Market Overview: RBA & BoC’s Rate Decisions in Focus

Good morning, traders! As the new trading week rolls on, E8 Funding presents yet another comprehensive Market Overview, ensuring you stay current with the latest and key events from the economic calendar.

Latest economic data show improvement in EU and US economies:

Last week’s data revealed remarkable resilience, particularly in European economies, often surpassing market expectations. Let’s delve deeper into the most significant news from the past week.

RBNZ Interest Rate Decision

During its November meeting, the Reserve Bank of New Zealand decided to maintain its official cash rate (OCR) at 5.5% for the fourth consecutive time, in line with market expectations. The decision reflects the board’s belief that the current OCR effectively curbs demand. The committee concurred that to reduce inflation to the 1-3% target range and promote sustainable employment, interest rates must remain at a restrictive level for an extended period. Additionally, the board did not rule out the possibility of further policy tightening if price pressures persist.

These remarks sparked a strong uptrend in the New Zealand Dollar (NZD), significantly outperforming the Australian Dollar on that day. The AUD experienced a decline of 0.76% against the NZD within just four hours, leading many traders to anticipate a continuation of this downward trend, aligning with the long-term upward trend line.

Is Europe now beyond its most difficult times?

Last week’s data revealed a decline in inflation expectations across major Eurozone economies, indicating easing inflationary pressures.

Consumer Price Index (CPI) Year-over-Year:

- Spain: from 3.5% to 3.2%

- Germany: from 3.8% to 3.2%

- France: from 4% to 3.4%

- Italy: from 1.7% to 0.8%

- Eurozone: from 2.9% to 2.4%

The encouraging CPI data, along with increasing consumer confidence in Germany and France, indicate an upturn in Europe’s economic situation. Yet, despite these optimistic indicators, the Euro has been on a downward trend since the beginning of last week. This raises the question: what is driving the decline in the Euro?

The probable cause is the expected shift in the ECB’s monetary policy. As inflation begins to stabilize, the ECB might move away from its previously aggressive approach. This shift in policy is leading traders to speculate about the timing of the ECB’s policy easing. Consequently, this speculation is prompting key market players to exit their short positions, contributing to the Euro’s decline

The recent weakening of the Euro is evident in the EURGBP currency pair, which has been experiencing a short-term downtrend since mid-November. This trend persists despite a series of positive economic data from Europe, now approaching a critical support level at 0.8500.

US growth exceeded expectations

Key among last week’s fundamental data were the estimated GDP figures from the US and Canada. Beginning with the US, the economy showed an annualized growth of 5.2% in Q3, surpassing the forecast of 5%. This growth, as reported by the Commerce Department, was fueled by higher-than-expected business investment and increased government spending, marking the most robust expansion since Q4 2021.

In contrast, the situation in Canada was less positive. The Canadian GDP saw a contraction of 0.3% in Q3 2023, its first decline since Q2 2021, and a reversal from a revised 0.3% growth in the previous quarter. This downturn highlights the significant impact of the Bank of Canada’s higher interest rates on the Canadian economy, diverging from the strong growth observed earlier in the year.

