Forex Day Trading: Best Strategies For Beginners

Over the years, various trading strategies have emerged for navigating the complex world of the Foreign Exchange Market (Forex). These approaches range from Scalping and Day Trading to Swing Trading and Long-Term Investing, each with its own set of advantages and disadvantages. If you find that scalping feels too fast-paced for you and swing trading seems too drawn out, then Day Trading could offer the perfect tempo for your trading endeavors. Here, we’ll explore why trading within the same day could be the ideal choice for you.

What is Day Trading?

Day Trading is defined as “a system where trades are opened and closed within the same day.” Sounds straightforward, right? But rest assured, that’s just the tip of the iceberg. While the definition outlines the core concept, mastering day trading requires a deeper understanding and knowledge.

In light of the definition, a forex day trader essentially capitalizes on minor price fluctuations that occur within a single trading day or session. Typically, the trader will open a position early in the morning after thoroughly analyzing market conditions and potential opportunities. They will then close the position either when they are satisfied with their results or at the end of the trading day, regardless of profit or loss.

Most day traders begin their trading activities with the opening of one of the major exchange sessions. For those in Europe, this is often the London session, while for traders in the U.S., it’s usually the New York session. This timing is deliberate for a couple of reasons. First, day traders have limited time to maximize their gains from market movements. Second, they often depend on market volatility and momentum, which are usually heightened during the transition between sessions. In practical terms, this leaves about 16 hours in a day (across two sessions) to make a successful trade. Given that the average daily movement for the EUR/USD currency pair is around 80 pips, it makes perfect sense for day traders to avoid entering positions later in the afternoon. By that time, the markets are often midway through their daily range, and volatility is generally diminishing.

To give you a deeper understanding of day trading, let’s delve into what a typical day looks like for a Forex day trader and explore how this strategy plays out in real-world scenarios.

How Does a Day Trader Approach the Market?

For the majority of day traders, starting the day early is crucial. You need to be prepared before the opening bell of the session you’re focused on, which often means dedicating the early morning to market analysis and identifying potential trading opportunities for the day. The daily routine of analyzing and monitoring trades is time-sensitive, but we’ll delve into the pros and cons of this strategy later.

When it comes to tracking trades, it’s vital for a day trader to keep a close eye on open positions. Since we’re talking about capitalizing on small market movements, traders often deal with large positions and tight stop-loss orders. This requires continuous attention and the ability to respond rapidly.

Apart from time commitment, success in day trading requires a high level of discipline. To illustrate, let’s consider a sample daily schedule for a day trader so you can see just how much discipline is needed to excel in this field.

Day Trading Workflow: An Example Plan

Pre-Market Hours (6:00 AM – 8:00 AM)

- Wake up and check overnight market news and updates right away.

- Review the economic calendar for any major scheduled announcements.

- Begin technical analysis, identifying potential trends.

Market Opening – London Session (8:00 AM)

- Double-check trading strategy for the day and set alerts for key price levels.

- Open the trading platform and prepare for the London session opening.

- Execute any pre-planned trades based on the early market movements and trends.

Mid-Morning Review (10:00 AM – 11:00 AM)

- Analyze trades and market conditions.

- Adjust stop-loss orders based on new data.

- Take partial profits if trades are performing well.

Lunchtime Lull (12:00 PM – 1:00 PM)

- Use this quieter period to review the morning’s trades.

- Update trading journal.

- Step away from the screen for a mental break.

Afternoon Trading – New York Session (1:00 PM – 4:00 PM)

- Re-enter the market if new trends emerge.

- Monitor open positions closely, ready to close trades if necessary.

- Watch for market volatility spikes due to U.S. market overlap.

Market Close and Post-Market (4:00 PM – 6:00 PM)

- Close any remaining positions by the end of the London session, or at the latest within two hours after, when volatility typically drops to lower levels.

- Update trading journal with end-of-day summaries.

Evening Routine (7:00 PM – 8:00 PM)

- Conduct post-market analysis.

- Plan for the next trading day.

- Shut down the trading station and mentally decompress.

