Market Overview: Central Banks’ Interest Rate Decision Rally

Good morning, traders! As we approach the upcoming trading week, E8 Funding has once again prepared a Market Overview to ensure you’re up-to-date with the latest and most significant events from the economic calendar.

Last week’s spotlight: Canada and Australia Maintain Interest Rates, Surprising NFP from the US

RBA Holds Interest Rates Steady, Aligning with Expectations

The Reserve Bank of Australia (RBA) maintained its interest rates last Tuesday, in line with expectations. This decision allows the bank additional time to evaluate the economic landscape before making any further tightening decisions in the upcoming year. This approach contrasts with the anticipated easing in the U.S. and Europe. Concluding its December policy session, the RBA held the rates at the 12-year peak of 4.35%. The bank noted that the economic information gathered since its quarter-point hike in November has largely met expectations.

In addition to the interest rate decision, the Australian Bureau of Statistics also released updates on the latest GDP growth rate and international trade figures.

In the third quarter of 2023, Australia’s economy grew by 0.2% quarter-over-quarter, falling short of market expectations and slowing down from the 0.4% expansion seen in Q2. This marked the most modest growth rate since the third quarter of 2022, with contributing factors including a deceleration in fixed investment growth, a halt in household consumption, and a negative contribution from net trade.

On the day of the interest rate decision, the Australian dollar declined by half a percent against the New Zealand dollar, reaching the trendline emphasized in the previous week’s market overview. Although the AUD/NZD pair approached weakness, it did not break below and instead experienced a rebound. Given the recent developments in the Australian economy and the performance of the AUD, the prevailing question now is whether the AUD/NZD is weak enough to break below this trendline. Alternatively, if the current trend shifts, we might see a significant rise back to the 1.0900 zone, approaching the upper trendline that forms the triangle pattern.

BoC Maintains Interest Rate at 5%, in Line with Expectations”

The Bank of Canada (BoC) decided to keep its key interest rate steady at 5% at the meeting last Wednesday, marking the third consecutive time it has done so, aligning with broad expectations. The BoC’s assessment indicates that the economy no longer exhibits excess demand, suggesting a pause in rate hikes. While the BoC acknowledges ongoing concerns about inflation, it stopped short of stating that these risks are intensifying. It notes that elevated interest rates are curbing spending, and there is a visible softening in the labor market.

Despite market speculations of a potential rate cut as early as March, with expectations of a 25 basis point reduction by April, Governor Tiff Macklem has indicated that the BoC is not yet considering monetary easing, citing persistent inflation significantly above their target.

NFP Beats Expectations

Following the announcement, market reactions aligned with expectations: the dollar and bond yields experienced an increase across the board, while gold and stock indices saw a slight decline. However, shortly after these initial movements, there was a typical reversal of some of these trends.

What drove this market response? The U.S. economy saw the addition of 199,000 jobs in November, a significant jump from the 150,000 jobs added in October and surpassing market predictions of a 180,000 increase. Notably, most of these jobs were in the private sector rather than government roles. In tandem, there was also a rise in average earnings. Average hourly earnings for all employees in U.S. private nonfarm sectors increased by 12 cents, or 0.4%, to $34.10 in November. This rise followed a 0.2% increase in the previous month and exceeded market expectations of a 0.3% rise. While these indicators are positive for the U.S. economy, the Federal Reserve may interpret them differently, given its ongoing efforts to tighten the labor market. Could this impact the anticipated timeline for rate cuts? We’ll delve deeper into this as we explore this week’s market overview.

China’s Consumer Prices Fall Fastest in 3 Years

In November, China experienced a significant 0.5% year-on-year decrease in its Consumer Price Index (CPI), marking the steepest decline since the peak of the pandemic three years ago. This data, released by China’s National Bureau of Statistics on Saturday, showed an intensifying deflationary trend from October when the CPI had fallen 0.2% from the previous year.

