Market Overview: Europe & Canada in Focus

Hello, traders! As we embark on a new trading week, E8 brings you a Market Overview, offering key economic events and insights to shape the FX Market. Stay ahead of market-driven events with our fundamental analysis.

Key Events of the Week Include:

- Economic Expansion in Australia and the Eurozone

- Interest Rate Decisions from the BoC and ECB

- PMI Reports from Canada and the United States

- International Trade Figures from Australia and China

- Labor Market Updates from Canada and NFP Figures from the US

Monday, March 4th, 2024

The week in Europe kicked off with the release of the latest Consumer Price Index (CPI) figures in Switzerland on Monday. An hour after unveiling the Swiss National Bank’s Annual Report for 2023, the Swiss Federal Statistical Office reported a dip in the country’s annual inflation rate to 1.2% in February 2024, down from the prior month’s 1.3%. Despite forecasts of 1.1%, this still represented the lowest reading since October 2021. The core rate, excluding volatile items like unprocessed food and energy, also saw a slight decrease from 1.2% to 1.1%.

Except for CPI figures release for Japan’s largest economy – Tokyo, there are no other significant events on Monday’s economic calendar.

Speeches:

- 04:00 pm – FED Patrick Harker

Tuesday, March 5th, 2024

The day starts with China’s Caixin Services PMI at 1:45 am, followed by a relatively quiet morning featuring only the release of the Eurozone’s PPI at 10:00 am.

The afternoon promises to be similarly subdued, with Canada’s Services PMI at 2:30 pm and the US counterpart following roughly 30 minutes later. Concurrently, the U.S. Census Bureau will announce the monthly shifts in Factory Orders.

The day wraps up with less significant economic updates from Australia, where the Australian Industry Group will report the latest changes in the Industry, Construction, and Manufacturing Index within the country.

Speeches:

- 05:00 pm – FED Michael Barr

- 08:30 pm – Michael Barr

Wednesday, March 6th, 2024

Remaining in Australia, the country’s Bureau of Statistics will release the latest economic growth figures shortly after midnight. The Australian economy grew by 0.2% quarter-over-quarter in Q3 of 2023, falling short of market expectations and down from 0.4% growth in Q2, marking the slowest expansion since Q3 of 2022. Annually, the GDP increased by 2.1%, slightly ahead of forecasts and an improvement from a revised 2.0% in Q2. This Wednesday, we anticipate the last quarter figures for 2023, which are expected to marginally outperform Q3 by 0.1%. These final GDP figures are crucial for the RBA (Reserve Bank of Australia) as the nation continues to combat a high inflation rate of 4.1%, significantly above the RBA’s 2% target, alongside decade-high interest rates.

Just before the London session begins, Germany, Europe’s largest economy, will publish its international trade data.

At 10:00, Eurostat will reveal retail sales figures, potentially shedding light on consumer spending trends in Europe, as this indicator reflects the total sales of goods.

The second key event of the week, after the Australian GDP, is the BoC (Bank of Canada) Interest Rate Decision at 2:45 pm. The Bank of Canada maintained its overnight rate target at 5% for the fourth consecutive time in January 2024, aligning with expectations and maintaining benchmark borrowing costs at a 22-year high. The Council highlighted ongoing inflation risks, especially in underlying price growth, necessitating sustained restrictive monetary policy. The Bank of Canada is anticipated to advocate for patience in its upcoming announcement, as weakening economic signals hint at potential rate cuts in the following months. Although rates are expected to remain steady, the subsequent press conference at 3:30 pm could lead to market volatility if there is a shift in the bank’s stance on future rate cuts.

Wednesday will also feature another significant event in Canada, as the Ivey Business School releases its Purchasing Managers Index (PMI) at 3:00 pm. This index tracks changes in economic activity month-to-month, as reported by a panel of purchasing managers from various sectors in Canada, and includes data from both public and private sectors.

After Canadian updates, FED Chairman Jerome Powell is scheduled to present the Semiannual Monetary Policy Report to Congress at 3:00 pm. At the same time, the U.S. Bureau of Labor Statistics will release data on job openings, representing all unfilled positions on the final business day of the month.

