Market Overview: BoJ, BoC, ECB Rate Decisions This Week

Hello traders! As we approach a fresh trading week, E8 has compiled a Market Overview to ensure you stay updated on the key and latest events from the economic calendar.

Key Fundamental Events of the Week Include:

- Interest Rate Decisions in Japan, Canada, and Europe

- Purchasing Managers’ Index (PMI) data from major economies

- Preliminary GDP Growth Rate Figures from the US

- NAB Business Confidence and Inflation Rate Data in Australia

- Inflation Rate in New Zealand

Monday, January 22nd, 2024

The beginning of the trading week is typically quiet, with only one notable event on the calendar: Christine Lagarde’s speech at 2:00 pm. However, it’s important to note that this speech is not expected to impact market dynamics significantly, as it involves Ms. Lagarde’s participation in a state memorial ceremony for former President of the Bundestag Wolfgang Schäuble in Berlin.

In addition to the ECB President’s speech, BusinessNZ will release new data for the Performance of Services Index (PSI) in New Zealand.

Tuesday, January 23rd, 2024

NAB Business Confidence

Tuesday could introduce the first significant volatility in the markets, as just 30 minutes past midnight, the National Australia Bank (NAB) is set to release its business confidence survey. This survey involves a telephone questionnaire of about 600 small, medium, and large non-agricultural companies. It gauges business conditions expectations for the upcoming month and is an average of trading, profitability, and employment indices as reported by the participating companies.

The previous release of the NAB survey led to a decline in the Australian dollar against most currencies, including a 100-pip drop against the US dollar on the day of release. The index fell to -9 in November 2023, down from a revised -3 the previous month, marking its lowest level since 2012 (excluding the COVID period), as sentiment worsened across most industries. Currently, there’s no official consensus for the new data, but market expectations hover around -7, indicating a slight improvement but not a significant one. If the index returns to the July 2023 level of 1, the AUD might strengthen, especially considering the current short-term downtrend in the AUD/USD, which is currently bouncing off the 0.6550 level. However, it seems more likely that the market is awaiting Thursday’s GDP figures from the US and Friday’s CPI release in Australia. These fundamentals will be crucial for the future trajectory of the pair. The question remains: will we see a complete rebound or a further decline with a break below the support?

Bank of Japan Interest Rate Decision

At 3:00 am, another pivotal event is scheduled – the Bank of Japan’s (BoJ) Interest Rate Decision. The BoJ previously held its key short-term interest rate at -0.1% and the 10-year bond yield target at approximately 0% in its last meeting of the year, a decision that was unanimously expected. Additionally, the central bank maintained the loose upper band of 1.0% set for long-term government bond yields. The board emphasized its commitment to continuing monetary easing, given the extremely high uncertainties domestically and internationally. They also stated their readiness to adjust policies in response to changes in economic activity, prices, and financial conditions, aiming to achieve a 2% price stability target sustainably, along with wage increases. The committee has affirmed its willingness to implement additional easing measures if necessary. Governor Kazuo Ueda noted that wage increases are trailing behind the rise in prices, and the target level of inflation may not be sustainable.

Given the latest CPI number released last Thursday, we don’t anticipate the BoJ to relax its monetary policy. The annual inflation rate in Japan decreased to 2.6% in December 2023 from 2.8% the previous month, marking the lowest rate since July 2022. We expect that the bank will adopt a “wait and see” approach for the upcoming CPI, GDP, and Labor Market data before making any significant decisions.

Currently, the USD/JPY pair is around 148.200, just under 200 pips away from the crucial 150.00 level. The last time the market reached this level, the BoJ had to intervene in the FX market to manage the exchange rate, which was adversely affecting their international trade. This intervention briefly aided the Yen, but it remains to be seen whether the BoJ will address the weak Yen and take measures to bolster its strength.

Later in the day, at 11:50 pm, the Ministry of Finance will release its latest data on Japan’s international trade (Balance of Trade).

New Zealand Consumer Price Index (CPI)

During the day, there aren’t many events likely to cause market volatility, but at the end of the day, specifically at 9:45 pm, Statistics New Zealand is set to release CPI figures. Market consensus anticipates a decline in the quarter-over-quarter inflation rate in New Zealand, dropping to 0.6% from a 1.8% increase in September 2023. Should this be the case, it would be a positive development for the country’s economy, considering the annual inflation is currently above 5%, with the latest consensus at 4.7%. Additionally, many analysts are predicting a further decrease in prices.

Flash Manufacturing & Services PMI Rally

Fifteen minutes following the release of the CPI figures, the Flash Manufacturing & Services PMI data for Australia will be published. This will be the first among several major economies to report their PMI numbers, with more PMI data from other key economies expected the following day.

Wednesday, January 24th, 2024

Following the Australian PMI:

- 12:30 am Japan

- 08:15 am France

- 08:30 am Germany

- 09:00 am Eurozone

- 09:30 am United Kingdom

- 02:45 pm United States

What is Manufacturing & Services PMI?

