Fundamental Analysis: Dollar’s Continued Strength

The US dollar is currently experiencing a remarkable surge, reaching multi-year highs after an 8-week rally that has captivated the attention of traders and investors worldwide. This powerful ascent has seen the greenback break through key resistance levels, leaving many to wonder if anything can halt its seemingly unstoppable momentum. To truly grasp the forces at play, we must delve into the fundamental factors driving it and analyze the potential trajectory of the dollar in the weeks to come.

Unpacking the Dollar’s Dominance

The dollar’s current strength is not simply a fleeting technical trend; it’s deeply rooted in a confluence of powerful fundamental factors. At the forefront is the stark contrast between the US economy and its global counterparts. While major economies like the Eurozone grapple with slowing growth, indicated by disappointing manufacturing PMIs and weak GDP figures, the US economy continues to exhibit resilience. This divergence in economic performance is a crucial driver of the dollar’s strength, attracting investment and bolstering confidence in the greenback as a safe haven for capital.

Adding to this economic advantage is the prevailing geopolitical landscape. The ongoing conflict in Ukraine and the resulting global uncertainties have fueled a flight to safety, with investors seeking refuge in the stability and liquidity of the US dollar. This safe-haven demand further contributes to the upward pressure on the currency, as investors seek to preserve capital in the face of global risks.

Furthermore, the Federal Reserve’s monetary policy plays a pivotal role in shaping the dollar’s trajectory. While the possibility of rate cuts has been discussed in recent months, recent data suggests a shift in market expectations. The probability of a December rate cut has diminished, indicating that the Fed may maintain its hawkish stance and keep interest rates higher for longer to combat persistent inflation. This commitment to price stability makes the dollar more appealing to yield-seeking investors, further strengthening its position in the global currency market.

The US Dollar Index (DXY) is showing some weakness today, but this downside momentum may be short-lived given the current market sentiment. From a technical perspective, the 106.00 level is a crucial support zone to watch. If the DXY drops below this level, it could signal a shift in momentum and a potential downturn for the dollar.

However, the dollar’s fate hinges on upcoming US economic data. If inflation proves to be stickier than anticipated, or if GDP data surprises to the upside, it could reignite the dollar’s rally and push the DXY towards the 108.00 level. These data points will be key for traders and investors assessing the strength of the US economy and the potential for further Fed action.

Beyond the Headlines: Delving into the Economic Indicators

Looking ahead, a number of key economic indicators will provide further insights into the dollar’s potential trajectory. The upcoming US GDP release will be closely watched, as a strong growth figure would reinforce the narrative of a robust US economy and support further dollar appreciation. This data point will be critical in assessing whether the US can maintain its growth momentum amidst global headwinds.

In addition to US economic data, it’s crucial to monitor inflation data from Europe. While the script doesn’t provide specific figures, it implies that Eurozone inflation is likely to remain subdued compared to the US. This is consistent with recent trends, where Eurozone inflation has struggled to gain momentum. Persistently low inflation in the Eurozone could further solidify the divergence in monetary policy between the Fed and the European Central Bank (ECB), with the Fed maintaining a hawkish stance while the ECB remains more dovish. This divergence could further strengthen the dollar against the euro.

EURUSD is currently hovering around 1.0500. If the dollar’s short-term weakness persists, we could see a significant upward correction, potentially reaching the 50% or even 61.8% Fibonacci retracement levels. However, it’s worth noting that many traders remain bearish on EURUSD, holding short positions in anticipation of a break below the recently tested 1.0400 support. This divergence in perspectives sets the stage for a potentially volatile period for the pair.

In addition to GDP and European inflation, the weekly US unemployment claims data will offer clues about the health of the labor market. Continued low unemployment claims would indicate a tight labor market, potentially adding to inflationary pressure and supporting the Fed’s resolve to maintain higher interest rates. This, in turn, would contribute to the dollar’s attractiveness as a yield-bearing asset.

Furthermore, the release of the core PCE inflation data, the Fed’s preferred inflation measure, will be crucial in gauging the persistence of inflationary pressures in the US. Sticky inflation figures would bolster the case for the Fed to keep interest rates elevated, potentially fueling further dollar gains as investors seek higher returns in a rising interest rate environment.

Opportunities and Challenges

While the dollar appears poised for continued strength, analyzing other currency pairs reveals potential trading opportunities and challenges. The New Zealand dollar, for instance, faces headwinds from an expected rate cut by the Reserve Bank of New Zealand (RBNZ) due to a slowing domestic economy and the impact of the Chinese slowdown. This divergence in monetary policy between the Fed and RBNZ favors further downside for NZD/USD, presenting a potential opportunity for traders to capitalize on the widening interest rate differential.