This accelerating deflation has triggered calls for immediate intervention from Beijing to stimulate demand and avert a continuous downward price spiral. While decreasing inflation might be seen positively in many economies, it’s a concern for China, which has been grappling with persistent price weaknesses throughout the year, largely due to a slump in the property market and subdued spending. Deflation poses a risk to the economy; it can lead to delayed purchases or investments by consumers and businesses in expectation of further price drops. This behavior could further decelerate economic growth, potentially leading to a detrimental cycle.

What to expect this week:

As we begin this week, there’s potential for significant market volatility, especially if outcomes deviate from expectations. In our coverage of this week’s central bank meetings, we will provide the latest updates and insights into possible shifts in monetary policy. Given that much of the information is likely already priced into the market, the primary focus will be on any changes that may occur. December’s meetings are particularly crucial, as any postponement in rate cuts or alterations in tightening or easing policies could significantly influence market momentum.

Most central banks are anticipated to maintain stable interest rates this week. Therefore, the key insights are expected to emerge from press conferences and speeches, which are likely to have a greater impact on market dynamics than the interest rate decisions themselves.

Monday, December 11th, 2023

Throughout Monday, there are no significant data releases scheduled. However, later in the evening, the Reserve Bank of Australia’s Governor Michele Bullock is set to deliver a speech at the AusPayNet Summit in Sydney. Shortly after this speech, about 10 minutes later, the Westpac-Melbourne Institute will release its report on the change in Australian consumer confidence.

Tuesday, December 12th, 2023

Just after midnight, at 12:30 AM, the National Australia Bank (NAB) will release its business confidence index survey. This survey, conducted over the phone with approximately 600 small, medium, and large non-agricultural companies, aims to gauge their expectations for business conditions.

At 7:00 AM, the latest UK labor market figures will be revealed. The adjusted experimental unemployment rate in the United Kingdom has been stable at 4.2% in the past three months, consistent with the period from April to June and aligning with market expectations. Along with the unemployment rate, data on employment change and average earnings will also be closely monitored.

At 10:00 AM, new data for the ZEW Economic Sentiment Index from Germany and the Eurozone will be released. In Germany, Europe’s largest economy, a notable shift seems to have occurred as November’s figure reached +9.8, exceeding market expectations of +5.0.

A critical set of data, particularly in light of the upcoming FOMC meeting, will be the U.S. Inflation Rate, announced at 1:30 PM. The annual inflation rate in the US decreased to 3.2% in October, down from 3.7% in September and August, and was below the market forecast of 3.3%. There’s anticipation of a further decline to 3.1% in November. This drop in inflation is mainly attributed to falling energy prices, while costs for food, shelter, and new vehicles have continued to rise, albeit at a slower rate. Core consumer prices, which exclude volatile items like food and energy, are expected to increase to 0.3%, up from the 0.2% rise in the previous month. How inflation pressures ease will be crucial for the Federal Reserve’s interest rate decisions next year, which we will discuss more in our report.

The day concludes with the release of the Tankan Index by the Bank of Japan at 11:50 PM. This index, which assesses sentiment among large manufacturers, surveys around 1,100 companies with capital exceeding 1 billion Yen. It gathers participants’ perspectives on current trends and conditions in their business and industry, as well as their expectations for business activities in the coming quarter and year.

Wednesday, December 13th, 2023

Wednesday in the UK begins with the release of month-over-month (MoM) GDP, Industrial Production, and International Trade data. These indicators have shown improvements in the UK’s economy, with GDP growing by 0.2% in September, exceeding the forecasts of a flat reading and following a revised 0.1% growth in August. Industrial production remained flat in September after a revised 0.5% MoM decline in August, but manufacturing production saw a 0.1% MoM increase, rebounding from a revised 0.7% drop in the previous month. Following the UK data, the Eurozone’s Industrial Production figures will be released at 10:00 am.