The Purchasing Managers’ Index (PMI) serves as an indicator of the economic trends in the manufacturing and service sectors. It is a diffusion index, offering insights into whether market conditions are expanding, remaining stable, or contracting, as perceived by purchasing managers. The PMI’s primary function is to furnish current and future business condition insights to company executives, analysts, and investors.

Bank of Canada Interest Rate Decision

On the last meeting on the 6th of December 2023, The Bank of Canada held its target for the overnight rate at 5% for a third consecutive meeting in December 2023, in line with market expectations, leaving borrowing costs at a 22-year high. Policymakers noted that there are further signs that monetary policy is moderating spending and relieving price pressures, but remain concerned about risks to the outlook for inflation and are prepared to raise the policy rate further if needed. The central bank wants to see further and sustained easing in core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior. The central bank also said it is continuing its policy of quantitative tightening.

Last week’s release of the annual inflation rate showed an increase to 3.4% in December 2023 from 3.1% the previous month, meeting market forecasts. This aligns with the Bank of Canada’s projections that headline inflation will likely hover near 3.5% into the middle of next year, reinforcing the possibility of another rate hike to curb unsustainable price growth.

Looking at the USD/CAD chart, it appears that the US dollar, which was previously strong, has shown signs of weakening, suggesting the possibility of an ongoing mid-term downtrend. Should the Bank of Canada take a hawkish position in its forthcoming meeting, it might further reinforce the likelihood of this trend continuing. The meeting is highly anticipated and could lead to significant market volatility.

Wednesday does not have any other major fundamental releases scheduled.

Thursday, January 25th, 2024

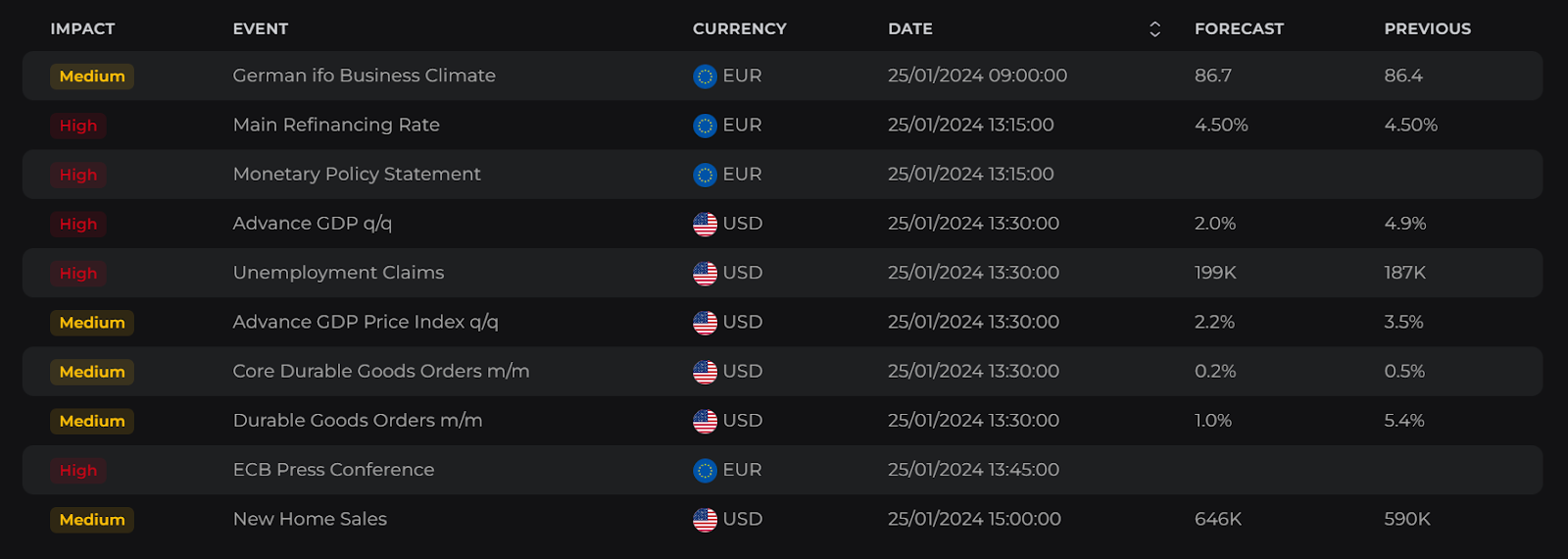

Thursday kicks off in Europe with France releasing its Business Confidence data at 7:45 am, which will be followed by the announcement of the Ifo Index in Germany at 9:00 am.

ECB Interest Rate Decision

Significant news from the Eurozone is expected at 1:15 pm when the European Central Bank (ECB) will announce its decision on monetary policy and benchmark interest rate. The ECB previously maintained interest rates at multi-year highs for a second consecutive meeting and signaled an imminent conclusion to its remaining bond purchase program, to address high inflation. The main refinancing operations rate stayed at a 22-year peak of 4.5%, while the deposit facility rate remained at a record 4%. Additionally, the ECB announced that full reinvestment under the PEPP will cease on June 30, followed by a reduction of the portfolio by €7.5 billion per month until the end of 2024. Policymakers have committed to keeping rates at sufficiently restrictive levels as long as necessary. Inflation is projected by the ECB to average 5.4% in 2023, 2.7% in 2024, 2.1% in 2025, and 1.9% in 2026, with the core rate slightly higher at 5.0% in 2023, 2.7% in 2024, 2.3% in 2025, and 2.1% in 2026. During the press conference, President Lagarde stated that rate cuts were not discussed, emphasizing that future decisions would be based on data.