As you can see, the day is structured, but also flexible enough to adapt to market conditions. It demands a high level of discipline to stick to the plan, continuously analyze the market, and adapt as needed. This schedule also shows that day trading isn’t just a few hours of market-watching; it’s a full-time commitment that spans well beyond regular market hours.

Now that we’ve covered the basics, let’s explore some straightforward strategies you can implement in day trading. Keep in mind that the strategies we’re about to discuss are quite simplistic. Most traders usually employ a mix of these and other advanced strategies. The more scenarios you can identify, the more opportunities you’ll find. However, for beginners, it’s advisable to start with just one or two, and as you gain experience on your trading journey, you can refine these strategies or even develop your own tailored approach.

5 Forex Day Trading Strategies for Beginners

If you’ve read up to this point, you’re likely quite intrigued by day trading and may be considering giving it a try. If that’s the case, we’ve prepared a list of five basic trading strategies specifically designed for day traders.

Trend Trading

Trend trading is pretty much what it sounds like, you aim to capitalize on the market by following its current trend. Begin by analyzing longer time frames, such as daily or four-hour charts, to identify the overall trend. Once you’ve done that, zoom in on shorter time frames like one-hour or 30/15-minute charts to look for specific trading opportunities. To assist you in identifying the current trend, you can use some of the best-known trend indicators, such as:

- The Bollinger Band Indicator

- The Moving Average Indicator (MA)

- The Moving Average Convergence Divergence indicator (MACD)

- The Relative Strenght Index Indicator (RSI)

- Parabolic SAR

As a day trader, you may also seek out market volatility to maximize your gains, and that’s where the Average Directional Index (ADX) can be useful. Unlike the trend indicators mentioned earlier, the ADX doesn’t indicate the direction of the trend. Instead, it measures market volatility, helping you select assets that currently exhibit strong momentum. This way, your trades are less likely to remain stuck in a narrow price range for the entire day.

