Fundamental Analysis: RBA’s Impact on the AUD

Last week’s 50bps cut by the Federal Reserve brought the target range for the fed funds rate to 4.75%-5%, and has ignited significant market movement. This first reduction in borrowing costs since March 2020, along with the central bank’s forecast of another 100 bps easing by year-end, has sent ripples through the global economy.

The dollar immediately reacted, depreciating against most currencies. As we enter this week, traders are eagerly awaiting further insights. Jerome Powell’s speech on Thursday and Friday’s release of the PCE Index, along with personal income and spending data, are expected to provide key clues about the dollar’s and FED’s trajectory. Will the dollar regain strength, or will we see a continued depreciation?

Let’s delve into the fundamental analysis for the upcoming week to explore these questions and uncover potential market trends.

As always, don’t forget to check out our Youtube channel where our Fundamental Analyst Ken discusses these events in detail and provides chart-based market insights!

Manufacturing and Services Flash PMI Rally (Monday)

Investors and economists alike are eagerly awaiting a flurry of Flash PMI data releases scheduled for today, offering a crucial early glimpse into the economic health of major economies across the globe. The Flash PMI Index, an early estimate of the broader Purchasing Managers’ Index (PMI), provides a timely snapshot of business activity in both the manufacturing and services sectors.

Key Release Schedule:

- 12:00 am – Australia

- 08:15 am – France

- 08:30 am – Germany

- 09:00 am – The Eurozone

- 09:30 am – United Kingdom

- 02:45 pm – United States

- 01:30 am – Japan (Tuesday)

The release of PMI data holds particular significance for the Eurozone, as it offers crucial insights into the health of its manufacturing and services sectors. Traders are advised to be prepared for heightened volatility in EUR pairs following these releases, as they can significantly impact market sentiment and trigger swift price movements.

RBA Interest Rate Decision & Monthly CPI Figures (Tuesday and Wednesday)

This week, the spotlight falls on Australia as the Reserve Bank of Australia (RBA) announces its interest rate decision, followed by the release of monthly CPI figures.

The RBA is widely anticipated to maintain its hawkish stance, awaiting further evidence supporting a potential easing of rates. During its August meeting, the RBA held the cash rate steady at 4.35%, emphasizing the need to remain vigilant against upside inflation risks. Despite acknowledging substantial uncertainty around the economic outlook, the board stressed that policy will remain restrictive until inflation aligns with its target.

From a trader’s perspective, this signals the RBA’s desire to provide economic stimulus but its reluctance to do so prematurely due to inflationary concerns. While the market eagerly anticipates an eventual easing, any speculation on a weakening AUD based solely on this possibility remains risky.

The RBA’s hawkishness is partly attributed to the monthly Consumer Price Index (CPI), which rose by 3.5% in the year to July, exceeding market expectations. The current market consensus anticipates a further decline in inflation to 3.1%. However, if this forecast is missed, it could signify a further delay in the RBA’s rate cut schedule. Conversely, lower-than-expected inflation data could fuel dovish sentiment among RBA members, potentially bringing a rate cut in 2025 closer to reality, although it remains unlikely for this year.

Jerome Powell (Thursday)

Thursday will see a heightened focus on Jerome Powell’s address at the 2024 U.S. Treasury Market Conference in New York. Traders will keenly observe the FED Chair’s remarks for clues on monetary policy direction, interest rate trajectory, and inflation outlook, seeking insights to guide their trading strategies.

SNB Interest Rate Decision (Thursday)

The Swiss National Bank’s interest rate decision is another key event on Thursday’s economic calendar. Following two consecutive 25 basis point cuts this year in response to easing inflation and the strength of the Swiss Franc, markets are widely anticipating another similar reduction. This would bring the benchmark rate down to 1%, potentially causing a temporary dip in the value of the Franc. However, the expected move is broadly in line with market forecasts and the Franc’s safe-haven appeal is likely to limit any significant or prolonged weakness.

