/JPY, usually have slightly wider spreads. Exotic pairs, involving currencies from emerging markets, tend to have the widest spreads due to lower liquidity and higher volatility.

Market Conditions

Market conditions play a crucial role in spread fluctuations. During periods of high volatility, such as major news releases or economic events, spreads tend to widen significantly. This is because market makers and brokers increase spreads to protect themselves from potential losses due to rapid price movements. Conversely, during calm periods with low volatility, spreads tend to narrow.

Provider Choice

Different providers offer different spreads, even for the same currency pair. This is because each has its own pricing model and risk management strategy. Some may offer tighter spreads to attract clients, while others may have wider spreads but compensate with lower commissions or other benefits. It’s essential to compare spreads from different brokers before opening an account to ensure you’re getting the best deal.

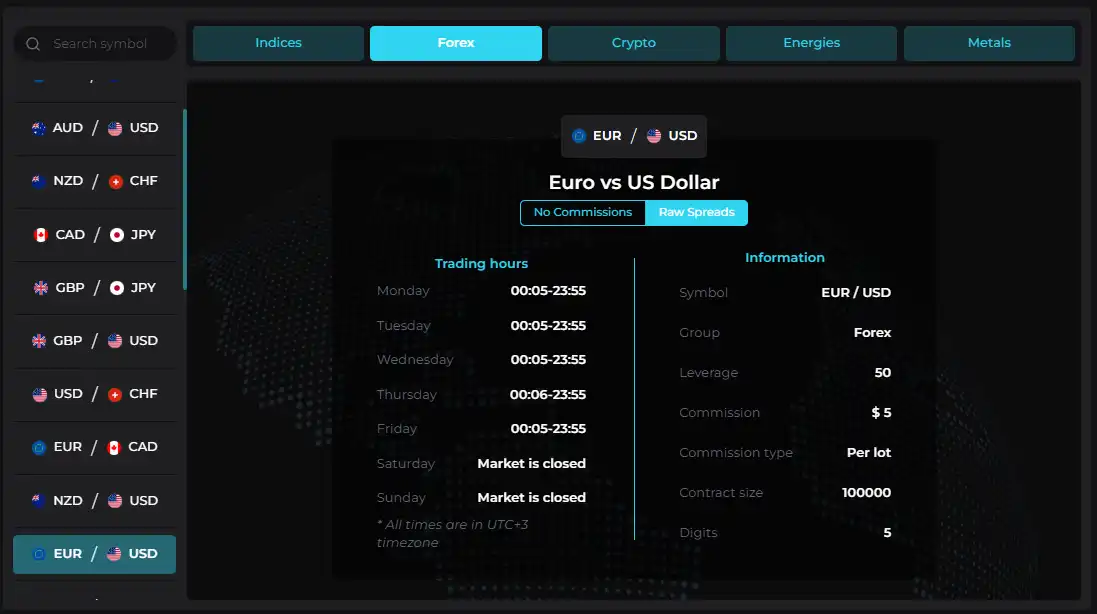

E8 Markets: Spreads Tailored to Your Trading Style

At E8 Markets, we understand that every trader is unique, with distinct trading styles and preferences. That’s why we offer two spread options to cater to your individual needs, ensuring you have the flexibility to choose the pricing model that best suits your strategy.

Standard Spreads: Competitive, No Commissions

Our standard spreads are designed to be highly competitive, providing you with cost-effective trading without any additional commissions. This option is ideal for traders who prefer simplicity, particularly those focusing on longer-term strategies where frequent trades are less common.

Raw Spreads: Ultimate Control, Commission-Based

For traders who seek the utmost control over their trading costs, our raw spreads offer the tightest possible spreads, often starting from zero. This option comes with a commission per trade, making it particularly attractive for short-term traders and scalpers who execute a high volume of trades on lower timeframes.

Trial Account & E8X Dashboard

When you purchase an evaluation from E8 Markets, you have the freedom to select either standard or raw spreads, allowing you to experience the benefits of each. Furthermore, anyone interested in exploring our spreads can create a trial account, which mirrors the same spreads we offer during the evaluation phase. This provides a realistic trading environment to test your strategies and experience our pricing models firsthand.

You can easily find details about our commissions for raw spreads within the E8X dashboard under the Instrument tab. This allows you to calculate your trading costs precisely.

Conclusion

Spreads are an unavoidable reality in Forex trading, but they shouldn’t be a roadblock to your success. By understanding their impact, the factors that influence them, and employing effective management strategies, you can navigate the market with confidence and optimize your trading outcomes.

Remember, successful Forex trading is a journey of continuous learning and adaptation. Keep exploring, experimenting, and refining your strategies. And most importantly, never stop seeking knowledge and honing your skills. The Forex market is vast and dynamic, and with the right approach, it holds immense potential for profit and growth.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.