Market Overview: Key GDP and Inflation Data Releases

Good morning, traders! As we approach the upcoming trading week, E8 Funding has once again prepared a Market Overview to ensure you’re up-to-date with the latest and most significant events from the economic calendar.

Last Week’s Spotlight: Canada’s Inflation and Europe’s PMI Figures

In Canada, the annual inflation rate decreased to 3.1% in October 2023, down from 3.8% in the preceding month and slightly under the anticipated 3.2%. This softer outcome, compared to the Bank of Canada’s projection of inflation hovering around 3.5% until mid-next year, has fueled speculation that further rate hikes are unlikely. The Bank of Canada appears to have reached its rate peak and might consider rate cuts to support the economy. More Canadian data is expected this week, offering insights into economic growth and the labor market. The stagnant growth and a higher unemployment rate, which helped temper the economy, come as December’s BoC meeting approaches, sparking debates over the bank’s next step. Traders are pondering whether the Bank of Canada will maintain its cautious stance or start stimulating the economy by easing monetary policy.

Meanwhile, in Europe, both Manufacturing and Services PMIs are on the rise again. Despite a dip in France’s Manufacturing PMI, other regions showed positive trends, notably Germany’s Manufacturing PMI, which leaped from 40.8 to 42.3, surpassing expectations of 41.2. Europe continues to confront economic challenges, but recent PMI figures indicate some improvement in European economies. The UK also witnessed progress, with its Manufacturing PMI climbing to 46.7 from 44.8, against forecasts of 45, and Services PMI rebounding to 50.5 from 49.5 in October.

Heading into the next week, it’s crucial to keep an eye on the economic calendar, as it’s packed with significant data releases. Key highlights include GDP growth rate figures from several major economies and inflation data from Europe. Additionally, China is set to release its latest Manufacturing PMI, and the RBNZ has an interest rate decision meeting on the agenda. Let’s break it down:

Monday, November 27th, 2023

Mondays often start off quietly, especially with regard to releases from the United States. On the schedule for 3 pm, the U.S. Census Bureau plans to announce the initial New Home Sales data for October 2023, marking the day’s only minor release.

Speeches:

At 2 pm earlier on the same day, Ms. Lagarde is scheduled to give an opening statement at the ECON Hearing. This event will occur in front of the Committee on Economic and Monetary Affairs (ECON) of the European Parliament in Brussels. Market volatility is not expected as a result of this event.

Tuesday, November 28th, 2023

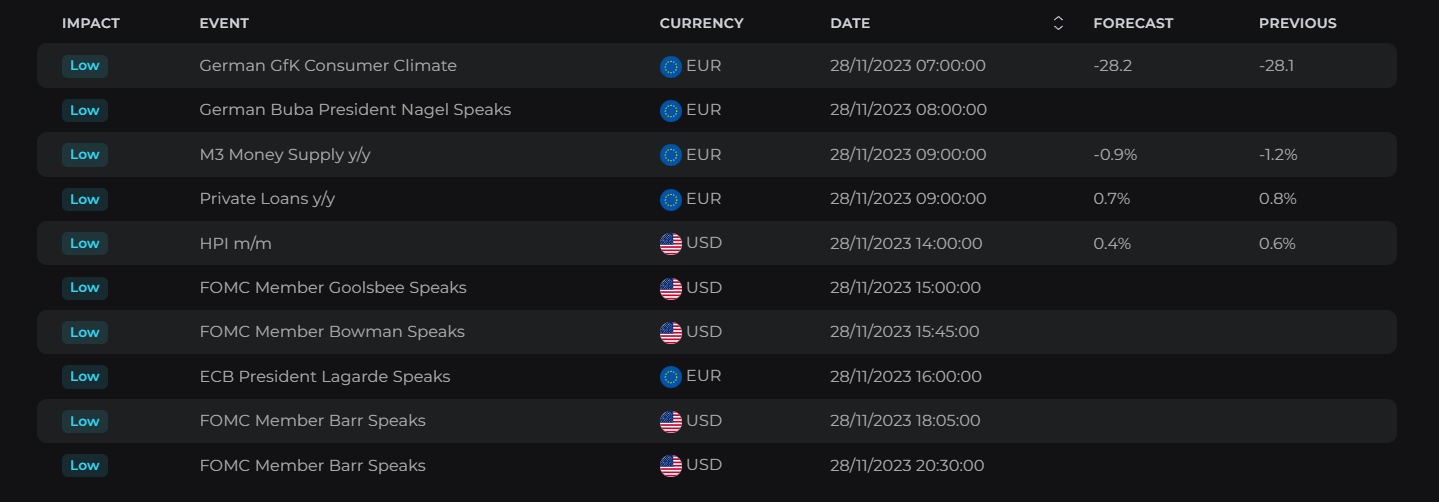

The day continues the calm pace set by Monday, with no major releases on the agenda. Early in the morning, at 12:30 am, we’ll see new retail sales data from Australia. Then, at 7 am and 7:45 am, consumer confidence data for two of Europe’s largest economies, Germany and France, will be released, highlighting the key announcements of the day.