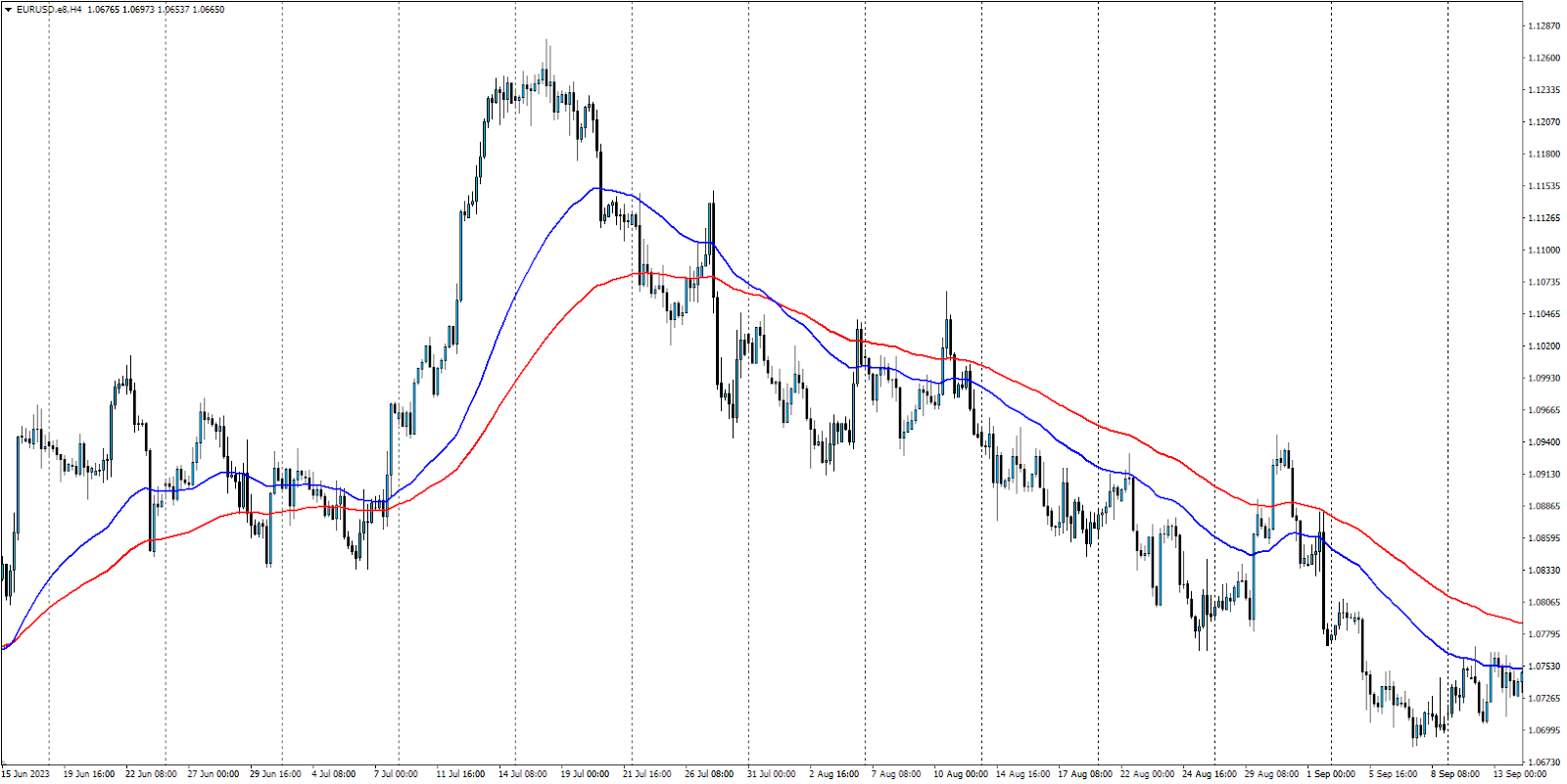

The example below demonstrates how we determined the overall trend by examining longer time frames and using the Moving Average (MA) indicator to refine our analysis. For this particular example, we employed 100-day and 50-day Exponential Moving Averages (EMA).

Euro / US Dollar, 4-hours chart

The four-hour chart of EURUSD features two lines plotted above candlesticks: the red line represents a 100-day Exponential Moving Average (EMA 100), and the blue line represents a 50-day Exponential Moving Average (EMA 50). When the smaller EMA 50 is below the larger EMA 100, it signals a downtrend. Conversely, when the EMA 50 is above the EMA 100, it indicates an uptrend.

The chart clearly illustrates the market’s bullish and bearish phases. On August 1st, 2023, the EMA 50 (blue) crossed below the EMA 100 (red), signaling a downtrend. Consequently, any day trader would have been focusing on joining the downtrend since that time.

