Fundamental Analysis: Will NFP Data Signal a Fed Pivot?

The past week brought a flurry of economic data from the United States, shedding light on consumer behavior and overall economic activity. While Thursday’s GDP data and Friday’s inflation figures met market expectations, consumer data presented a mixed picture. Personal income rose, potentially fueling inflation, yet personal spending declined, suggesting lower demand and downward pressure on prices. This leaves the Federal Reserve (Fed) without a clear direction, making this week’s labor market data and Non-Farm Payroll (NFP) report crucial for anticipating future monetary policy actions.

Beyond US labor market data, several other key releases will capture attention this week. These include unemployment data from Canada and pivotal inflation figures from the eurozone, where political risks have recently weighed on the Euro. Market anticipation of future European Central Bank (ECB) policy adjustments could trigger further Euro volatility. Today, we’ll also hear from ECB President Christine Lagarde at the European Central Bank Forum on Central Banking in Portugal, followed by Fed Chair Jerome Powell’s speech at the same event on Tuesday.

US Labor Market Data: A Turning Point for the Fed?

The US dollar has begun to consolidate as we approach a critical point in Fed monetary policy. With inflation still above target and recent consumer data providing a mixed picture, traders are awaiting Friday’s NFP report and unemployment rate for guidance. Any signs of labor market cooling could trigger bearish momentum for the dollar, as it would increase the likelihood of a September rate cut. Currently, the CME FedWatch Tool signals a 60% chance of a September cut. Conversely, a tight labor market coupled with persistent inflation might delay a rate cut, potentially extending into August and driving bullish dollar volatility.

Throughout the week, we’ll receive additional US labor force data, such as JOLTS Job Openings and the weekly Initial Jobless Claims report. The Institute for Supply Management will also provide insights into economic performance with Manufacturing PMI data on Monday and Services PMI data on Wednesday.

Flash Inflation Rate in the Eurozone

Across the Atlantic, a series of inflation figures from major eurozone economies will be unveiled. Preliminary data from Germany, the largest eurozone economy, surprised the market with a sharper-than-expected decline in inflation. If this trend continues across other eurozone economies, the market may anticipate a more dovish ECB, potentially leading to bearish momentum for the Euro. While the Euro recently benefited from unexpectedly positive PMI figures, the inflation data could reverse this sentiment if it confirms a slowdown in prices.

Swiss Unemployment and Inflation Rate

Staying in Europe, Switzerland will release key data on Thursday, including the latest change in Swiss unemployment and inflation rate. The SNB has already implemented two rate cuts, leading to a rapid decline in the Franc. The bank is likely to maintain its current policy for an extended period, especially if the upcoming data shows resilience. This could potentially trigger a reversal for the Franc, allowing it to regain some of its lost value in the medium term.

Canadian Unemployment Rate

The final key economic data release this week will come from Canada, which will unveil its unemployment rate simultaneously with the US NFP report. The current consensus forecasts a rise to 6.3% in June from 6.2% in the previous month. If this consensus is met or exceeded, the chances of the BoC delivering another rate cut this year will increase, potentially leading to a more dovish tone from the central bank and bearish sentiment on the Canadian dollar, which has recently experienced a bullish surge. Conversely, unchanged data could lead to a wait-and-see approach from the BoC, potentially pushing the CAD higher.

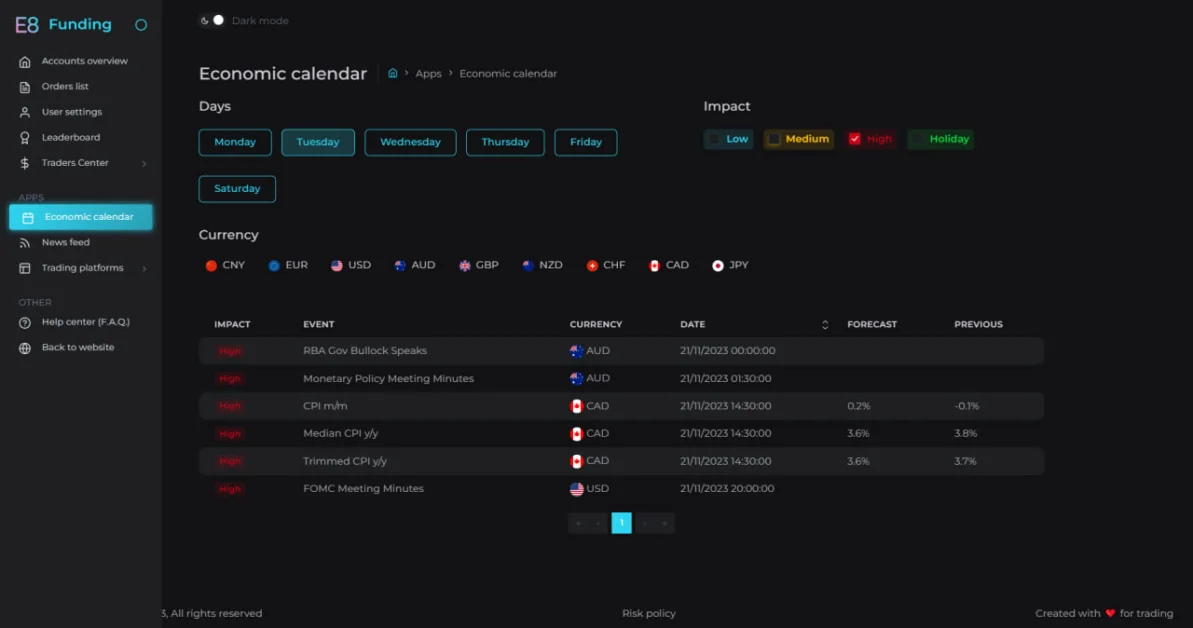

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.