A few hours before the Federal Reserve’s interest rate decision, the U.S. Bureau of Labor Statistics will publish the latest Producer Price Index (PPI) figures. In October, US producer prices fell by 0.5% MoM, marking the most significant decline since April 2020 and defying market expectations of a 0.1% increase. This fall in both CPI and PPI was primarily attributed to the decrease in energy prices in previous months. The PPI is a leading indicator for the CPI, as rising producer prices, as tracked by the PPI, often lead to increased consumer prices, as indicated by the CPI. Those interested in a deeper understanding of PPI and CPI are encouraged to visit the official website of the U.S. Bureau of Labor Statistics.

Commodity traders will likely be keen on the new EIA Weekly Petroleum Status Report, particularly following the U.S. announcement to increase its reserves last week.

At 7:00 pm, the most anticipated event of the week occurs: the Federal Reserve’s interest rate decision. The benchmark interest rate is expected to remain unchanged at 5.5%, as suggested by the CME FedWatch Tool. More crucial, however, will be the FOMC Economic Projections and Press Conference 30 minutes later, which may provide key information about interest rate cuts in 2024.

While the Fed plans to cut rates next year as part of its strategy after the easing of inflationary pressures, the timing remains a question. As of now, the chance of a rate cut by March 2024 stands at 42.0%, influenced by the recent NFP figures and Unemployment rate, with expectations possibly shifting to May.

This week’s Fed meeting, particularly following the new CPI and PPI data, is expected to bring high volatility to markets, especially if expectations aren’t met and new possibilities emerge, particularly regarding the timing of the Fed’s rate cuts.

After the FOMC, the focus will shift to New Zealand’s economic growth. Its GDP grew by 0.9% quarter-on-quarter in the three months to June 2023, outperforming the expected 0.5% growth and rebounding from a stall in the previous period, mainly due to stronger activity in the services sector. The Q3 figures are anticipated to be revised to 0.2%, as per the current market consensus.

Thursday, December 14th, 2023

Thursday begins with labor market data from Australia, followed by a speech from Brad Jones, the Assistant Governor (Financial System) at the Australasian Finance and Banking Conference in Sydney. This speech is not anticipated to significantly impact market volatility.

Another key event in this week’s series of interest rate decisions is the Swiss National Bank (SNB) announcement at 8:30 AM. In its September 2023 meeting, the SNB unexpectedly maintained its benchmark policy rate at 1.75%. This decision, which marked a halt in the rate-hike campaign that began in June the previous year, countered expectations of a 25bps increase. The SNB noted that further tightening might be necessary for medium-term price stability and committed to closely monitoring inflation. Considering the Swiss economy’s 0.3% growth in Q3 2023 and a slowdown in CPI to 1.4% in November 2023, it seems likely that the SNB will maintain its rate at 1.75%. The lingering question for many recovering economies is whether it’s time to ease monetary policy and, if so, when.

Two other central banks are also expected to hold meetings on their interest rate decisions. The Bank of England (BoE), which kept its benchmark rate at a 15-year high of 5.25% in its November meeting, is projected to do the same this week. This expectation stems from the latest CPI data showing a decline in prices to 4.6% in October. With only three out of nine Monetary Policy Committee members voting for a hike in November, no significant shift in voting is anticipated. The BoE’s path to interest rate cuts appears longer, with the earliest expected cuts being in mid-2024, contingent on meeting CPI and GDP forecasts.

In between central bank meetings, the U.S. will release its Retail Sales figures and additional labor market data. U.S. retail sales decreased by 0.1% MoM in October, ending a six-month growth streak. The upcoming month’s figures are expected to indicate a slowdown in consumer spending. No major changes are expected in the Initial Jobless Claims.

The last central bank on our agenda for the week is the European Central Bank (ECB), meeting at 1:15 pm. In its October meeting, the ECB maintained interest rates at multi-year highs, marking a shift from its 15-month rate hike streak. This was influenced by easing price pressures and recession concerns. With the Euro Area’s inflation rate at 2.4% year-on-year in November and the economy stalling in Q3 2023, the ECB faces a tough decision. Many analysts expect the ECB to follow the Fed and BoE’s lead in cutting rates as early as March 2024. More information will be available on Thursday, including the ECB’s decision, a press conference 30 minutes later, the ECB Economic Projections at 2:45 pm, and a speech by ECB President Christine Lagarde at 3:15 pm.