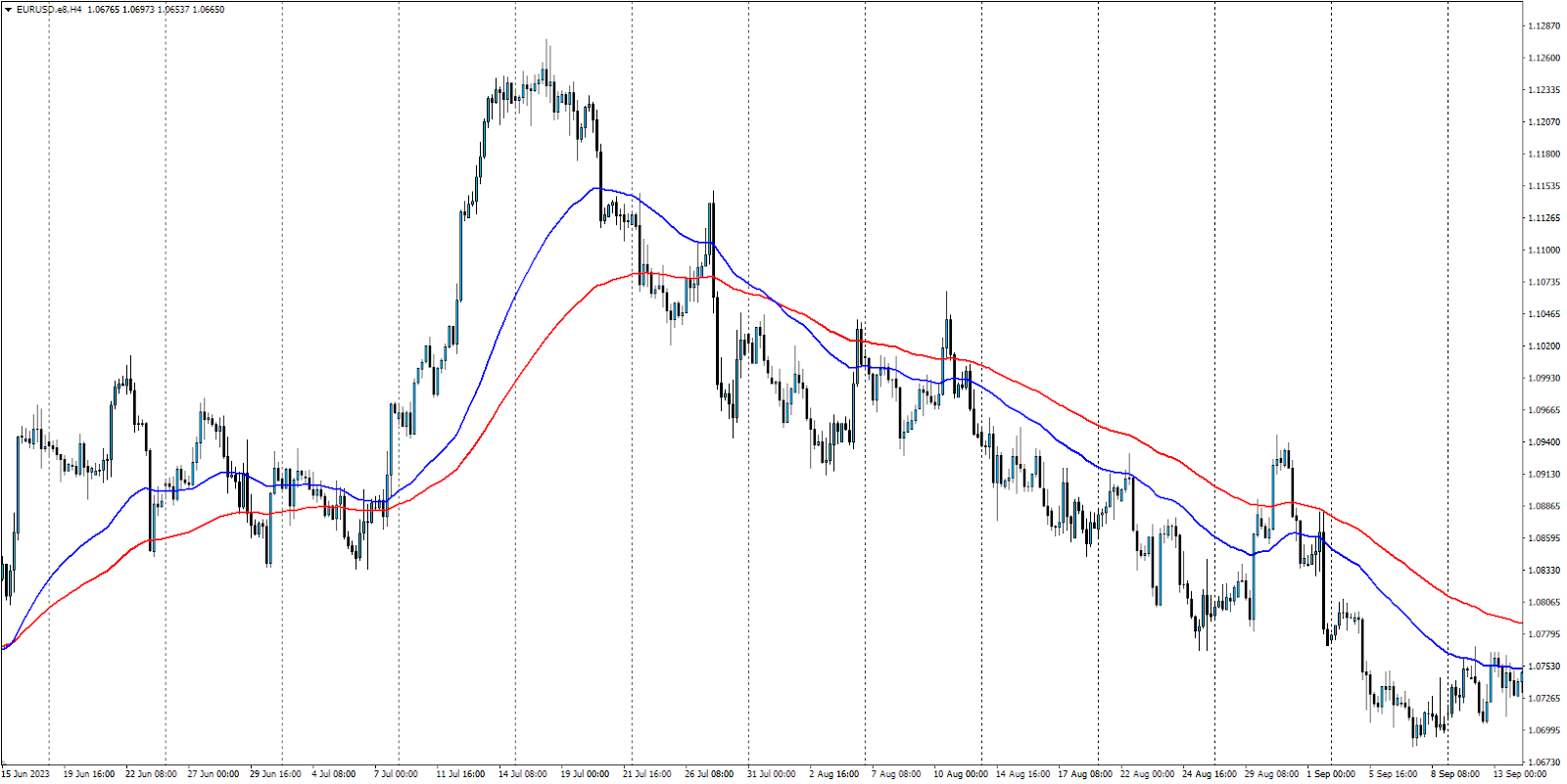

After pinpointing the trend on the higher time frames, we transition to shorter ones to confirm that the market direction is consistent across both. To keep things straightforward, we won’t alter the periods of the Moving Average indicators, which are once again relevant.

Euro / US Dollar, 30-minutes chart

Considering the downtrend in the longer timeframe, it’s natural to also seek a downtrend in the 15/30-minute charts. The chart above displays the EURUSD 30-minute chart spanning from the end of April to the beginning of September. Initially, the blue EMA 50 was above the red EMA 100, which would suggest to any day trader to stay out of the market. However, on September 1st, these two EMAs crossed, indicating a downtrend in the shorter timeframe. When both higher and lower timeframes indicate a downtrend, a day trader might consider joining the bearish trend.

This strategy is generally considered lower-risk because the prevailing wisdom suggests that trading in the direction of the trend is optimal, not just in the Forex market. Many traders could improve their success rate just by adhering to this straightforward guideline. While this trend-following strategy often produces successful trading signals, it can also generate false ones. Therefore, it’s advisable to supplement this approach with additional methods. For example, many traders incorporate price action, manually draw trend lines, or use additional indicators. Some even include fundamental analysis to corroborate the trend before entering a position.

Counter-trend Trading

Counter-trend trading is much like trend trading but with a twist. Instead of aligning with the prevailing market trend, you identify it and then look for opportunities in the opposite direction, essentially betting on the end of the current trend and the beginning of a new one.

