Market Overview: Interest Rate and Inflation in Japan

Good morning, traders! As we gear up for the forthcoming trading week, E8 Funding presents you with our latest Market Overview. This overview is designed to keep you informed about the most vital events from the economic calendar, ensuring you’re fully prepared for the week ahead in the financial markets.

Last week’s spotlight: Central Banks Rally

Last week’s focus was predominantly on the interest rate decisions made by central banks in major economies, including the U.S., Europe, and the UK. Amid easing economic challenges and a gradual decrease in inflation, these banks have adopted a “wait and see” approach. As the year draws to a close, it is widely anticipated that central banks will implement only minor changes to their monetary policies, while strategizing for the upcoming year. Many are expected to initiate their first rate cuts in the second quarter of 2024. To facilitate these decisions, traders and analysts will be closely monitoring economic indicators, particularly inflation trends and labor market dynamics. These two factors are crucial in providing insights into the future decisions of central banks.

What to expect this week:

The upcoming week is expected to be noticeably calmer compared to the previous one, primarily featuring minor economic data releases. However, there are a few significant events to note. The interest rate decision in Japan on Tuesday stands out as a key event. Additionally, the release of inflation data from Canada, the UK, and Japan throughout the week will be important. These releases, particularly the inflation figures, are likely to garner attention as they provide crucial insights into the economic health and potential policy directions of these countries.

Monday, December 18th, 2023

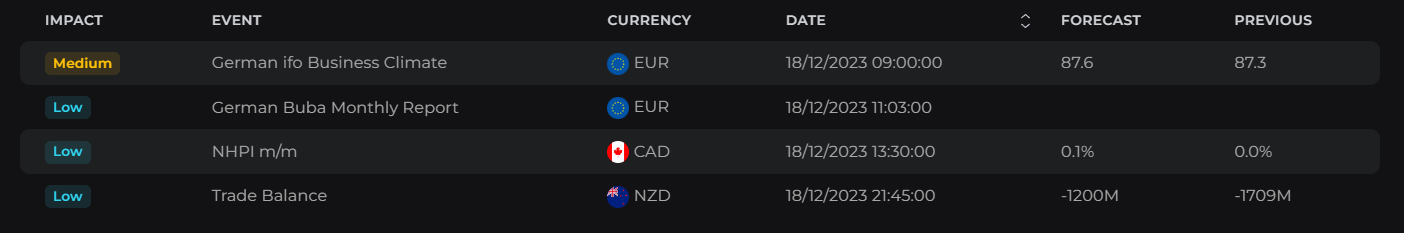

The week starts off smoothly with the IFO Business Climate Index for Germany, a key indicator that evaluates business sentiment regarding the current economic climate and expectations for the next six months.

Later, at 1:30 pm, Statistics Canada is set to unveil the most recent data in the real estate sector, focusing specifically on the New Housing Price Index.

In the evening, New Zealand’s official statistics body, Stats NZ, will release its latest figures on the nation’s international trade. These figures are particularly noteworthy as they represent the highest trade deficit in New Zealand’s history.

The day is scheduled to include three speeches. The first, at 10:30 am, will be delivered by Ben Broadbent of the Bank of England at the London Business School. Following this, there will be two speeches from members of the European Central Bank. At 1:30 pm, Isabel Schnabel will present a keynote lecture at the Sixth ECB Biennial Conference, focusing on fiscal policy and EMU governance”. Later, at 3:00 pm, Philip R. Lane will speak at the same conference, addressing new policy challenges and necessary reforms for the Economic and Monetary Union (EMU).

Tuesday, December 18th, 2023

Tuesday begins early with the release of the ANZ Bank’s latest Business Confidence figures in New Zealand. This index provides insights into businesses’ perceptions of the future state of their operations and the economy at large. In November, the ANZ Business Outlook Index soared to 30.8, up from 23.4 in October, indicating the highest level since March 2015. This marks the third consecutive month of positive readings, reflecting robust business activity in the country.