Speeches:

Tuesday is lined up with several speeches. The first one, at the early hour of 1:18 am, features panel participation by RBA’s Governor Michele Bullock at the HKMA-BIS High-Level Conference in Hong Kong.

The ECB’s agenda begins at 12:30 pm with Mc Caul participating in the panel “Regulatory Leaders’ Dialogue: Are we entering a new age of bank supervision?” at the Financial Times Global Banking Summit in London. Later in the day, at 4 pm, a pre-recorded video address by Ms. Lagarde at the 2023 European Financial Reporting Advisory Group (EFRAG) Conference in Brussels will be published. The ECB’s day concludes with a lecture by Mr. Lane at 6:30 pm at the Michael Chae Seminar on Macroeconomic Policy, organized by Harvard University in Cambridge.

The Federal Reserve has a few members speaking on Tuesday as well. Governor Christopher J. Waller is up first at 3:05 pm at the American Enterprise Institute in Washington. Following him, at 3:45 pm, Governor Michelle W. Bowman will speak at the Utah Bankers Association and Salt Lake Chamber Breakfast in Salt Lake City, discussing Monetary Policy and the Economy. Vice Chair for Supervision Michael S. Barr will deliver two speeches, one at 6:05 pm on the Modernized Community Reinvestment Act and Indian Country, and the other at 8:30 pm in a virtual fireside chat on the Community Reinvestment Act Regulations with the Opportunity Finance Network.

From the Bank of England, Jonathan Haskel will present at Warwick University at 5 pm on “UK inflation: how did we get here and where are we going?”

None of these speeches are expected to cause significant market volatility. However, for insightful fundamental perspectives, the speeches by Michelle W. Bowman from the Fed and Jonathan Haskel from the BoE are highly recommended for attention.

Wednesday, November 29th, 2023

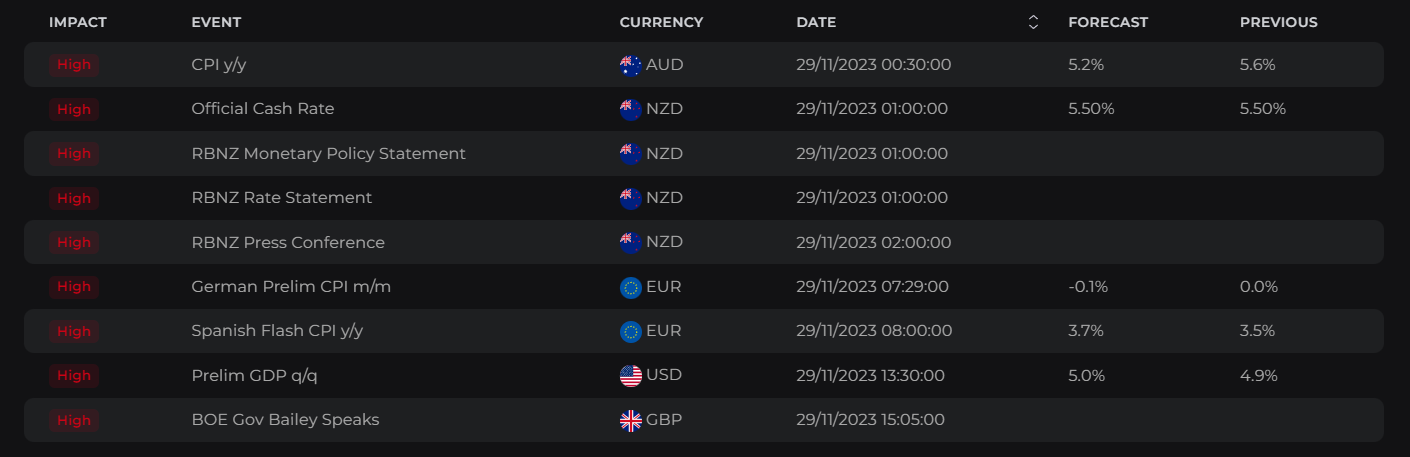

Wednesday stands out from the earlier days of the week with a series of significant data releases. The day commences with Australia’s monthly CPI indicator at 12:30 am, followed by the RBNZ interest rate decision at 1:00 am. With inflation having stabilized but not significantly decreased, markets anticipate the interest rates to hold steady at 5.50% for the fourth consecutive meeting. Any change in the interest rate decision or adjustments in monetary policy announced during the press conference an hour later could trigger substantial market volatility.