To identify the end of a trend, you can employ the same indicators used for trend continuation (when 2 EMAs cross). However, for this example, let’s switch things up and use the MACD (Moving Average Convergence Divergence) indicator. The concept here is to look for crossovers between the MACD line and its histogram as a sign of a potential reversal. For additional confirmation, you can also wait for the MACD histogram to cross the zero level. The prevailing concept among day traders is that when the MACD indicator’s histogram (represented by grey bars) is above the 0 level, it signals an uptrend. Conversely, when the histogram is below the 0 level, it indicates a downtrend. To better understand this approach, refer to the example provided below.

Euro / US Dollar, 4-hour chart

Next, we follow the same procedure as with the initial trend-following strategy: we start by examining higher timeframes to identify potential trend reversals before seeking opportunities on smaller timeframes. Once we spotted a possible reversal we move to smaller timeframes to find out if the market already reversed.

Trading reversals, which involve catching the end of one trend and the beginning of another, can be high-risk and go against the popular adage, “The trend is your friend.” However, it can also offer substantial rewards. This is because you’re entering the market at the very beginning of a new trend, which has the potential to last much longer than joining an existing trend that could end any time soon.

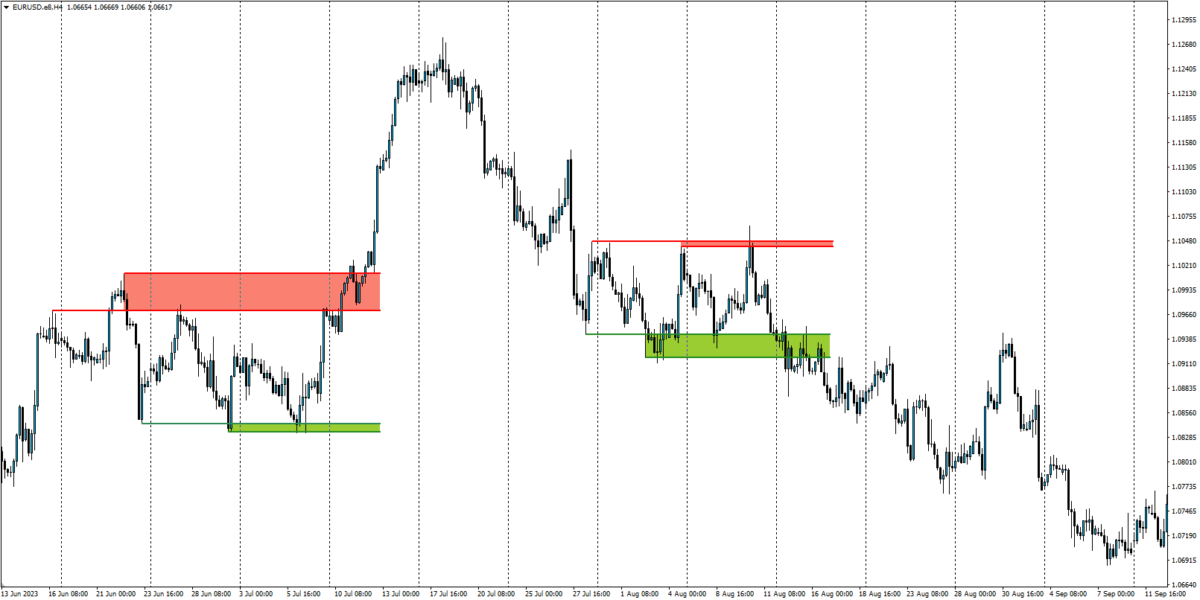

Range Trading

The concept of range trading is straightforward. The strategy begins by identifying a market that is moving sideways, forming what is known as a trading range. Within this range, you pinpoint the higher and lower levels, and form a “channel,” by marking the high points (resistances) and low points (supports) where the price tends to rebound. The goal in range trading is to sell when the price bounces off the resistance and to buy when it rebounds from the support.

Euro / US Dollar, 4-hour chart

Many traders approach this strategy with caution because it’s uncertain whether the price will bounce back or break through the channel. Traders often look for confirmations like candlestick patterns, such as “hammers” or “shooting stars,” which form when the price bounces off one of the channel levels, leaving behind a long shadow and a small candle body pointing in the opposite direction.

