Fundamental Analysis: RBA, BoE, and SNB in Spotlight

Last week proved to be a rollercoaster ride, particularly for the Euro and US Dollar. While both currencies experienced significant volatility, their catalysts were markedly different. The Euro faced early-week losses, primarily due to the European parliamentary elections. The unexpected surge of right-wing political parties introduced a wave of uncertainty into the markets. Conversely, the US Dollar found bullish momentum after a hawkish Federal Reserve press conference. While the Euro’s future remains clouded by local political risks, the Fed provided a clearer outlook. Despite slightly lower-than-expected inflation, the Fed expressed concerns about the tight labor market and a revised upward forecast for inflation in the US. These hawkish commentaries, coupled with the adjustment of 2024 rate cut expectations from two to one, propelled the dollar upwards. It’s anticipated that this bullish momentum will persist until new data indicates a change in direction.

RBA Interest Rate Decision (Tuesday):

The week ahead features pivotal decisions from other central banks, starting with the Reserve Bank of Australia (RBA) on Tuesday. The RBA has been grappling with a significant dilemma. In its last decision, the bank even considered raising rates in 2024 due to persistent inflation and a tight labor market. These factors have supported the Australian Dollar’s recent strength. Given this context, it’s highly probable that the RBA will either maintain its current rate or adopt an even more hawkish stance, potentially hinting at a rate hike. Either scenario could further bolster the Australian Dollar. However, a more dovish stance, though less likely, cannot be ruled out entirely. Recent GDP data and declining business confidence reveal that economic activity in the country is slowing. To stimulate the economy, the bank might consider a rate cut. Nevertheless, most analysts and economists do not expect the RBA to take this path, as they remain data-dependent, particularly on the inflation and labor market fronts. In summary, the RBA is likely to maintain its hawkish tone, which could provide additional support to the Australian Dollar. Traders will be closely monitoring inflation and labor market data for any signs that the RBA might consider a rate cut, as markets tend to react based on expectations.

US Consumer Sentiment and Retail Sales (Tuesday):

Tuesday also brings US Retail Sales data, providing insights into consumer spending behavior. This information will offer valuable hints about market expectations for future GDP and inflation figures. Higher retail sales could suggest that GDP figures might come in better than anticipated, but they could also be inflationary, further delaying rate cuts and supporting the dollar. Conversely, lower retail sales might indicate weaker demand, potentially helping to suppress inflation. An hour after the Retail Sales data release, the Federal Reserve will also provide Industrial and Manufacturing Production figures, offering a broader perspective on economic activity.

UK Inflation and BoE Interest Rate Decision (Wednesday and Thursday):

Similar to last week’s situation in the US, where inflation figures were released a day before the Federal Reserve’s decision, the UK will experience a similar sequence. On Wednesday, we’ll get to see how inflation in the UK has changed. This will be a crucial piece of data for the Bank of England, as markets are uncertain whether the bank will deliver one or two rate cuts this year. On Thursday, the BoE is expected to vote 7-2 in favor of holding interest rates at 5.25%. However, the accompanying commentary will be more important, as it can provide insights into the bank’s future actions. If inflation shows signs of easing, we might see a more dovish BoE, further supporting the possibility of a second rate cut in addition to the one expected in August. Such a stance could cause the pound to depreciate. Conversely, if inflation proves sticky, the BoE might signal only one rate cut or even delay the August rate cut, potentially triggering bullish momentum for the pound. So far, the pound has been consolidating, awaiting a clear direction, which might be provided this Wednesday.

SNB Interest Rate Decision (Thursday):

The Swiss National Bank’s (SNB) last rate decision was a surprise move, as the bank reduced its key policy rate by 25 basis points to 1.5%, marking the first cut in nine years. This decision made the SNB the first major central bank to ease monetary policy, causing the Franc to depreciate for a while. However, the situation changed after SNB Governor Thomas Jordan’s speech, where he indicated that the bank is less likely to deliver another rate cut in the near future. The SNB’s board still sees the inflation situation as unclear and, like the ECB, is in no hurry to take further dovish action until they are certain that prices are stable. We are unlikely to see significant momentum from the rate decision itself. However, similar to other central bank decisions, the commentary from the SNB will be crucial, especially regarding their inflation projections, which will be the most important factor to watch for when assessing the likelihood of another rate cut.