At 8 am, the estimated inflation data for Spain is due for release, and at 1 pm, Germany will report its consumer price rate, which was previously confirmed at 3.8% year-on-year in October 2023. This marks a sharp decline from the previous month’s 4.5%, making the upcoming estimate a potential indicator of future Eurozone inflation trends and the ECB’s monetary policy direction. Additionally, at 10 am, the Eurozone’s economic and industrial sentiment and consumer inflation expectations will be released.

In the US, significant news is expected with the second estimated GDP growth rate for the third quarter, along with corporate profits for the same period and U.S. international trade figures, all at 1:30 pm. The U.S. economy showed an annualized growth of 4.9% in the third quarter of 2023, the highest since the end of 2021, surpassing the forecasts of 4.3% and the 2.1% expansion in Q2. The second estimate even suggests a slight increase to 5.0%.

The day concludes with data from Japan at 11:50 pm. The Ministry of Economy, Trade, and Industry (METI) will release Japan’s estimated industrial production and retail sales figures.

Speeches:

Adachi Seiji, a member of the Bank of Japan’s Policy Board, is scheduled to speak at a meeting with local leaders in Ehime at 1:30 am.

Andrew Bailey is set to give a speech at the 50-year anniversary celebration of the London Foreign Exchange Joint Standing Committee (FXJSC) at 15:05 pm

Neither of these speeches is expected to cause significant market volatility.

Thursday, November 30th, 2023

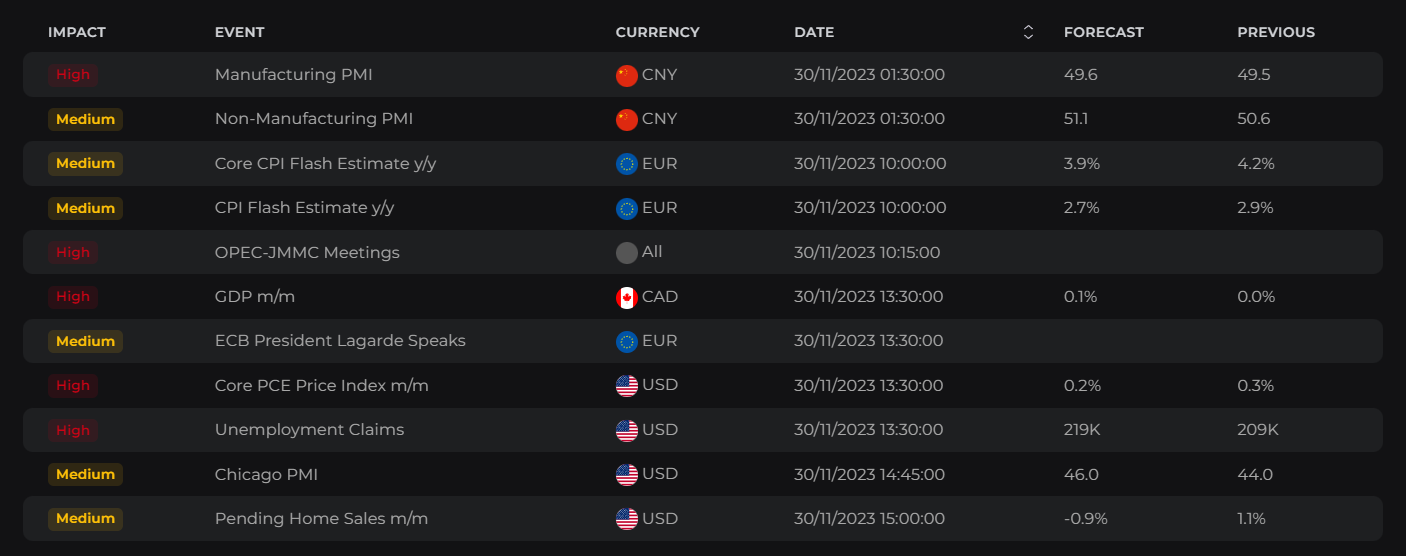

Thursday kicks off with housing statistics from Australia at 12:30 am, followed by a significant release of the manufacturing PMI from China. Last month, the official NBS Manufacturing PMI in China unexpectedly dropped to 49.5, below the anticipated 50.2, indicating the nation’s economic recovery remains unstable and in need of further governmental support measures. Additionally, at 5 am, Japan will release its consumer confidence and housing statistics.

