Fundamental Analysis: Uncertainty Amidst US Labor Market

The US dollar, often viewed as a barometer of global economic health and a safe-haven asset, is currently grappling with a period of heightened uncertainty. Recent months have witnessed a notable decline in the dollar’s value, primarily attributed to the erosion of three key pillars that once underpinned its strength: robust economic performance, persistent inflation, and the anticipation of prolonged higher interest rates from the Federal Reserve. This confluence of factors has injected a degree of volatility into the currency markets, leaving investors and analysts closely watching for signs of a potential turning point.

US Labor Market Data in Focus

The upcoming week promises to be pivotal for the greenback, as a series of crucial economic data releases and the Federal Reserve’s interest rate decision are poised to shape its trajectory. The non-farm payrolls report, a key indicator of job growth in the United States, is set to take center stage. A robust labor market, as reflected in strong job creation figures, could potentially bolster the dollar and signal continued economic resilience. However, a weaker-than-expected report could increase concerns about a slowdown, potentially putting further downward pressure on the USD.

Meanwhile, the Federal Reserve’s policy meeting holds significant weight for the dollar’s outlook. While the market currently anticipates a 25 basis point rate cut, there remains a non-negligible probability of a more aggressive 50 basis point reduction. Should the FED opt for the latter, it could trigger a bullish response for the dollar, signaling a proactive approach to supporting the economy amid growing headwinds. Such a move would likely be interpreted as a sign of the FED’s commitment to maintaining economic growth, potentially attracting investors back to the dollar.

Bank of Canada’s Policy Decision

On the international front, the Bank of Canada is also expected to announce a 25 basis point rate cut this week. This move could exert downward pressure on the Canadian dollar (CAD), reflecting the central bank’s efforts to stimulate the Canadian economy. The divergence in monetary policy between the US and Canada could further widen the interest rate differential between the two countries, potentially leading to a strengthening of the US dollar against the Canadian dollar.

Australian Dollar’s Potential Pullback

Additionally, the Australian dollar (AUD), which has been outperforming other currencies recently, may face a pullback if the US dollar regains strength. The AUD’s recent strength has been driven by a combination of factors, including robust commodity prices and a relatively hawkish stance from the Reserve Bank of Australia. However, a resurgent US dollar could dampen the AUD’s appeal, particularly if it signals a more optimistic outlook for the US economy.

In conclusion, the US dollar is currently navigating a complex and uncertain landscape. The forthcoming economic data releases, particularly the non-farm payrolls report, and the Federal Reserve’s interest rate decision will play a pivotal role in shaping its near-term performance. Market participants will be closely monitoring these developments, seeking to decipher the intricate signals emanating from the economic and policy spheres. While a strong labor market and a moderate rate cut by the Fed could provide a much-needed boost to the dollar, any signs of economic weakness or a more aggressive monetary easing could exacerbate its recent decline. The road ahead is fraught with uncertainty, but one thing is clear: the dollar’s journey will be shaped by the complex interplay of economic data, central bank policies, and global economic developments. Investors and traders would be well-advised to remain vigilant and adaptable in this ever-changing environment.

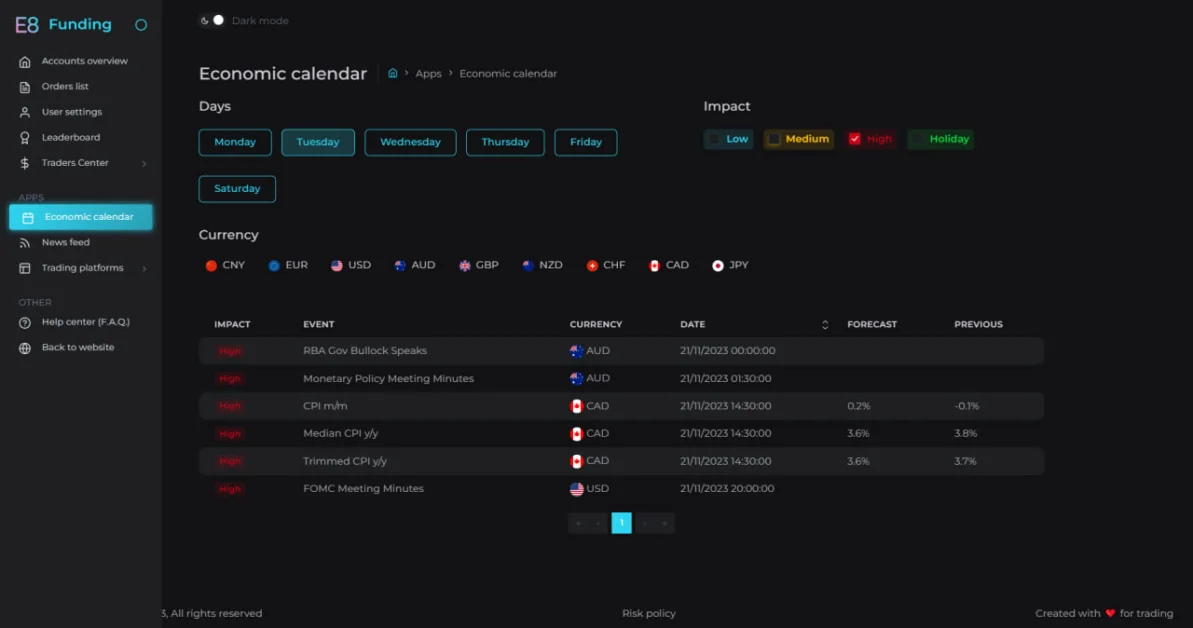

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.