Powell’s Dovish Tone & Key PCE Data

E8 Traders, gear up for our weekly FX fundamentals deep dive. We’ll break down last week’s market-moving events and data, plus analyze what’s ahead. Discover how these developments could impact your trading strategies and potentially trigger major momentum shifts.

Last Week’s Highlight

Undoubtedly, the most significant event of the previous week was the Jackson Hole Symposium, where Jerome Powell delivered notably dovish remarks. Powell expressed growing confidence that inflation is on a sustainable path back to the 2% target and highlighted the unmistakable cooling of the labor market.

As we previously discussed, the focus has shifted from whether the FED will implement a rate cut to the magnitude of that cut – will it be 25bps or 50bps? Currently, the market is pricing in a 61.5% probability of a 25bps cut and a 38.5% probability of a 50bps cut. The increasing likelihood of a more substantial 50bps cut has been contributing to the depreciation of the dollar.

The DXY recently dipped below its December 2023 lows. This week’s release of the Core PCE Index will be pivotal. If the data confirms a further easing of inflation, the dollar could face additional downward pressure. Let’s delve into this and other key economic events on this week’s calendar.

Australian CPI Data and Retail Sales

Wednesday brings crucial data from Australia with the release of the monthly Consumer Price Index (CPI). In June, CPI rose by 3.8% year-on-year, marking a slight decrease from the six-month high of 4% in May, and aligning with market expectations. Current market forecasts anticipate a further dip in Australian inflation to 3.4%. If this is met, traders might perceive the Reserve Bank of Australia (RBA) as having a more dovish stance.

However, previous CPI prints suggest caution (such as the May print). Should the inflation data surprise to the upside, the AUD could regain bullish momentum as market expectations adjust towards the RBA maintaining higher interest rates for an extended period.

On Friday, we’ll gain insights into the health of the Australian economy with the Retail Sales release. This data will reveal whether Australian consumers are still inclined to spend. While higher retail sales can be inflationary, they also signal more positive GDP growth data. If the figures exceed expectations, the RBA might face challenges in its efforts to curb inflation in the mid-term.

GDP Growth Rate in the US and Canada

This week will also shed light on the economic performance of both the United States and Canada. In the US, Q2 GDP is projected to grow by 2.8%, a significant jump from Q1’s 1.4% and surpassing earlier forecasts of 2%. This suggests a strengthening US economy.

Meanwhile, Canada’s annualized GDP growth reached 1.7% in Q1 2024, accelerating from a downwardly revised 0.1% growth in the previous quarter. However, this figure fell short of market expectations of a 2.2% expansion. As of now, there’s no clear consensus on Canada’s Q2 GDP data, but the monthly GDP indicators are flashing warning signs of a potential slowdown in economic growth.

Estimated CPI Data in Europe

Key Eurozone economic data will be released on Thursday and Friday. This includes Germany’s estimated inflation rate for August on Thursday, where a 0.2% decrease in prices is expected. France’s data follows on Friday, culminating in the Eurozone’s overall inflation figures. If Eurozone inflation falls to the predicted 2.3% in August, an ECB rate cut could be likely as inflation stabilizes.

Additionally, this week we gain further insights into the Eurozone’s economy with consumer confidence data on Wednesday and the unemployment rate released alongside the inflation data.

Inflation Data from the US

Friday delivers the most crucial data of the week with the release of the Core PCE Index, Personal Income, and Spending. These figures hold significant weight as the PCE Index is the FED’s primary inflation gauge. Amidst a dovish FED contemplating either a 25 or 50 bps rate cut, this data could be the deciding factor.

Currently, the consensus forecast for the Core PCE Index remains at 0.2%. However, if the actual data exceeds this figure, the odds will tilt towards a 25bps cut. Conversely, a downside surprise in the data could propel the dollar further into bearish territory, heightening expectations for a 50bps cut.

Additionally, Personal Income and Spending data offer valuable insights into future inflation trends. While both higher income and spending support economic activity, they can also fuel inflation. Increased consumer spending makes it more challenging to curb inflation, and higher incomes provide individuals with greater spending power.

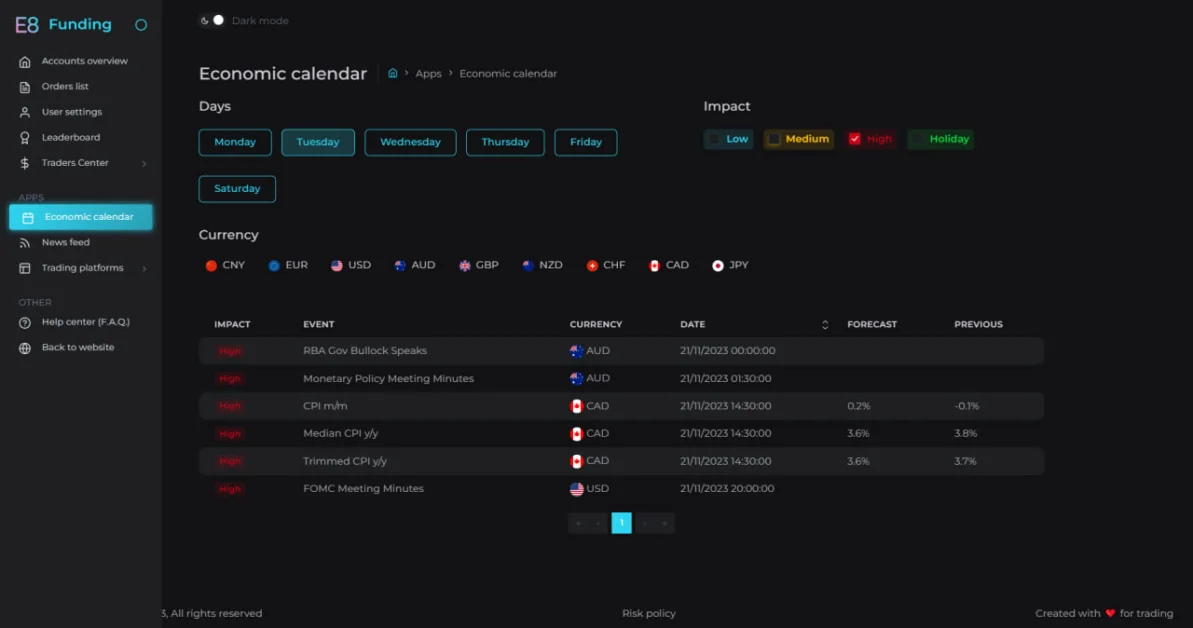

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.