Market Overview: FEDs Interest Rate Decision and NFP Data

Good morning, traders! With a new trading week on the horizon, E8 has prepared a Market Overview to keep you informed about the upcoming developments on the economic calendar.

Key Fundamental Events of the Week Include:

- European GDP Growth Rate and Inflation Rate

- Interest Rate Decisions from the FED and BoE

- Purchasing Managers’ Index (PMI) data from China and the US

- Australian Inflation Rate

- US Non-Farm Payrolls and Unemployment Rate

Monday, January 29th, 2024

Monday starts off quietly, as is often the case at the beginning of a trading week. There are not many noteworthy events on the economic calendars. For those focusing on the European market, Luis de Guindos will be speaking at the Investment Outlook conference organized by Citi Private Bank in Madrid. However, it’s unlikely that this speech will have a significant impact on market volatility.

Tuesday, January 30th, 2024

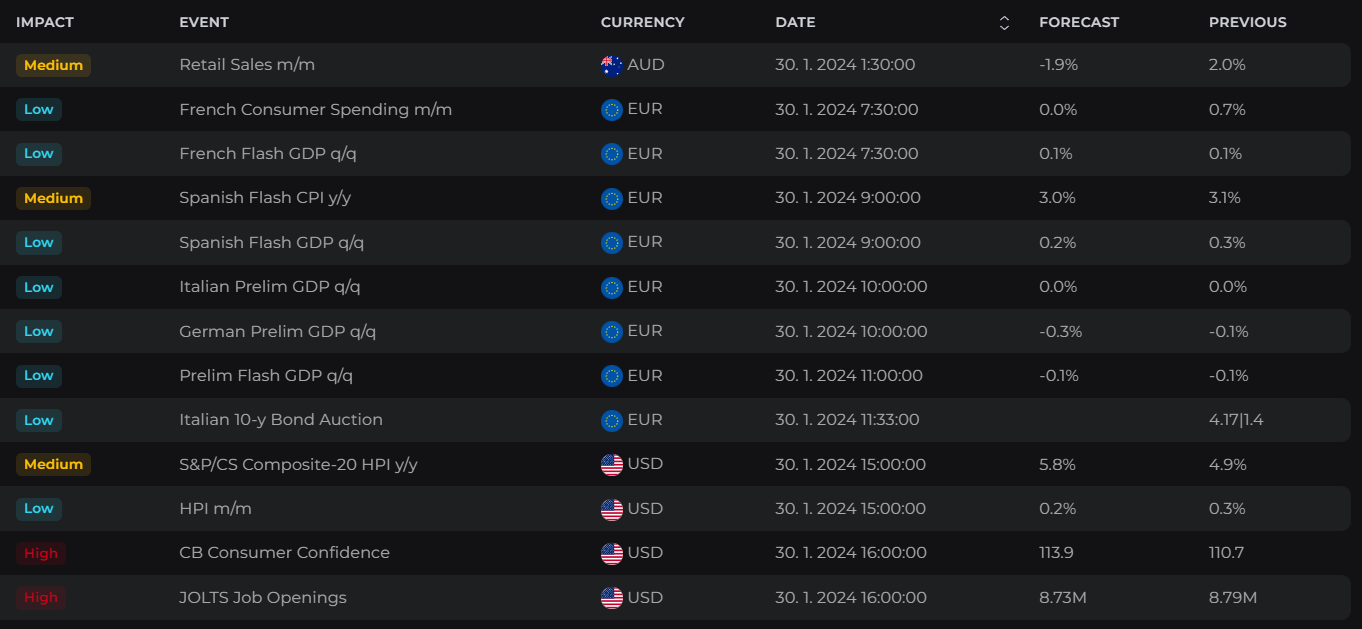

Tuesday is expected to bring increased volatility compared to the previous day, with events starting just 30 minutes after midnight when Japan’s Unemployment Rate is reported.

An hour later, Australian Retail Sales figures will be released. However, the more significant updates from Australia are anticipated on Wednesday when the Bureau of Statistics is set to unveil the country’s latest inflation rate, along with economic data from China that often has an impact on the Australian dollar.

Last week, we were discussing whether the AUD would depreciate against the US Dollar. The upcoming CPI release and the FED’s interest rate decision on Wednesday will likely provide us with the answer to this question, and as a result, we can anticipate significant market activity this week. From a technical standpoint, the range between 0.6550 and 0.6500 currently acts as strong support, preventing the AUD/USD from declining further, even toward 0.6300 in the medium term. Some traders are also speculating about the formation of the well-known head and shoulders pattern. However, it’s a risky proposition to speculate at this moment, especially considering the important data expected this week, particularly from the US.