In Europe, the day begins with Germany’s Retail Sales at 7 am and Switzerland’s half an hour later. Of greater significance, estimated inflation figures are due for France at 7:45 am, for Italy at 10 am, and for the entire Eurozone at the same time. The Euro Area’s inflation rate was confirmed at 2.9% year-on-year in October 2023, its lowest since July 2021 and nearing the ECB’s target of 2%. This raises questions about the ECB’s interest rate decision for December 12th. In its October meeting, the ECB maintained interest rates at multi-year highs, halting its 15-month streak of rate hikes and adopting a cautious stance. With falling inflation, the question now is not just whether the ECB has reached a peak, but also if rate decreases are imminent or premature.

At 1:30 am, Statistics Canada will release its latest GDP growth rate figures for the third quarter. In Q2 of 2023, the economy underperformed, missing expectations and slowing from earlier robust growth, reflecting the impact of the Bank of Canada’s higher interest rates.

The U.S. Bureau of Economic Analysis is set to release the Core PCE Price Index along with personal income and spending at 1:30 pm, providing insights into the American household situation. Simultaneously, the Department of Labor will announce the weekly number of Americans filing for unemployment benefits. Additionally, more U.S. real estate data, including pending home sales, will be available at 3 pm.

The day concludes with Japan’s unemployment rate at 11:30 pm, which has been steady at around 2.6%.

Speeches:

Thursday features a lineup of speeches, predominantly from ECB members, but begins with Nakamura Toyoaki, a BoJ Policy Board member, addressing local leaders in Hyogo at 1:30 am.

The ECB’s fifth Forum on Banking Supervision is scheduled for November 30th and December 1st, 2023, at the ECB Main Building in Frankfurt. The forum commences with a welcome address by Ms. Lagarde at 1:30 pm, followed by a conversation at 1:45 pm between Mr. Enria and Jacques de Larosière, former Governor of the Banque de France and Managing Director of the IMF. Elizabeth McCaul will participate in a panel at 2:15 pm discussing “Taking stock: the single supervisor ten years on,” and Kerstin af Jochnick will join a panel at 3:45 pm on “Modern supervision: what is key?”

From the Bank of England, Megan Greene will speak at Leeds University on the topic of monetary policy and its medium-term trajectory.

None of these speeches are anticipated to significantly impact market momentum.

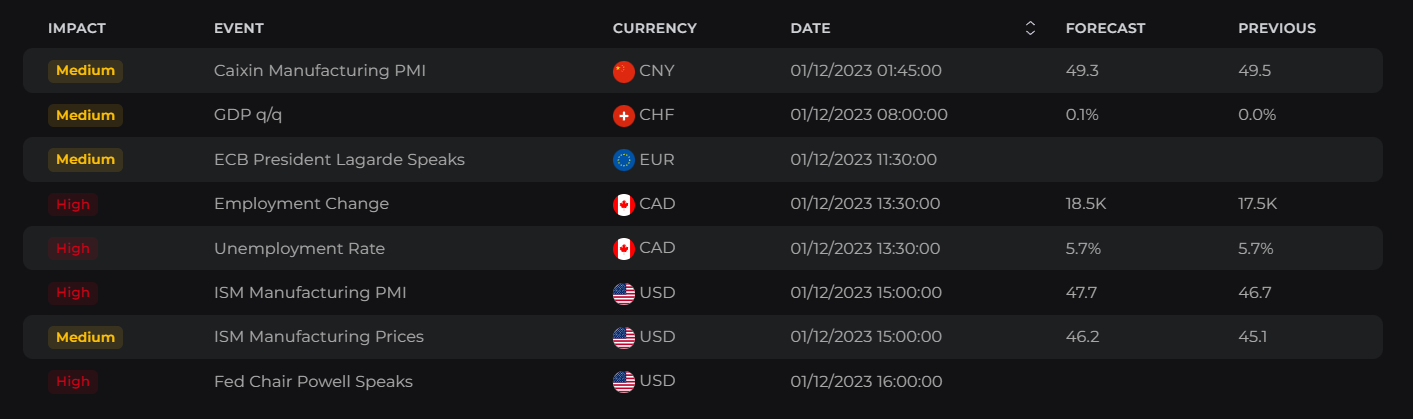

Friday, December 1st, 2023

The day’s first set of data arrives from China at 1:45 am. The Caixin China General Manufacturing PMI dropped to 49.5 in October 2023, down from 50.6 in September, and failed to meet the market forecast of 50.8. This decline indicated the first contraction in the manufacturing sector since July, reflecting a fragile economic recovery, with output decreasing anew. Moreover, the growth in new orders was marginal, and foreign sales declined for the fourth consecutive month, influenced by sluggish global economic conditions and high prices. Although many analysts anticipate a rebound of the index above 50, the current market consensus is at 49.7.