Speeches:

- 05:00 pm – FED Mary Daly

Thursday, March 7th, 2024

Thursday begins in Australia, this time with a focus on its International Trade, which will be reported just 30 minutes past midnight. China will follow with its Balance of Trade figures at 3:00 am.

In Europe, Switzerland will announce its Unemployment Rate at 6:45 am, which is currently at its highest since February 2022. Additionally, Germany, the EU’s most industrialized country, will disclose its Factory Orders data.

The spotlight in Europe continues as the ECB (European Central Bank) is set to make its monetary policy decision, including interest rates, at 1:15 pm, marking a critical event of the week. ECB officials have recently maintained that discussing interest rate cuts is premature, despite signs of subsiding inflation within the Eurozone. They remain cautious, emphasizing that early rate reductions could impede the return to target inflation levels. Despite market expectations factoring in rate cuts for 2024, which has eased financial conditions, the ECB in January held interest rates at historically high levels, committing to keep them restrictive to counter inflation effectively. Last week, inflation in the Eurozone fell to 2.6%, prompting comments from members like De Guindos on potential rate adjustments. Yet, most economists anticipate the ECB might initiate cuts by June, making Thursday’s meeting highly anticipated though potentially unsurprising. The ECB is closely monitoring the Eurozone’s GDP, wage trends, and geopolitical tensions, all crucial in shaping their monetary policy. Similar to the Bank of Canada’s recent update, the ECB’s press conference at 1:45 pm is expected to be even more scrutinized than the rate decision itself, providing key insights and forward-looking statements.

Later, at 3:00 pm, FED Chairman Jerome Powell will address the U.S. Senate Committee on Banking, Housing, and Urban Affairs.

The day concludes with Japan’s Household Spending Report at 11:30 pm.

Speeches:

- 04:30 pm – FED Loretta Mester

Friday, March 8th, 2024

The last day of the week begins in Germany with a monthly update on Industrial Production, which has seen its fourth consecutive month of decline, along with the Producer Price Index (PPI).

Three hours later, significant news will emerge from the Eurozone as Eurostat announces the estimated GDP growth for Q4. The economy of the Euro Area showed no growth in the final quarter of 2023, continuing from a 0.1% shrinkage in the preceding quarter, affected by high inflation, peak borrowing costs, and weak foreign demand. Within the major economies of the bloc, Germany experienced a 0.3% shrinkage, mainly due to industrial sector weaknesses, while France’s GDP saw no change. Conversely, Spain and Italy witnessed growth rates of 0.6% and 0.2%, respectively. For the entire year of 2023, the Eurozone’s GDP growth slowed to 0.5%, a significant drop from the 3.4% and 5.9% growth rates seen in 2022 and 2021, respectively.

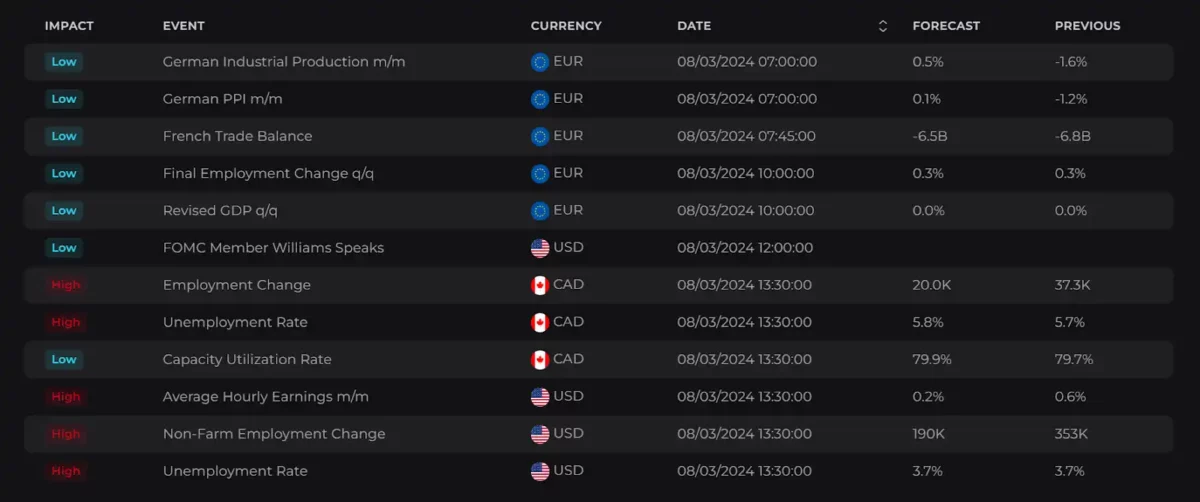

The week concludes with labor market data from Canada and the US.