NZDUSD is currently targeting the 0.5800 level, which represents the 2023 low. This downward momentum appears likely to continue due to recent economic data coming out of New Zealand, painting a less optimistic picture of their economy. However, if the US dollar experiences a short-term correction, we could see NZDUSD bounce back towards the 0.5900 level. This level could act as a temporary resistance zone before the broader downtrend potentially resumes.

Similarly, the Australian dollar, despite a relatively strong domestic economy, is grappling with the strong US dollar and potential spillover effects from the Chinese slowdown. Although the Reserve Bank of Australia (RBA) has maintained a relatively hawkish stance, a high CPI reading this week could provide only temporary support for the AUD. The longer-term outlook remains bearish, with the possibility of AUD/USD challenging 2022 lows as the divergence in economic growth and monetary policy between the US and Australia widens.

While AUDUSD is currently showing some resilience compared to NZDUSD, the overall trend remains bearish. The pair is likely to continue its downward trajectory, potentially bouncing off either the 0.6550 or 0.6600 level before breaking back below 0.6500. In the medium term, a move towards 0.6400 is a distinct possibility.

Volatility and Strategic Trading

The currency market is expected to remain volatile in the coming months, presenting both opportunities and challenges for traders. Staying informed about economic data releases and central bank announcements is crucial for navigating this dynamic landscape and making informed trading decisions.

Combining fundamental analysis with technical analysis can help identify high-probability trading setups and manage risk effectively. By analyzing chart patterns, support and resistance levels, and other technical indicators, traders can gain a deeper understanding of market sentiment and potential price movements.

Diversifying across different currency pairs further mitigates potential losses and enhances portfolio stability. By spreading risk across a range of currencies, traders can reduce their exposure to any single currency’s volatility and capitalize on opportunities in different markets.

Conclusion: The Dollar’s Reign and the Road Ahead

The US dollar’s strong fundamentals and supportive technical outlook suggest further strength in the near term. By understanding the key drivers, diligently monitoring economic data, and employing a comprehensive trading strategy, traders can position themselves to navigate the complexities of the currency market and capitalize on the opportunities that lie ahead.

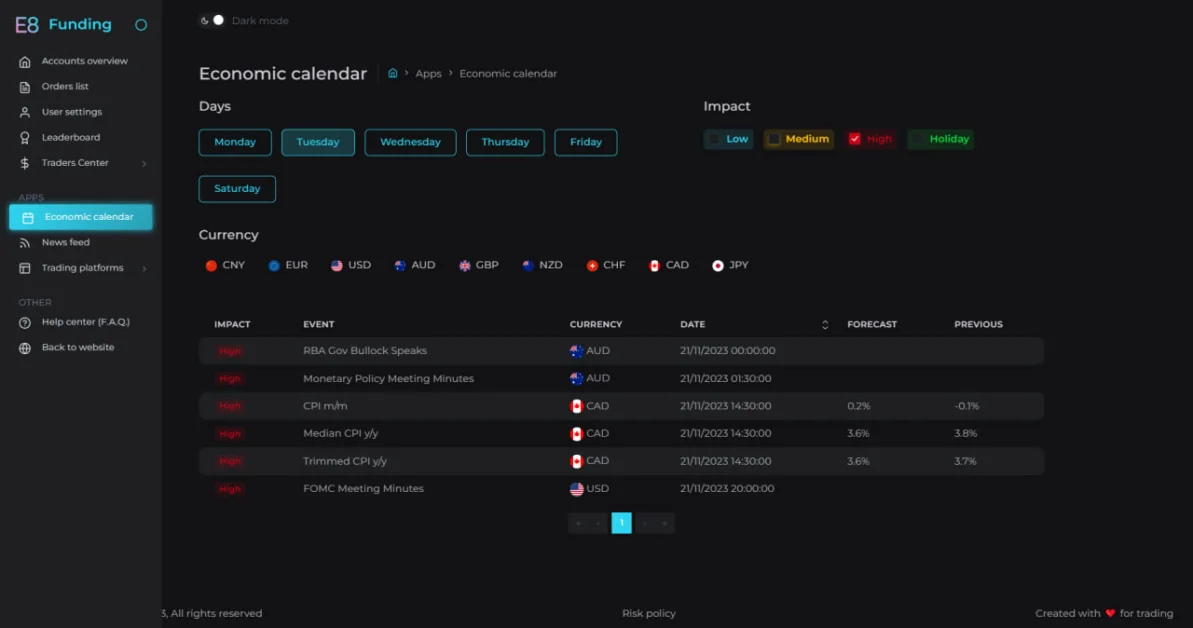

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.