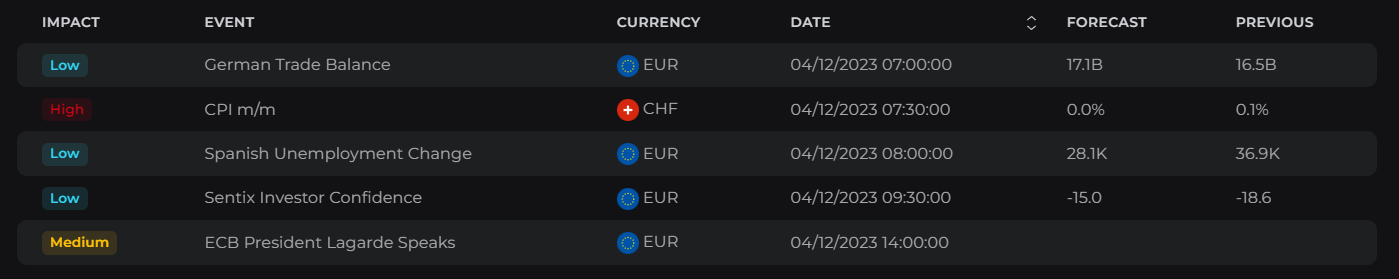

Monday, December 4th, 2023

Monday kicked off with Germany’s international trade data, showing the trade surplus expanded to EUR 17.8 billion in October, exceeding market forecasts of EUR 17.1 billion. Then, 30 minutes later, the Swiss Federal Statistical Office announced that November’s inflation rate had decelerated to 1.4%, lower than both market expectations and the 1.7% recorded in October. This represented the lowest rate since October 2021.

On today’s schedule, Christine Lagarde will deliver a speech and participate in a Q&A session at the Académie des Sciences Morales et Politiques conference in Paris. However, this event is not expected to cause any volatility in the markets.

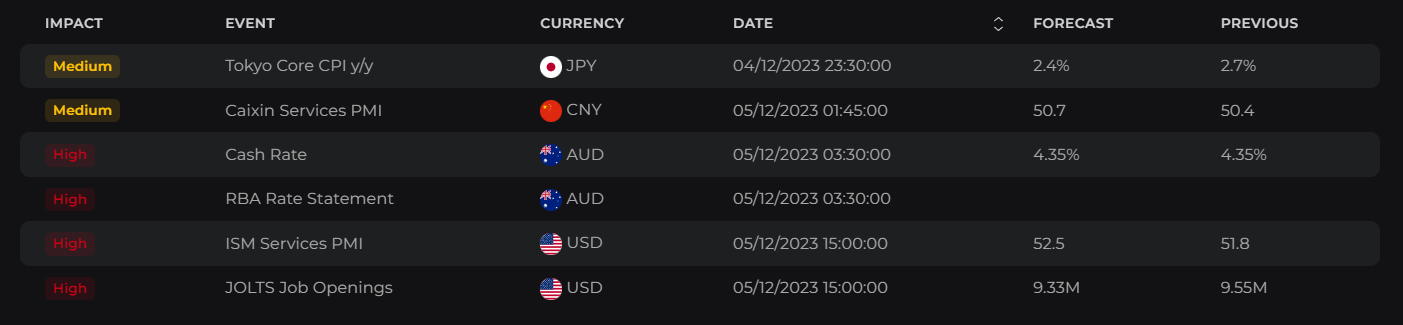

Tuesday, December 5th, 2023

Tuesday begins just after midnight with the release of the Caixin Services and Composite PMI from China. At 3:30 am, the RBA is widely anticipated to maintain interest rates at 4.35%, amid signs of a slowing job market and reduced inflationary pressure from falling petrol prices. This will be the Reserve Bank board’s final single-day meeting, as they will switch to a two-day format in February, culminating in a press conference to discuss interest rate decisions and the economic outlook.

Throughout the day, the schedule is light on major data releases, except for the Eurozone PPI, which may give us a preview of the CPI expectations a week ahead of the ECB’s monetary policy meeting. The afternoon promises more activity, featuring the ISM Services PMI and labor market data from the US. Previously, the number of job openings in the US increased to 9.55 million in September, the highest in four months and above the expected 9.25 million. The new figures are anticipated to show a slight decrease but are expected to remain at around 9.3 million.

No significant speeches are planned for Tuesday.

