Fundamental Analysis: FED & BoE Rate Decision

Last week’s financial landscape was dominated by the European Central Bank’s (ECB) interest rate decision, followed shortly by President Lagarde’s press conference. Market watchers were surprised to see the euro strengthen despite the ECB’s 25 basis point rate cut. This unexpected outcome can be attributed to Lagarde’s hawkish tone, suggesting a potential pause in future rate cuts. This shift in sentiment propelled the euro to outperform the US dollar.

Mid-week economic data from the UK fueled concerns about the nation’s economic health. July marked the second consecutive month of stagnation, a stark contrast to the 0.2% growth that had been anticipated. Adding to the gloom, industrial production slumped 0.8% month-over-month, defying forecasts of a 0.3% increase. The manufacturing sector also experienced a setback, with production declining 1% against expectations of a 0.2% rise. This cascade of disappointing figures exerted significant downward pressure on the pound, which ended the day as one of the weakest major currencies.

US inflation data released on Wednesday delivered a mixed message to the markets. Core consumer prices, which strip out volatile food and energy costs, ticked up 0.3% in August, slightly surpassing the anticipated 0.2% increase. This uptick represents a modest acceleration from July’s 0.2% rise. Conversely, the broader annual inflation rate continued its cooling trend for a fifth consecutive month, clocking in at 2.5% in August 2024 – the lowest reading since February 2021. This figure not only undershot the 2.6% forecast but also represents a significant dip from July’s 2.9%. The implications of this mixed data were immediately felt, with market expectations for interest rate cuts undergoing a notable shift. We will delve deeper into this dynamic in our upcoming analysis of this week’s FOMC meeting and the Fed’s subsequent interest rate decision.

Now, let’s turn our attention to the key data releases and economic events scheduled for this week.

CPI Data from Canada

The week commenced with the release of Canadian CPI data. The annual inflation rate fell to 2.5% in July 2024, down from 2.7% in June. This marked the softest increase in consumer prices since March 2021, aligning with both market expectations and the Bank of Canada’s forecasts. Currently, there’s no market consensus on the upcoming inflation data. Should the downward trend in Canadian prices persist, it could prompt the Bank of Canada to deliver another rate cut, potentially further weakening the already struggling Canadian dollar.

Inflation and the Bank of England’s Next Move

This week, the UK’s August inflation data will be closely monitored. The previous release revealed a modest increase in the annual inflation rate to 2.2% in July, slightly below forecasts. Meanwhile, core inflation declined to 3.3%. If this easing trend continues, it might encourage the Bank of England (BoE) to adopt a more dovish tone.

In its August meeting, the BoE reduced the Bank Rate by 25bps to 5%, in line with most market expectations. However, the central bank signaled caution in further loosening monetary policy until there is greater certainty that inflation will remain under control. The decision was described as “finely balanced,” with four Monetary Policy Council members voting to maintain rates due to concerns about higher services price growth and the potential for second-round effects. Despite these concerns, the BoE expects headline inflation to decline further, aligning inflation expectations with its target. The bank also acknowledges that the restrictive policy stance is likely to slow GDP growth and continue to soften the labor market, justifying a less restrictive approach.

Current market expectations suggest that 7 out of 9 MPC members will vote to hold interest rates steady. However, if Tuesday’s inflation figures show a more pronounced decline than anticipated, the BoE could signal a dovish shift, potentially preparing markets for a rate cut in its next meeting. This would likely trigger bearish momentum for the pound. Conversely, if the BoE maintains its current stance, similar to the ECB’s wait-and-see approach last week, the pound could continue to strengthen.

FED Interest Rate Decision: A Pivotal Week for the US Dollar

The most anticipated event this week is undoubtedly the Federal Reserve’s interest rate decision, scheduled for Wednesday evening. Recent shifts in rate cut expectations have already put downward pressure on the US dollar, and this meeting could amplify that trend.

Last week, market sentiment indicated a near 90% probability of a modest 25 basis point rate cut. However, following Wednesday’s CPI data, which revealed a more significant easing of inflation than expected, the CME FedWatch tool now suggests a 67% chance of a larger 50 basis point cut. This shift has injected uncertainty into the market, making the Fed’s upcoming decision even more critical.

Should the Fed opt for a smaller 25 basis point cut, the dollar could claw back some of its recent losses. Conversely, a more aggressive 50 basis point cut could send the dollar into a deeper downtrend. Upcoming data, such as Tuesday’s Retail Sales report, may provide further clues about the inflation trajectory. Weaker-than-expected figures could signal further easing of inflation, potentially bolstering the case for a larger rate cut.

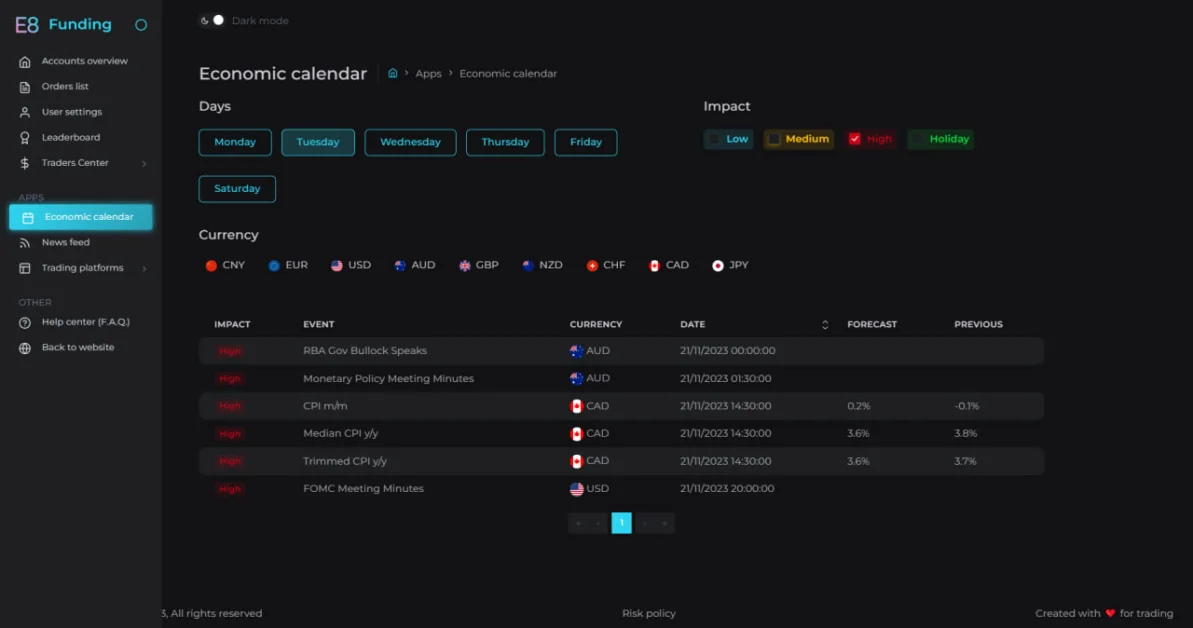

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.