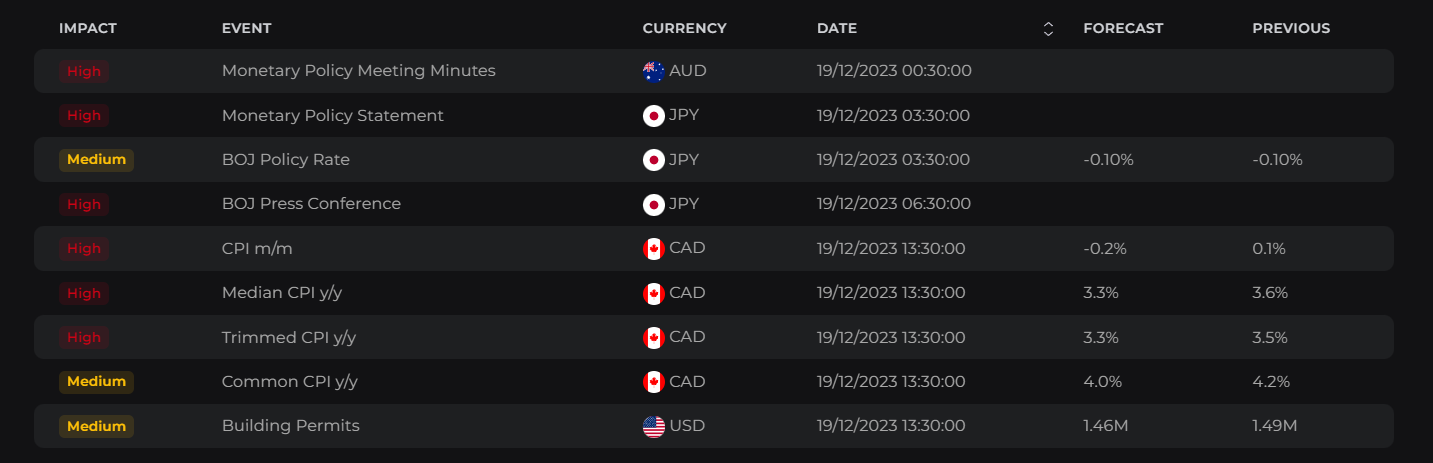

Following the ANZ report by 30 minutes are the RBA Meeting Minutes. These minutes offer a deeper understanding of the Reserve Bank of Australia’s monetary policy adjustments, particularly regarding the interest rate decision made at the start of December. They also provide insights into the RBA’s perspective on future policy steps.

At 3 am, the Bank of Japan is set to announce an interest rate decision. This decision is critical for determining whether the current cycle of price and wage increases aligns with the central bank’s sustainable 2 percent inflation target. Financial markets are keenly awaiting indications of when the BOJ might begin transitioning towards normalizing monetary policy. This includes potentially ending negative rates and phasing out its yield curve control program, which maintains borrowing costs at minimal levels. Currently, the BOJ maintains short-term interest rates at minus 0.1 percent and aims to keep 10-year Japanese government bond yields around zero percent.

At 7:00 am, the Federal Customs Administration of Switzerland will update on changes in Swiss international trade.

The afternoon’s focus shifts to Canada’s inflation rate change. The annual inflation rate decreased to 3.1% in October from 3.8% in September, slightly below the anticipated 3.2%. This was softer than the Bank of Canada’s projection of inflation hovering near 3.5% until mid-next year. The upcoming release is eyed optimistically, with a market consensus at 2.9%, suggesting that the central bank may not pursue further policy tightening. Although there’s no official information yet on the new core inflation rate, which excludes volatile components like food, energy, and mortgage interest costs, market expectations hint at a possible decrease to 2.5%.

The Canadian CPI will be followed by the U.S. Census Bureau’s real estate reports, including building permits and housing stats, set for release at 1:30 pm.

Just before midnight, Japan’s Ministry of Finance will disclose its international trade figures. These figures are gradually recovering from the significant deficit experienced at the end of 2022 and the beginning of 2023.

On Tuesday, three notable speeches are scheduled, none of which are expected to significantly sway market momentum. The day begins at 9 am with an introductory statement by Andrea Enria at the ECB Banking Supervision press conference. Here, he will discuss the comprehensive outcomes of the 2023 Supervisory Review and Evaluation Process (SREP). Frank Elderson will also participate in this conference, contributing to the dialogue.

Later, at 1 pm, Sarah Breeden, a member of the Bank of England, will deliver a speech at the Institute of International Finance’s Talking Policy series.

Wednesday, December 18th, 2023

The day begins with the release of the GfK Consumer Confidence Index, which, like the IFO Business Index released on Monday, gauges sentiment. However, it focuses on consumer perspectives, including income expectations, propensity to buy, and savings tendencies. Additionally, Germany is poised to disclose its Producer Price Index (PPI) figures for November.