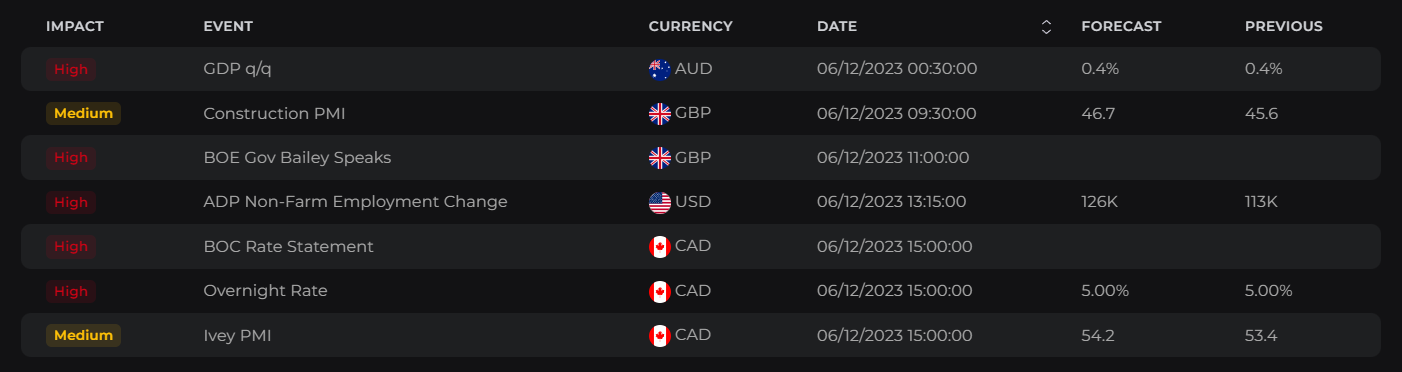

Wednesday, December 6th, 2023

Tuesday will again see important data from Australia, this time the Q3 GDP growth rate. The Australian economy grew by 0.4% quarter-over-quarter in Q2, matching the upwardly revised figure from Q1 and surpassing the expected growth of 0.3%. This marked the seventh consecutive quarter of growth, driven largely by international trade. Q3’s growth is anticipated to maintain this pace at 0.4%, in line with market expectations.

At noon, several minor economic data points will be released from Europe, starting with Germany’s monthly factory orders, followed by Eurozone retail sales. Although Eurozone retail sales fell by 0.3% in September, marking the third consecutive month of decline, the upcoming data is expected to show an improvement, with forecasts suggesting a revision to 0.2% month-over-month.

In the afternoon, attention will turn to the latest international trade figures from the US and Canada. Special focus will be on Canada, as they are set to release Ivey PMI figures and, more crucially, the Bank of Canada’s interest rate decision. Economists predict that the Bank of Canada will maintain interest rates at this week’s key policy announcement, with some suggesting that the central bank may have concluded its rate hikes. Regarding rate cuts, it’s widely anticipated that the Bank of Canada will start reducing interest rates in the second quarter of next year as inflation and economic growth slow down.

BoE Governor Andrew Bailey is scheduled to speak 30 minutes following the release of The Financial Stability Report, but significant market volatility is not expected.