US Labor Market (Thursday):

On Thursday, in addition to the BoE and SNB decisions, we’ll also receive the latest Initial Jobless Claims data from the US. This data will provide further signs of where the US labor market stands. As of now, there is no clear consensus on what the new data might be, but most analysts point to a slight decrease in jobless claims, signaling a continuation of the tightness in the labor market, which would support the Fed’s hawkish stance on rates.

Manufacturing & Services Flash PMI Rally (Thursday)

The Purchasing Managers’ Index (PMI) is a survey-based economic indicator that gauges the health and direction of economic trends in both the manufacturing and services sectors. The index values indicate whether the sector is expanding (above 50), contracting (below 50), or remaining stagnant (50). These economic data releases are significant, but most traders focus on instances where the PMI level crosses the 50 mark, as this is usually followed by market momentum: crossing above 50 indicates bullish sentiment while crossing below 50 signals a bearish sentiment.

Besides the Flash PMI data from major economies, we will also receive more data from the UK. The Office for National Statistics will release the latest changes in the country’s Retail Sales. This data will play an important role and will reflect on the next Inflation and GDP data prints, as we have already explained with Tuesday’s Retail Sales data from the US.

Closing Thoughts:

To conclude this week’s Fundamental Analysis, traders should be prepared for volatility, especially in Pound pairs but also in the Australian Dollar and Swiss Franc. More news will be coming out from Europe, but these will be primarily geopolitical triggers, which are often more uncertain than the economic indicators we follow. Therefore, any Euro traders should keep a close eye on their positions. If any changes are to be expected in the market this week, the US looks poised for more bullish momentum. For other currencies, we have to await the central bank decisions and, especially, the commentary from board members. Wishing you all a successful week, and I look forward to informing you about economic events and data releases next week!

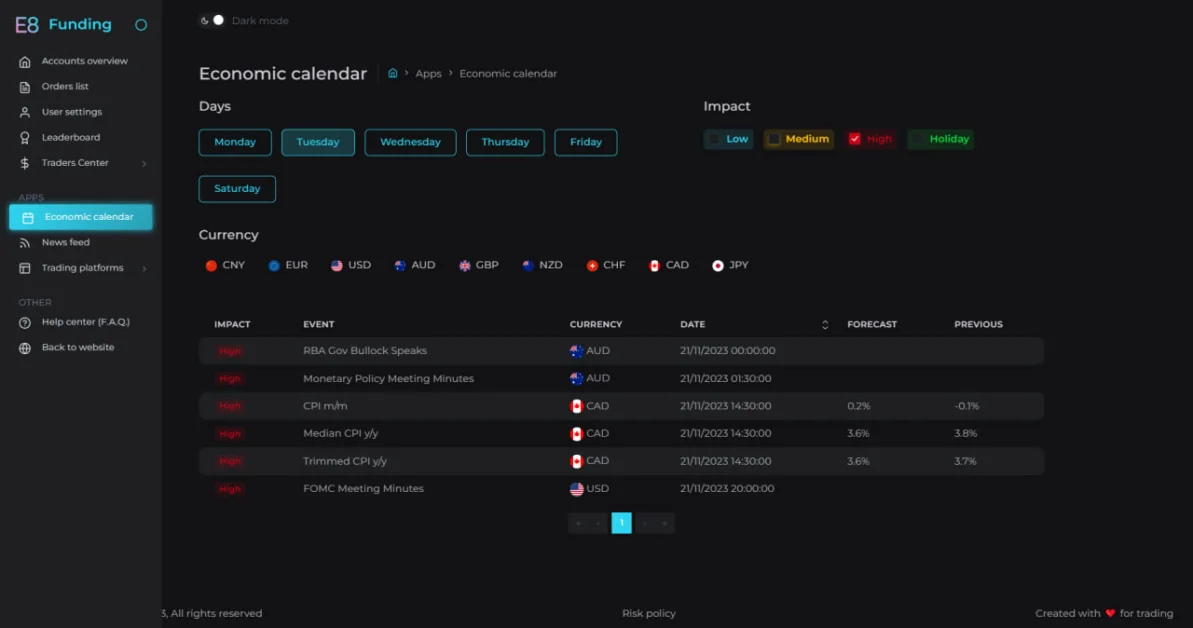

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.