At 8:00 am, the Swiss State Secretariat for Economic Affairs will announce Switzerland’s GDP growth rate for the third quarter. Similar to Canada, Switzerland’s growth rate stands at 0%, signaling a renewed stagnation in the Swiss economy. This outcome suggests that the Swiss National Bank’s unprecedented tightening measures are having a considerable impact halfway through the year.

No other significant data releases are scheduled except for an ISM Manufacturing PMI from the US at 3 pm and a series of figures from Canada at 1:30 pm. This includes the unemployment rate, employment change, and average hourly wages. While the upcoming interest rate decision on December 6th, 2023, remains a topic of debate, the GDP and labor data will undoubtedly play a crucial role. These figures are expected to influence expectations for the interest rate decision and could reflect on the Canadian dollar’s performance this week.

Speeches:

Friday marks the second day of the ECB’s fifth Forum on Banking Supervision, featuring Michael S. Barr from the Federal Reserve at 8 am. Another anticipated event is Frank Elderson’s speech on “The road ahead for bankers and policymakers” at 10 am, followed by a conversation between Ms. Lagarde and Mr. Enria at 11:30 am.

In addition, Jerome Powell is slated for a conversation with Spelman College President Helene Gayle at a Fireside Chat at Spelman College in Atlanta at 4:00 PM.

None of these speeches are expected to reveal major key information, so the markets should not exhibit significant reactions to these events.

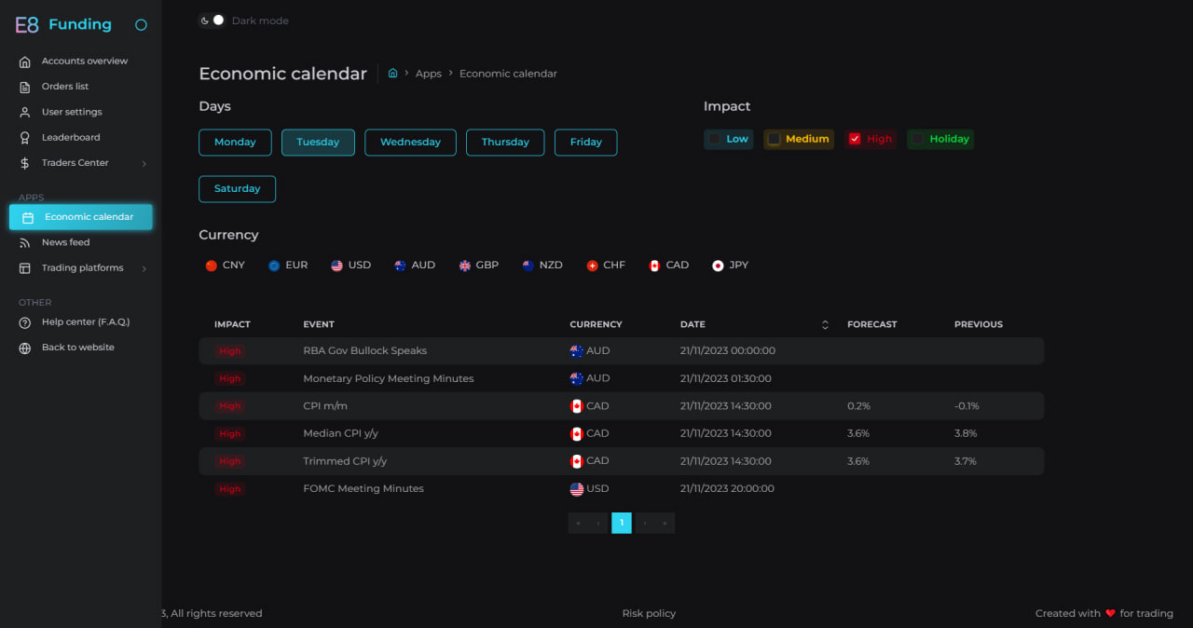

E8X Dashboard

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Don’t miss out on crucial market insights – visit the E8X Dashboard today!

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.