Fundamental Analysis: DXY Bullish Breakout

The US dollar’s impressive comeback continues, building on recent strength and solidifying its position in the forex market. This resurgence is underpinned by a combination of factors, including robust economic data, persistent inflation, and safe-haven demand amid geopolitical uncertainties. This fundamental analysis delves into the drivers behind the dollar’s sustained strength and explores potential trading opportunities, with a focus on the upcoming ECB rate decision, Canadian CPI data, and UK economic indicators.

Sustained Momentum: The Dollar’s Upward Trajectory

The dollar’s rally, now spanning two consecutive weeks, reflects a significant shift in market sentiment. Initially triggered by escalating geopolitical tensions in the Middle East, the dollar’s strength has been further reinforced by positive economic data. This combination of factors has fueled a powerful uptrend, raising questions about how high the dollar can climb.

Economic Resilience: Underpinning Dollar Strength

Recent US economic data has painted a picture of resilience, particularly in the labor market. The Nonfarm Payrolls report revealed strong job growth, low unemployment, and rising wages, all of which contribute to inflationary pressures. This robust economic performance has diminished expectations for aggressive Fed rate cuts, further supporting the dollar’s upward trajectory. Moreover, the positive economic data suggests that the US economy is weathering the storm of global uncertainty better than many of its counterparts. This relative strength makes the US dollar a more attractive investment compared to currencies of economies facing more significant headwinds.

Inflation Persistence: A Key Factor

Inflation remains a key factor in the dollar’s narrative. Despite some cooling, US inflation remains sticky, exceeding market expectations and keeping the Fed on alert. This persistent inflation reduces the likelihood of significant rate cuts, bolstering the dollar’s appeal. The upcoming CPI data will be crucial in assessing whether inflationary pressures are indeed subsiding or if the Fed will need to maintain its hawkish stance to bring inflation back down to its target level.

Technical Confirmation: A Clear Uptrend

The dollar’s uptrend is evident not only in the fundamentals but also in the technicals. The US Dollar Index (DXY) has broken out of its previous range, clearing key resistance levels and signaling further upside potential. The breakouts above 103.00 level and strong momentum observed on various timeframes reinforce the bullish outlook for the dollar. Technical indicators such as moving averages and trendlines also point towards a continuation of the dollar’s upward momentum.

ECB Rate Decision: A Crucial Juncture for the Euro

The upcoming ECB rate decision will be a crucial event for the euro. While a 25 basis point rate cut is largely priced in, the market will be closely watching for signals about the ECB’s future policy stance. Given the slowdown in the Eurozone economy, a dovish outlook could weigh on the euro, potentially exacerbating its decline against the strong dollar. However, any hints of hawkishness or concerns about inflation could provide some support for the euro. The ECB’s communication and forward guidance will be critical in shaping market expectations and influencing the euro’s trajectory.

Canadian CPI Data: Implications for the Loonie

Canadian CPI data, due out on Tuesday, will be another key event to watch. Inflation is expected to remain relatively unchanged, but any surprises could trigger volatility in the Canadian dollar. Weaker-than-expected inflation could fuel expectations for further Bank of Canada rate cuts, potentially weakening the loonie against the dollar. On the other hand, if inflation proves to be more resilient than anticipated, it could provide some support for the Canadian dollar.

UK Economic Indicators: Assessing the Pound’s Outlook

The UK economy will also be in focus this week, with several important data releases scheduled. CPI inflation, claimant count change, unemployment rate, and retail sales figures will provide insights into the health of the UK economy. Concerns about a slowdown and the potential for Bank of England rate cuts could weigh on the pound, especially against the resurgent dollar. These data releases will be closely scrutinized by market participants to gauge the Bank of England’s next policy move and assess the overall health of the UK economy.

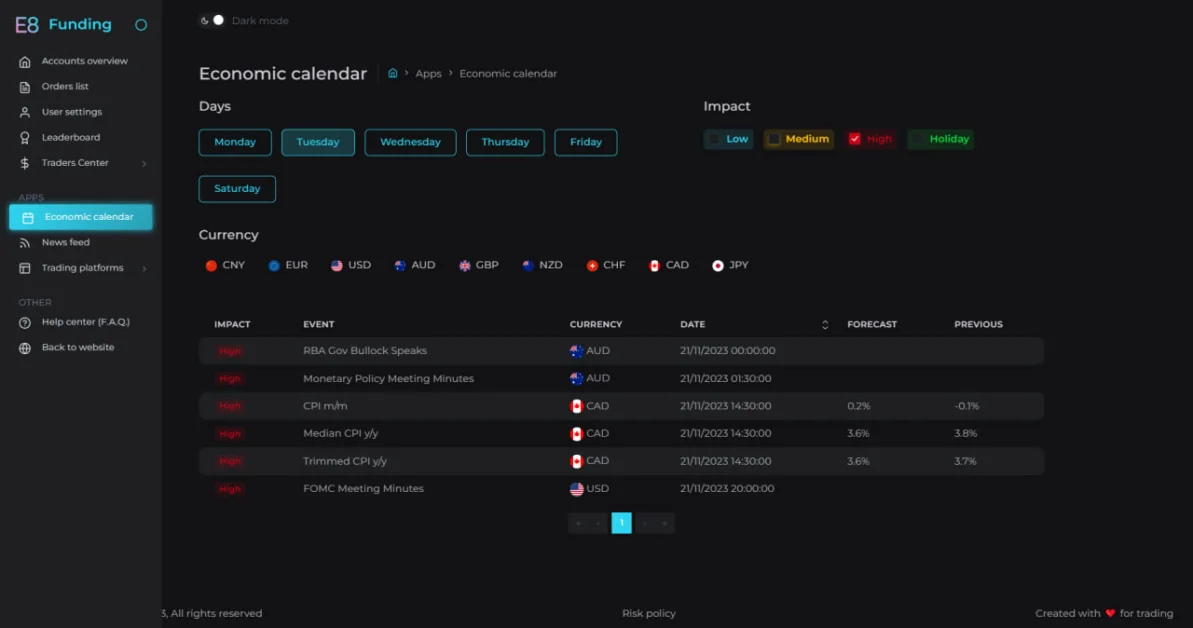

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.