Breakout Trading

In this strategy, we operate within the same trading range or channel discussed in the previous strategy. The key difference here is that we’re looking for a breakout rather than a bounce from the channel’s critical levels. For a visual example, you can refer to the chart above that demonstrates the range trading strategy.

The core concept of this strategy involves trading when the price breaks out of the channel. Many traders employ more than just self-identified trading channels, like in the previous example; they also use Pivot Points or the previous day’s Highs and Lows. As always, it’s advisable to seek some form of confirmation before entering the market. As with any strategy, it’s prudent to wait for a confirmed signal before initiating a trade. In this case, you might consider waiting until a candle has fully closed above or below the channel as confirmation of a breakout before joining the market’s direction.

News Trading

Certainly, this strategy focuses less on technical analysis elements like price action and indicators but demands just as much time and attention as the other strategies discussed. As a news trader, you need to stay updated on a variety of economic factors that directly influence the forex market. These include the release of economic data such as unemployment or inflation rates, changes in monetary policy, interest rate decisions, or even speeches by central bank board members.

In this context, a straightforward example could be an interest rate hike resulting from a central bank board meeting. A current instance might be observed in any G7 economy, where the local central bank aims to curb high inflation by increasing interest rates. If we notice such a price increase in a particular economy, we can generally anticipate that the central bank will follow suit and adjust its benchmark rate accordingly, and so tightening the economy. When the latest inflation data surpasses expectations, traders often expect that the central bank will implement a rate hike, which usually triggers bullish momentum for that country’s currency.

The central bank board meeting following each interest rate decision is of utmost importance. During these meetings, the bank’s leader addresses the state of the economy and outlines their monetary policy, including expectations for future interest rates, potential factors that could alter this trajectory, and much more. The entire realm of news trading and fundamental analysis revolves around whether these meetings align with or deviate from expectations related to various indicators. This dynamic sets the stage for trends in the foreign exchange (FX) market and drives market momentum.

Just as technical traders track patterns on charts, fundamental traders monitor patterns in economic data, and the difference isn’t that significant. Once you become adept at understanding these fundamental patterns and how they relate to various economic indicators or central bank policies, you’ll be in a position to anticipate market movements. This foresight will enable you to enter trades before the market has fully priced in these economic data, giving you a strategic advantage. After all, it’s fundamental analysis that shapes our understanding of future price developments, whereas technical analysis relies on historical data for its insights.

Now that we’ve clarified the fundamentals of day trading, let’s examine its pros and cons. It is up to you to explore whether this approach aligns with your preferences and evaluate if you have the potential to become a successful trader using this strategy.

Key Benefits of Day Trading

Let’s kick off with the brighter side of day trading by exploring its benefits. This should assist you in determining whether this strategy is the right fit for you.

Strats each day over

One of the standout advantages of being a day trader is the fresh start you get each day, coupled with the ability to see immediate results. Let’s face it, holding positions overnight can be a nerve-wracking experience, as unexpected events can impact the market in ways that may not be favorable to you. The instant feedback you receive from day trading allows you to continually refine your strategy, work on its weak points, and consistently make improvements.

Investment compound

For traders with a profitable strategy, compounding their trading capital becomes a daily activity whenever they make a profit. This allows them to take on larger positions the next day, thanks to the uptick in their account balance. As a result, this form of compounding contributes to an escalating scale of profits as their trading capital expands.

No overnight risk

Trading exclusively during the day, as opposed to overnight, comes with certain advantages, some of which we’ve already discussed. For one, you sidestep the risk of price gaps that can arise from unexpected events affecting the markets either directly or indirectly. Another risk associated with overnight trading is the swap commission incurred for holding a position beyond the close of the trading day. While the swap isn’t necessarily always negative, it’s a non-issue for day traders who close out their positions before the day’s end.

Skill Development

As a full-time day trader, you accumulate a wealth of experience not just by frequently analyzing the market compared to long-term traders, but also through nearly constant market scrutiny and end-of-day trading reviews. While scalpers mainly concentrate on technical analysis and long-term traders focus on fundamentals, a day trader needs to proficiently navigate both. Consequently, your expertise is likely to grow exponentially as you engage in daily trading activities.