With Eurostat reporting last week that inflation rose to 2.9% in December 2023, up from a more than two-year low of 2.4% in November, the ECB is likely to continue monitoring key economic indicators and may not take significant actions at this week’s meeting. Market momentum could arise about 30 minutes after the ECB’s Press Conference, as more detailed insights into the ECB’s plans for monetary policy and interest rate outlook for 2024 may be revealed. Similarly, President Christine Lagarde’s speech at 3:15 pm, commenting on recent developments, will be of significant interest.

GDP and Labor Market in the US

Before the ECB’s Press Conference and President Lagarde’s speech, the US is set to release several key pieces of economic data, including the advanced GDP growth rate, monthly Durable Goods Orders, and Initial Jobless Claims.

Recently, there was a notable decrease in the number of Americans filing for unemployment benefits, with a drop of 16,000 to 187,000 in the week ending January 18th. This figure, the lowest since September 2022, came in well under market expectations of 207,000. It suggests that unemployed individuals are finding it relatively easier to secure new jobs. This data continues to reinforce other job-related statistics, highlighting the historical tightness of the US labor market. Such a trend gives the Federal Reserve more room to maintain its hawkish stance into the second quarter if needed, to control inflation. The current consensus for the week ending January 25th is set at 200,000, further indicating the tight labor market in the US.

BoJ Monetary Policy Meeting Minutes

Wrapping up the day, at 11:30 pm, the Statistics Bureau of Japan is scheduled to release the latest CPI data for Tokyo, the heart of Japan’s economy. Alongside this, the Monetary Policy Meeting Minutes will be published, offering a detailed perspective on the economic outlook and actions that have been undertaken by the board members of the bank.

Friday, January 26th, 2024

On Friday morning, the latest Consumer Confidence figures from the three largest European economies – the UK, Germany, and France – will be released.

Personal Spending and Income in the US

The trading week concludes in the US with the release of the Core PCE Price Index, Personal Spending, and Income data at 1:30 pm. This will offer a more detailed insight into the financial situation of consumers.

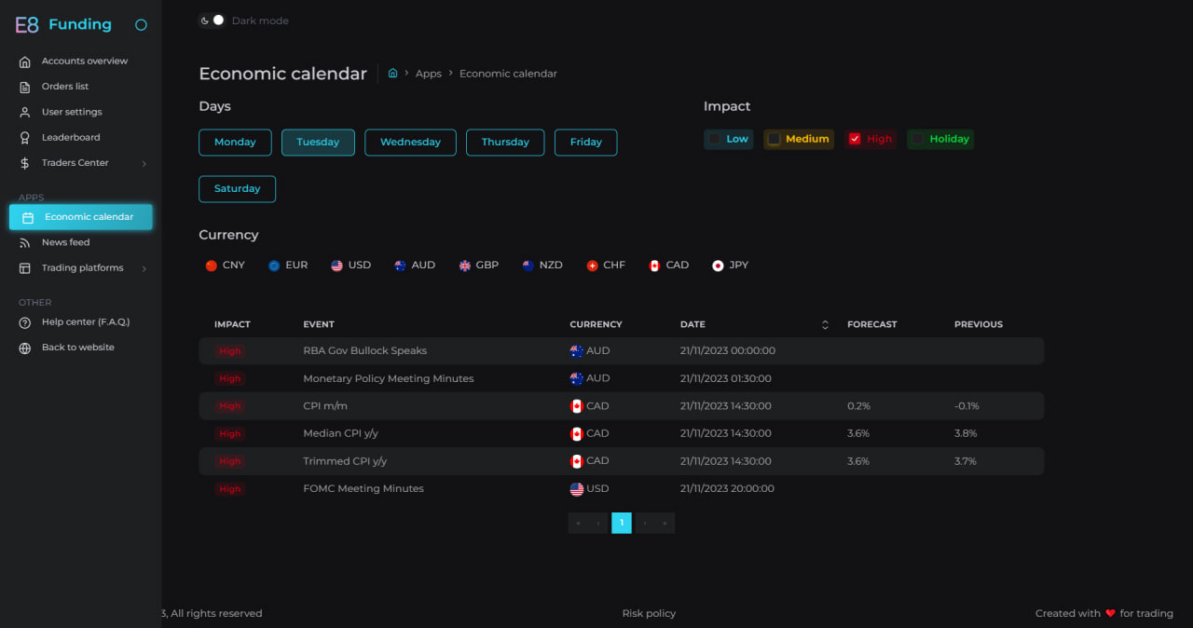

E8X Dashboard

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.