Starting with Canada at 1:30 pm, the focus will be on the Unemployment Rate, Employment Change, and Hourly Wages. The key figure, the Unemployment Rate, hovers around a 22-month high of 5.7-5.8%. This data has slightly alleviated concerns over the Canadian economy slowing too rapidly due to higher interest rates, providing the Bank of Canada with more flexibility to keep rates at restrictive levels. The number of unemployed individuals decreased by 19,200 to 1,243,800 from the previous month, with youth unemployment dropping by 18,800. Furthermore, the Canadian economy added a significant 37,300 jobs, the highest in four months and surpassing the expected 15,000 job increase.

In the US, the Bureau of Labor Statistics will release its NFP figures on the first Friday of the month as usual. In January 2024, the US added 353K jobs, an increase from a revised 333K in December and well above the anticipated 180K, marking the largest employment surge in a year and indicating the continued tightness of the labor market, which in turn supports the strength of the US dollar. The upcoming figures will be closely watched to see if this tightness can intensify further.

Alongside the NFP data, we will also see updates on the Unemployment Rate and Hourly Earnings.

Speeches:

- 12:00 pm – FED John Williams

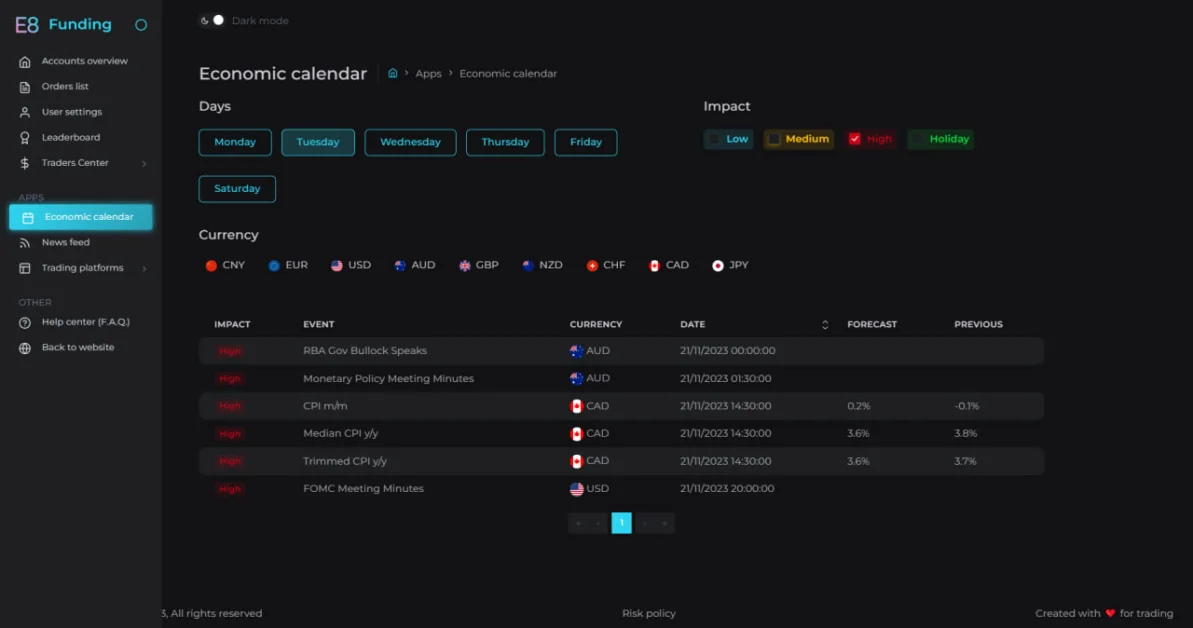

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.