Fundamental Analysis: Hawkish FED and Economic Resilience

This week, the US dollar stands as a dominant force, buoyed by a robust domestic economy and expectations of a calculated “hawkish cut” from the Federal Reserve. However, the global economic landscape is far from uniform, with other major economies grappling with a confluence of challenges, including persistent inflation and faltering growth. Let’s delve deeper into the fundamental factors that are shaping the currency markets this week.

US Dollar: A Safe Haven in a Stormy World

The US dollar’s recent surge is a testament to the resilience of the American economy. Despite growing expectations of a 25 basis point rate cut at the upcoming FOMC meeting, key economic indicators paint a picture of continued strength. Consumer spending remains robust, fueled by a tight labor market and rising wages. This “warm” economic environment, however, raises concerns about the persistence of inflation, suggesting that the Fed may opt for a cautious approach to further monetary easing.

From a technical perspective, the dollar index (DXY) is staging an impressive comeback. After finding solid support around the 106 level, the DXY has almost broken through key resistance and is getting poised to challenge new highs for 2024. This bullish momentum is likely to persist if the Fed delivers a “hawkish cut” – lowering rates while signaling a cautious stance on future easing, effectively managing market expectations.

This week’s US economic calendar is packed with crucial data releases, including PMI figures, retail sales numbers, the Fed’s preferred inflation gauge, core PCE, and, most importantly, the Fed interest rate decision on Wednesday. These data points will provide valuable insights into the health of the US economy and influence the Fed’s policy decisions, ultimately impacting the dollar’s trajectory.

Pound Sterling: Battling Stagflation

The pound sterling faces a crucial week ahead, with a barrage of economic data releases, encompassing GDP figures, PMI readings, CPI inflation data, and labor market statistics. Recent data paints a concerning picture for the UK economy, with GDP contracting for two consecutive months, raising the specter of a technical recession. Adding to the gloom, inflation remains stubbornly high, creating a stagflationary environment where economic stagnation coexists with rising prices.

This challenging backdrop puts the Bank of England (BoE) in a precarious position. While high inflation calls for higher interest rates, the weakening economy demands monetary stimulus. The BoE’s “gradualist” approach to rate cuts may be put to the test if economic data continues to deteriorate. Technically, GBP/USD is showing signs of vulnerability, with a break below the critical support level at 1.2600 potentially triggering further declines.

Euro: Grappling with Economic Headwinds

The eurozone is also confronting the specter of stagflation, as evidenced by a series of disappointing PMI data from economic powerhouses like Germany and France. The European Central Bank (ECB), like its UK counterpart, faces the daunting task of balancing inflation concerns with the need to support economic growth. With downside risks to the eurozone economy accumulating, the euro is likely to remain under pressure in the near term.

The EUR/USD pair remains trapped within the 1.0460 – 1.0600 range. A decisive break below this zone, particularly with a close below 1.0400, could signal a significant shift in momentum and the continuation of a downtrend in the medium term.

Japanese Yen: Waiting for Policy Clarity

The Japanese yen has been characterized by heightened volatility in recent weeks as market participants attempt to decipher the Bank of Japan’s (BoJ) next policy move. While some speculate that the BoJ may finally abandon its ultra-loose monetary policy and embark on a path of interest rate hikes, recent commentary from policymakers suggests that a rate hike may be delayed until early next year.

USD/JPY has been on a relentless upward trajectory, breaking through key resistance levels and now setting its sights on the 156 zone. A “dovish hold” from the BoJ, where interest rates are maintained at current levels but the door is left open for future cuts, could further exacerbate yen weakness. However, a surprise rate hike or hawkish tone could trigger a sharp reversal in USD/JPY at a current 154.500 level.

Canadian Dollar: Exposed After Rate Cut

The Bank of Canada (BoC) caught market participants off guard last week with a larger-than-anticipated 50 basis point rate cut. While the move provided a temporary boost to the Canadian dollar, the currency remains susceptible to further declines if upcoming economic data disappoints.

USD/CAD has been trending higher, driven by the divergence in monetary policy between the US and Canada. A decisive break above the 1.4350 resistance level could unleash further gains in USD/CAD, potentially propelling the pair toward the highs from 2016. Canadian retail sales and CPI data, scheduled for release this week, will be closely scrutinized for clues about the BoC’s future policy actions and the Canadian dollar’s outlook.

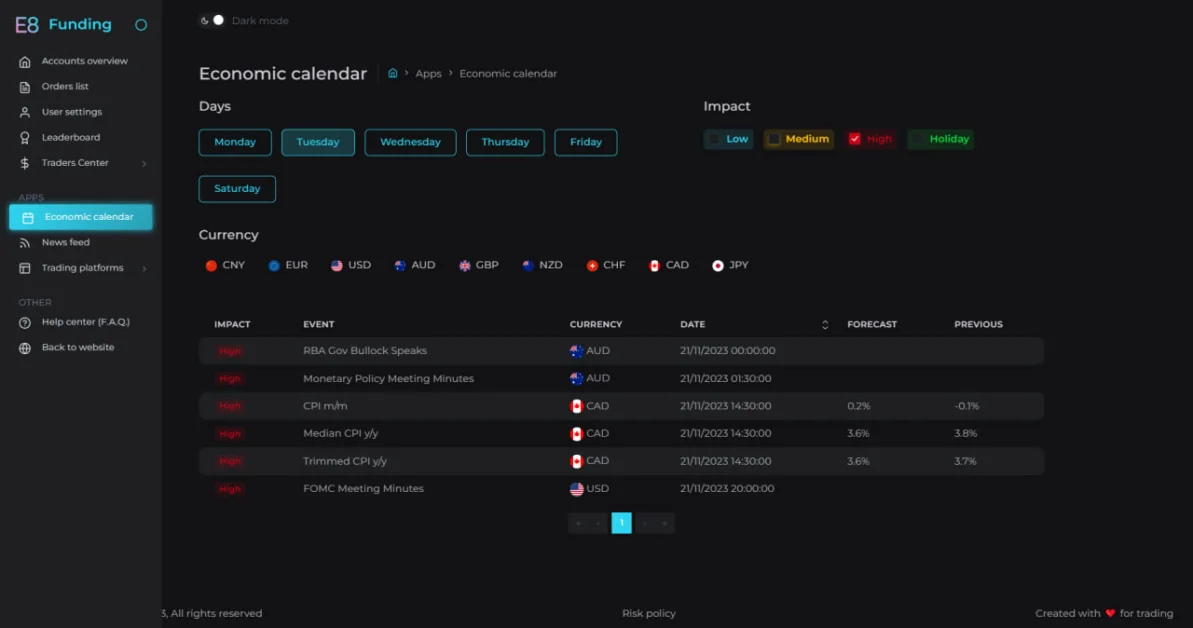

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.