A Mix of Economic Data from Eurozone (Friday)

The week concludes with a diverse set of economic data releases from the Eurozone. Early on Friday, we’ll gain insights into inflationary pressures in France, the bloc’s second-largest economy, along with crucial labor market figures from Germany, its largest. Following these releases, analysts will be keenly focused on the Eurozone Economic Sentiment indicator, particularly in light of the flash PMI data released earlier in the week.

PCE and Consumer Sentiment Data from the US (Friday)

Friday afternoon will deliver crucial economic indicators for the Fed, with the release of the PCE Price Index along with personal income and spending data. Recent trends highlight the market sensitivity to these figures: despite the PCE index (measuring underlying inflation) aligning with expectations at 0.2%, the US Dollar strengthened due to personal income exceeding forecasts. This suggested that increased consumer income could translate into higher spending, potentially fueling inflation and reducing the likelihood of further aggressive rate cuts by the Fed.

This week’s data carries similar weight, with a focus beyond the PCE to personal income and spending, particularly if they deviate from consensus estimates. Current PCE expectations remain at 0.2%, but an inflation surprise to the downside could pressure the dollar and encourage a more dovish Fed stance after its recent 50 bps cut. Conversely, higher-than-anticipated inflation could bolster the dollar and embolden the Fed to maintain its hawkish approach.

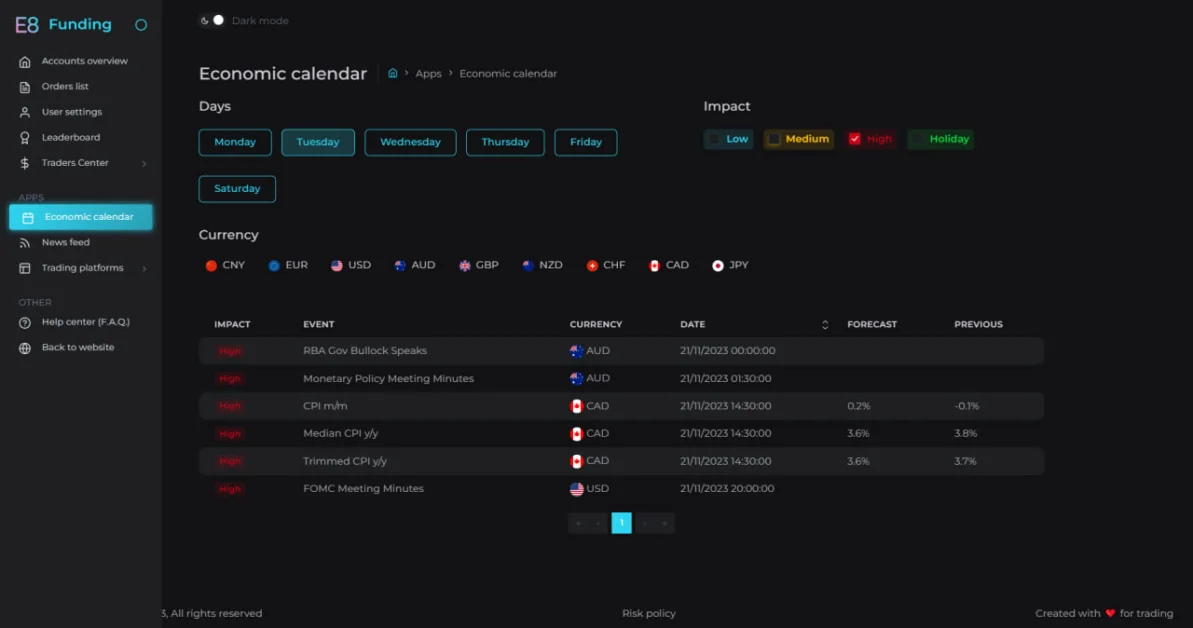

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.