As the central bank meetings conclude, the focus shifts to the flash PMI rally for Manufacturing and Services. New Zealand’s PMI will be released at 9:30 pm on Thursday, followed by Australia’s 30 minutes later.

Friday, December 15th, 2023

Friday continues with the release of PMI figures from Japan at 12:30 am. Alongside Japan’s PMI, China will also provide its latest updates on annual industrial production and retail sales.

The PMI data release sequence progresses in Europe, starting with France at 8:15 am, followed by Germany at 8:30 am, and culminating with the Eurozone’s figures at 9:00 am. The UK’s PMI will be released shortly after, at 9:30 am.

In Europe, the week concludes with two notable events at 10:00 am: the release of Europe’s international trade data and a speech by Bank of England (BoE) member Dave Ramsden at Deloitte, discussing the Bank’s resolution regime. No significant revelations are anticipated during Ramsden’s speech.

In the afternoon, the United States will present minor data, including Industrial Production and PMIs. The day concludes with remarks from Bank of Canada (BoC) Governor Tiff Macklem at 5:40 pm. Similar to Dave Ramsden’s speech, Macklem’s address is not expected to significantly influence market dynamics.

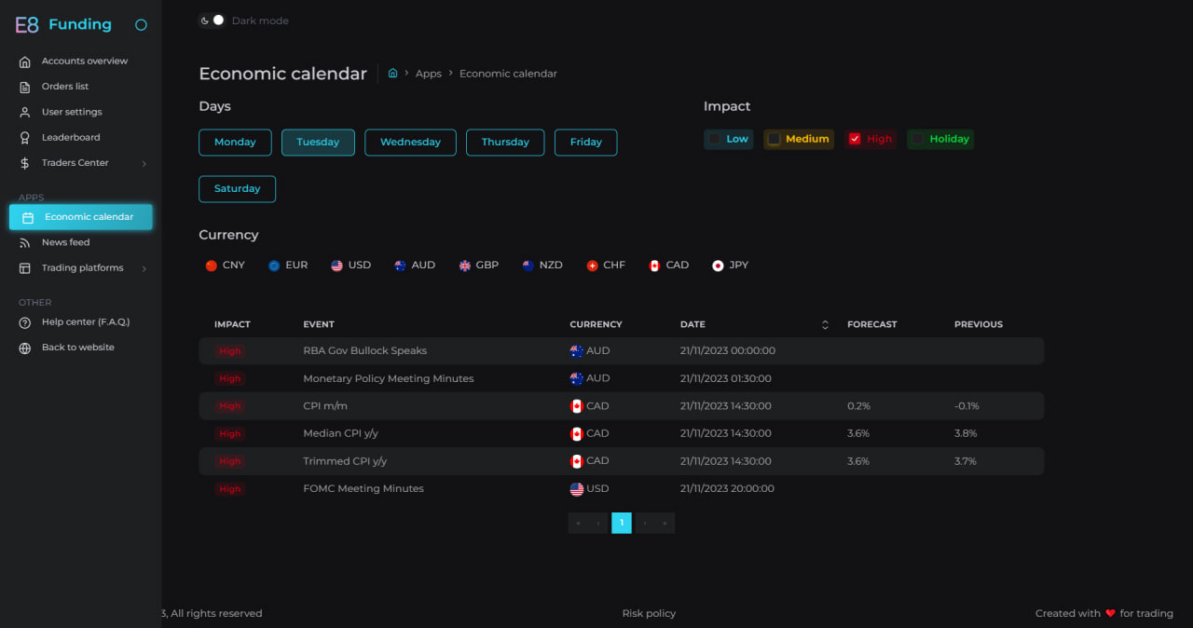

E8X Dashboard

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.