Multiple Approaches

Continuing on the topic of market analysis, the diversity of approaches also expands your strategic options. As a day trader, you essentially straddle the worlds of both scalping and long-term trading. While these two styles typically have strategies designed for specific trading periods, a day trader can draw from both realms in addition to employing strategies explicitly tailored for day trading. Consequently benefits from a broader array of perspectives compared to other trading styles.

Key Drawbacks of Day Trading

Of course, every strategy comes with its own set of downsides. Here are the key disadvantages we believe you should be aware of in the context of day trading.

Time commitment

The substantial time commitment is often cited as one of the major drawbacks of day trading. As the name suggests, day traders typically spend a large portion of their day analyzing the market and monitoring trades. That’s why the majority of day traders operate on a full-time basis. While there are some day trading strategies that don’t require you to be glued to your screen all day, those are more the exception than the rule. However, it’s important to remember that this extensive time investment also allows you to amass valuable knowledge and continually improve your trading skills.

Discipline is essential

Discipline is often the unsung cornerstone for any successful day trader. While discipline is crucial for traders of any strategy, its importance is doubly significant in the realm of day trading. On one hand, it may not be fair to label discipline as a drawback of the strategy; after all, discipline is essential not just in trading but in life in general. It’s not only a key to success in trading but also a fundamental trait for achieving success in any endeavor.

Emotions can trick you

One quality every day trader should cultivate is humility, especially when it comes to avoiding overtrading. Psychology is a major factor in trading and can profoundly influence your trading career. An unwritten rule in this realm is that if a trading opportunity doesn’t present itself naturally, don’t force it. As a day trader, there will be days when you don’t trade at all, and frankly, that’s preferable to making a trade you might later regret.

The risk associated with high-margin

Day trading involves the risk of high-margin exposure due to the small price fluctuations that are the focus of this trading style. To optimize performance, these small positions, which need to be closed by day’s end, often require larger lot sizes to yield meaningful profits. Regardless of your trading strategy, the first thing you should prioritize is risk management, as it’s crucial for long-term success in trading.

Higher commissions

Higher commissions are an unavoidable aspect of trading, particularly for those who trade frequently, these are usually traders in lower time frames. While day traders may not incur overnight fees known as swaps, they are still subject to paying the spread, which is the difference between the ask and bid price. This is why traders often choose their brokers meticulously, researching various conditions such as spreads on different assets to minimize fees in order to maximize profits.

As we’ve mentioned earlier, every trading strategy comes with its own set of advantages and disadvantages, not just day trading. As a trader deciding on a strategy, it’s crucial to find one that best suits your needs.

How to Get Started in Day Trading?

Now that we’ve covered the foundational aspects of day trading, it’s time to get practical about becoming a day trader. The first step is to create a detailed trading plan. We’ve discussed how discipline can be a game-changer for trading success, and adhering to a well-thought-out plan will help you stay organized and focused. Envision your ideal trading day from Monday to Friday, specifying times for market analysis, trade execution, and even periods for self-improvement and strategy refinement, as illustrated in our example. Knowing your goals is crucial for achieving them!

Next, outline your approach to risk management. Define how much you’ll risk per trade, along with the specifics of your stop-loss and take-profit orders, to establish a risk-reward ratio. Ask any successful trader about risk management, and you’ll find that they all have strategies in place; it’s a non-negotiable aspect of trading.

Once you’ve established your financial parameters, it’s time to solidify your trading strategy. List the rules that will guide you in determining when to enter or avoid a trade. Being organized is key; a disordered approach won’t yield consistent results. Keep in mind that these rules and your strategy can be refined as you gain more experience. Think of this as your “Trader’s Diary,” a comprehensive guide that you’ll consult whenever a market opportunity arises. This diary will serve not only as a record of your trades but also as a constant reminder of your trading plan and discipline.

May this guide be a helpful companion as you embark on your journey into day trading, providing valuable insights and experiences. Whether you opt for this strategy or not, we wish you the best of luck in all your future trading endeavors.” Whatever your decision on this strategy, we wish you the best of luck in all your future trading endeavors.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.