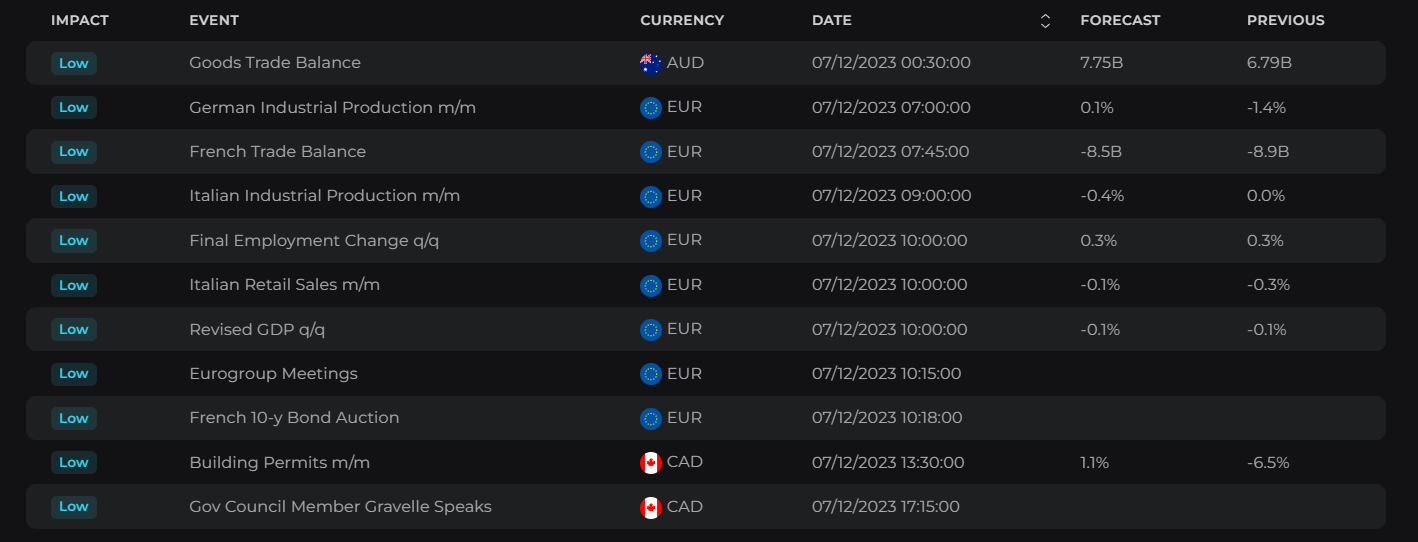

Thursday, December 7th, 2023

Thursday begins, like the previous two days, with data from Australia, this time focusing on their international trade. This is particularly significant as Australia’s net trade and exports, which rose by 4.3%, are key contributors to the country’s GDP. The data from these three days are crucial as they provide insights into Australia’s economic situation and future outlook. Just three hours later, international trade figures from China will also be released.

At 10 am, traders will focus on the estimated GDP growth rate data, considering Europe is currently undergoing its weakest performance since 2021. Despite the recent streak of positive economic data from Europe, which fuels hope for an improvement in the GDP figures, the first estimate indicates that the Eurozone GDP is expected to contract by 0.1%.

The afternoon features more labor market data from the US. Later in the night, a closer look will be taken at Japan’s household spending and finalized GDP. Preliminary data indicated Japan’s economy contracted by 0.5% quarter-over-quarter in Q3 of 2023, which was worse than the anticipated 0.1% decline and followed a 1.1% growth in Q2.

Highlighting the day’s speech agenda are two addresses from the Bank of Canada: Deputy Governor Toni Gravelle and Governor Tiff Macklem. Their speeches are expected to be significant, likely addressing Wednesday’s policy decision and providing insights into the central bank’s future moves.

Friday, December 8th, 2023

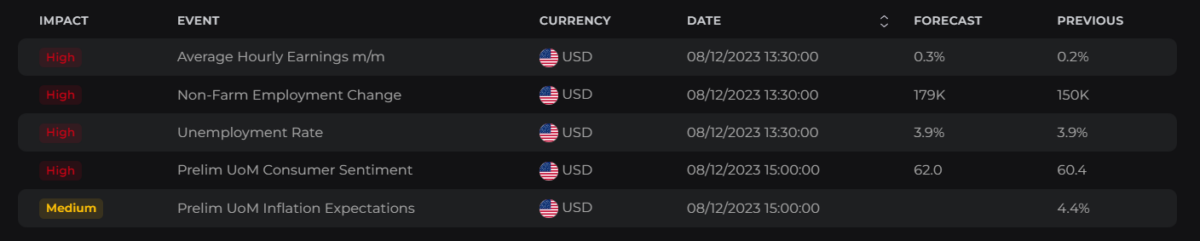

The agenda for the first Friday of the month primarily includes the usual Labor Market data from the US, featuring the Non-Farm Payrolls (NFPs) and Unemployment Rate.

In October, the US economy added 150,000 jobs, a significant drop from the downwardly revised figure of 297,000 in September and falling short of the anticipated 180,000. This slowdown in job growth, influenced partly by strikes including those by UAW members, suggests a gradual cooling of the labor market. The November’s forecast is for the unemployment rate to hold steady at 3.9%, with non-farm payrolls expected to increase by 185,000, following the 150,000 rise in October.

The week concludes with the release of the University of Michigan index data. While inflation expectations are part of this release, the focus will be on the consumer sentiment index, which is projected to rise from 61.3 to 62.

E8X Dashboard

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.