European GDP Growth Rate

The London session will kick off the week with the release of key economic indicators, starting with the flash GDP growth rate figures for Europe. These reports will begin in France and then move on to Spain, Germany, Italy, and eventually the overall GDP figures for the entire Eurozone. Simultaneously, the European Commission will provide Economic and Industrial Sentiment data. In the third quarter of 2023, the Eurozone economy experienced a 0.1% contraction, marking a reversal from the 0.1% growth in the previous quarter (revised downward). This contraction was the first since the final quarter of 2022. Currently, the consensus stands at an unchanged -0.1%.

The rest of the day appears relatively calm, except for the release of JOLTs Job Openings data from the US at 4:00 pm.

On Tuesday, two board members will deliver speeches, commencing with opening remarks by Philip R. Lane at the ‘A Year with the Euro in Croatia’ conference organized by Hrvatska Narodna Banka in Zagreb at 10:00 am. Additionally, Anneli Tuominen will attend a webinar organized by the European Banking Institute on the book launch titled “Artificial Intelligence and Market Abuse.” It is not expected that either of these speeches will significantly impact market volatility.

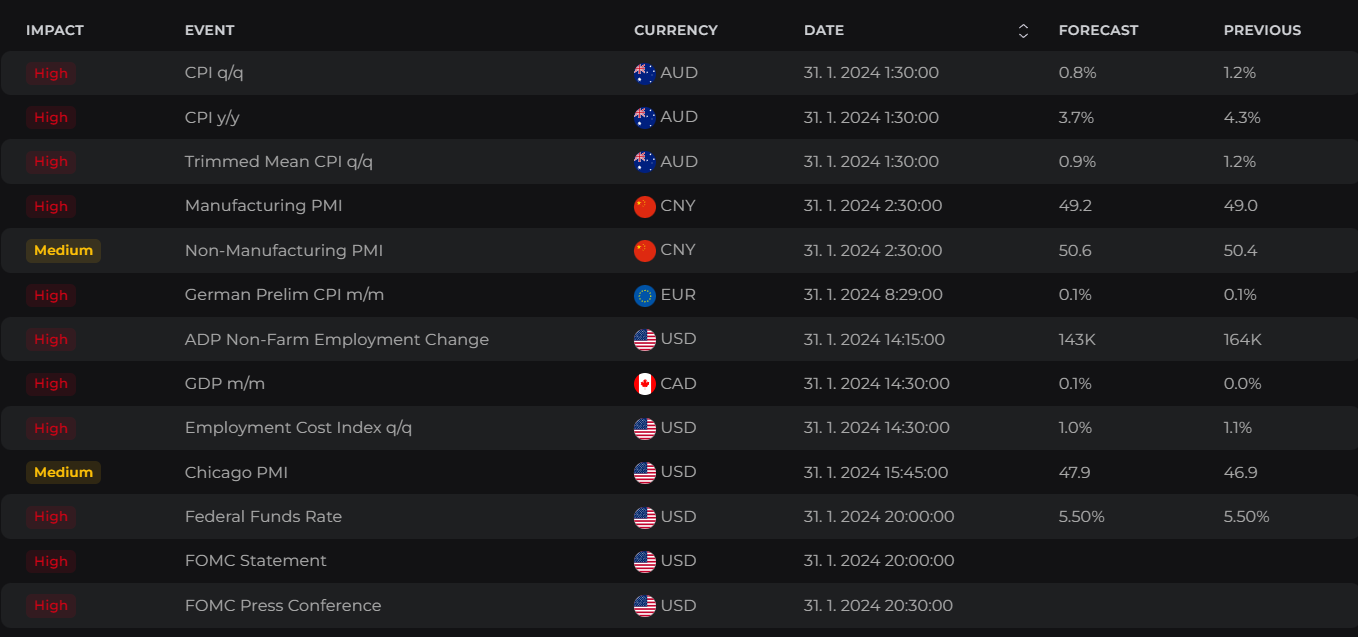

Wednesday, January 31st, 2024

50 minutes past midnight, the Bank of Japan is scheduled to release a Summary of Opinions, while the Ministry of Economy, Trade & Industry (METI) will publish data on Industrial Production and Retail Sales.

A week prior, we were speculating on the possibility of USDJPY reaching the 150.00 level in the mid-term. Given the count of news from the US this week, there is no doubt that such a development could occur. It all hinges on the Monetary Policy announcement from the Fed, and potentially, the Non-Farm Payroll (NFP) figures on Friday. The market has appeared to be in a consolidation phase for some time, and traders are eagerly awaiting a trigger for momentum.

Inflation Rate in Australia

At 1:30, the Australian Bureau of Statistics will release the latest Inflation Rate figures. In the third quarter of 2023, Australia’s inflation dropped to 5.4% year-on-year, down from 6.0% in the previous period, although slightly above market forecasts of 5.3%. This marked the third consecutive quarter of declining annual inflation, indicating the softest figure since the first quarter of 2022, primarily due to a slowdown in goods and services inflation. As of today, the consensus for Q4 stands at 4.3%, which would be positive news for the Australian economy and the RBA, potentially bringing them closer to their goal of initiating rate cuts in 2024. It’s worth noting that while positive news for the Australian economy may not necessarily translate into a stronger Australian dollar, as a more dovish RBA policy may deter currency investors, who tend to favor hawkish stances.

An hour later, the National Bureau of Statistics (NBS) of China will release manufacturing PMI data, which unexpectedly fell to 49.0 in December 2023 from 49.4 in the previous month, missing market estimates of 49.5. This marks the third consecutive month of contraction in factory activity, reflecting challenges such as property market weakness, deflationary risks, and growing global headwinds.

NBS PMI from China

The NBS Manufacturing Purchasing Manager Index (PMI) measures the performance of the manufacturing sector, with a reading above 50 indicating expansion, below 50 representing contraction, and 50 indicating no change. A reading above 50 would likely have a positive impact on both the Chinese yuan (CNY) and the Australian dollar (AUD), given their trade relationship. However, the current consensus stands at 49.2, indicating a slight improvement but still below the 50 threshold.

Wednesday morning brings more data from Japan, with Consumer Confidence and Housing Statistics shedding light on the situation within Japanese households.

Preliminary Inflation in the EU

As the London session begins, at 8:45 am, France, the second-largest European economy, will release Preliminary Inflation Rate figures. Staying in the EU, Germany will publish labor market data at 9:55 am and its Preliminary Inflation Rate figures at 2:00 pm. Based on the consensus, it appears that prices in the Eurozone are gradually decreasing, which could move the European Central Bank (ECB) closer to its 2% inflation target and potential rate cuts as early as the second quarter of 2024.

At 2:30 pm, Canada will deliver data on Preliminary economic growth change (GDP) for November.

Federal Reserve Bank Interest Rate Decision

The most pivotal economic event is undoubtedly the Fed’s interest rate decision at 8:00 pm. Policymakers are expected to leave interest rates unchanged at their January meeting, and they are unlikely to make any significant adjustments to their economic projections for interest rates, growth, employment, and inflation in the years ahead. The focus will primarily be on the guidance provided by Fed Chair Jerome Powell during the post-meeting press conference.

While we were previously speculating about a potential rate cut in March 2024, board members are now more cautious with their statements, with Daly and Bostic pushing for possible cuts in the third quarter of 2024.

Another FX pair under discussion was USDCAD, which, much like USDJPY, has been consolidating and awaiting upcoming news. A bullish turn for the US Dollar could break the resistance level of 1.3500, potentially reaching 1.3600 or even 1.3700, depending on market volatility. Conversely, a bearish outcome from the Fed could drive the USD down to the strong support level of 1.3200 in the medium term.

Thursday, February 1st, 2024

Thursday kicks off with another crucial piece of Chinese PMI data, this time from Caixin, holding a similar level of significance as the NBS data from the previous day.

The Caixin Manufacturing PMI (Purchasing Managers’ Index) assesses the performance of the manufacturing sector through a survey of 430 private industrial companies. Like the NBS PMI, a reading above 50 indicates expansion in the manufacturing sector compared to the previous month, below 50 represents contraction, and 50 indicates no change.

Caixin PMI from China

In December 2023, the Caixin PMI edged up to 50.8 from November’s 50.7, surpassing market expectations of 50.4. This marked the highest reading since August. The consensus for January stands at 50.6, but many analysts anticipate results better than expected, possibly around the 50.8 mark.

At 11:00 pm, the Eurozone will release Flash Inflation Rate figures for January. In December, the average for Eurozone countries using the Euro was confirmed at 2.9%, up from a two-year low of 2.4% in November. The forecast now stands at 2.8%, indicating that inflation across Europe may stabilize in 2024, potentially paving the way for the ECB to discuss rate cuts more progressively once labor market data and economic growth figures are released.

Bank of England Interest Rate Decision

The second key economic event of the week is scheduled for 1:00 PM – the Bank of England (BoE) Interest Rate Decision. During its December meeting, the Bank of England voted by a majority of 6-3 to maintain its benchmark interest rate at 5.25%, a 15-year high, for the third consecutive time. This decision aligned with policymakers’ efforts to combat inflation, despite signs of a deteriorating economic landscape. The remaining three members advocated for a 25 basis points rate hike, citing the relatively tight labor market and evidence of persistent inflationary pressures.

Similar to the Fed’s meeting the day before, the BoE is expected to keep the rate steady, particularly in light of recent unexpected inflation developments, which rose to 4% in December 2023 from a nearly two-year low of 3.9% in November, surpassing forecasts of 3.8%. Now that the rate hiking cycle appears to be behind us, it is not just the rate itself that’s important; many banks are discussing the steps ahead. It is the conference and speeches that provide an overview of the potential policy direction. These events, such as speeches from board members and governors, often generate more significant volatility than the rate decision itself.

PMI Data from the US

One more set of PMI figures will be released on Thursday, this time from the US. The ISM Manufacturing PMI improved slightly to 47.4 in December 2023 from November’s 46.7, surpassing market forecasts of 47.1. Nonetheless, this reading marked the 14th consecutive month of contraction in factory activity, extending the longest period of declining activity since 2000-2001. As of today, data are not expected to show any significant improvement.

Thursday’s agenda also includes two speeches: Remarks by Philip R. Lane and Christine Lagarde at an event organized by the Einaudi Institute for Economics and Finance (EIEF) in Rome. Neither of these speeches is likely to create significant market momentum.

Friday, January 2nd, 2024

The final trading day of the week appears to revolve around the United States, as there are no significant economic events scheduled from other countries on the calendar. Additionally, it is the first Friday of the month, which signifies the release of the Non-Farm Payrolls (NFP) report.

Non-Farm Payrolls & Unemployment Rate in the US

In December 2023, the US economy added 216,000 jobs, surpassing the downwardly revised figure of 173,000 in November and exceeding market expectations of 170,000. Additional details from the report revealed that the Unemployment Rate remained steady at 3.7%, while the annual wage inflation, as measured by the change in Average Hourly Earnings, rose to 4.1% from November’s 3.9%.

Initially, these results did not provide a significant boost to the US Dollar. However, once the initial volatility subsided, the dollar started to strengthen in the medium term, outperforming most other currencies in the following week.

Market expectations for the upcoming Friday suggest that the US economy may add 173,000 jobs. While this figure may not be as robust as the previous month, it’s essential to note that the consensus does not always align with market reactions. When there’s a deviation from the consensus, it can lead to heightened market volatility. Therefore, for traders who are not experienced in news trading, it’s often advisable to wait for the actual NFP result and then make trading decisions with the newly obtained information.

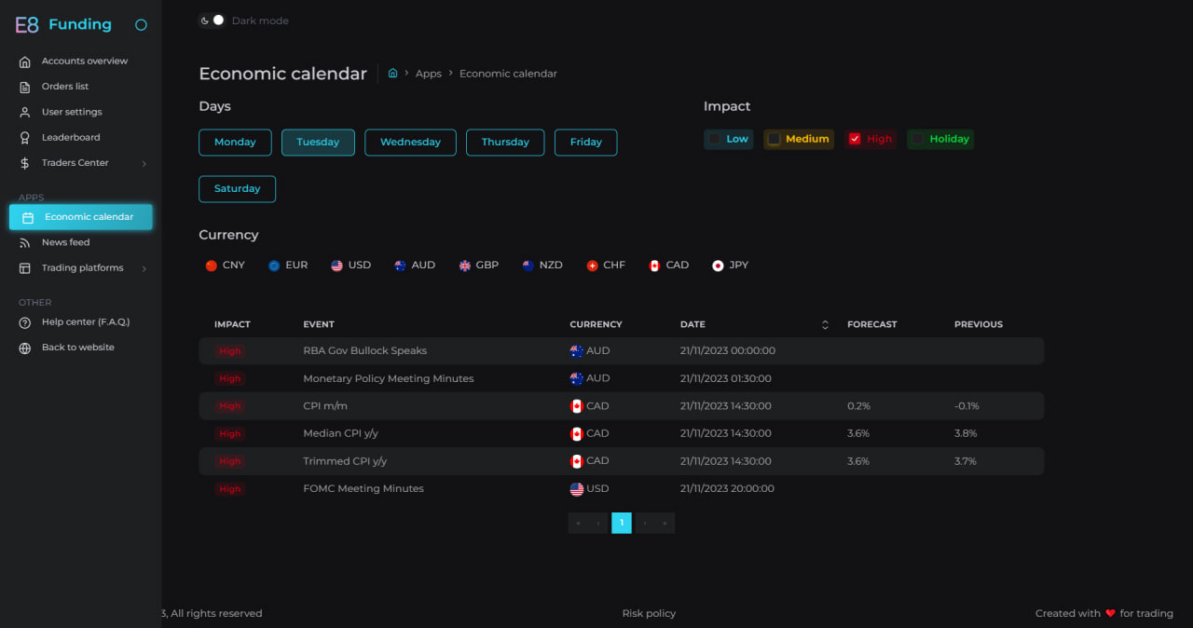

E8X Dashboard

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.