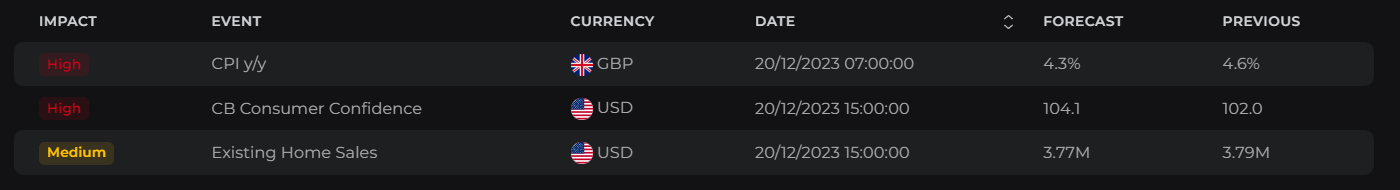

Simultaneously, the UK’s Office for National Statistics will announce the latest changes in the Consumer Price Index (CPI). In October, the inflation rate in the United Kingdom declined to 4.6%, down from 6.7% in both September and August, and fell below the market’s expectation of 4.8%. Each new inflation report is gaining significance as the Bank of England considers rate cuts next year, contingent on prices aligning with forecasts. For November, inflation is anticipated to further decrease to 4.4%, potentially reaching the lowest point since 2021.

The afternoon’s focus shifts to consumer confidence indices in both the Eurozone (flash consumer confidence) and the United States (Conference Board consumer confidence). Additionally, the U.S. Bureau of Economic Analysis will release data on New Existing Home Sales. Commodity traders will also be closely monitoring the release of the new Energy Information Administration (EIA) Weekly Petroleum Status Report for insights into energy markets.

The economic calendar concludes on Wednesday with the Bank of Canada’s (BoC) Summary of Deliberations. This document offers valuable insights into the latest interest rate decisions and monetary policy changes, as well as the bank’s perspectives on future economic conditions.

On Wednesday, the schedule includes just a single speech. Philip R. Lane will be speaking at a seminar titled “The Euro Area Outlook,” organized by the Economic and Social Research Institute (ESRI) in Dublin. This session will also feature a question-and-answer segment. Despite the importance of the topic and the stature of the speaker, this event is not anticipated to influence market dynamics notably.

Thursday, December 18th, 2023

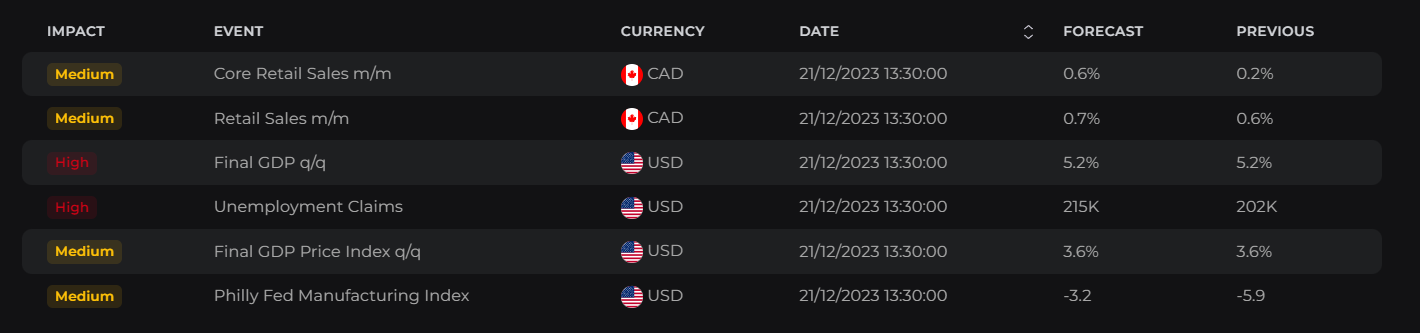

Thursday morning appears relatively tranquil, with the first significant data release scheduled for 1:30 pm. At this time, Canada will announce its retail sales figures for October.

In the United States, the finalized GDP growth rate for the latest quarter, initially announced at the end of November, will be presented. Additional data from the U.S., particularly from the labor market, will also be released. This includes the Initial Jobless Claims report. The week ending December 9th saw a notable decrease in the number of Americans filing for unemployment benefits, dropping by 19,000 to 202,000. This figure was significantly below market expectations of 220,000, marking the lowest level of new claims in two months. This data underscores the tightness in the U.S. labor market and could provide the Federal Reserve with more flexibility to maintain its terminal rate for an extended period, especially if inflation persists. However, the upcoming report is expected to show a rise in claims to around 218,000, aligning more closely with the Federal Reserve’s expectations for a tightening labor market.

Later in the night, at 11:30 pm, Japan’s Ministry of Internal Affairs and Communications will release its latest inflation rate data. In October, Japan’s annual inflation rate climbed to 3.3%, up from 3.0% the previous month, marking the highest rate since July. Despite accelerations in specific categories like furniture, household utensils, culture, and recreation, market analysts anticipate that November’s inflation rate will remain around 3%, although there is no official market consensus at this time.

Friday, December 18th, 2023

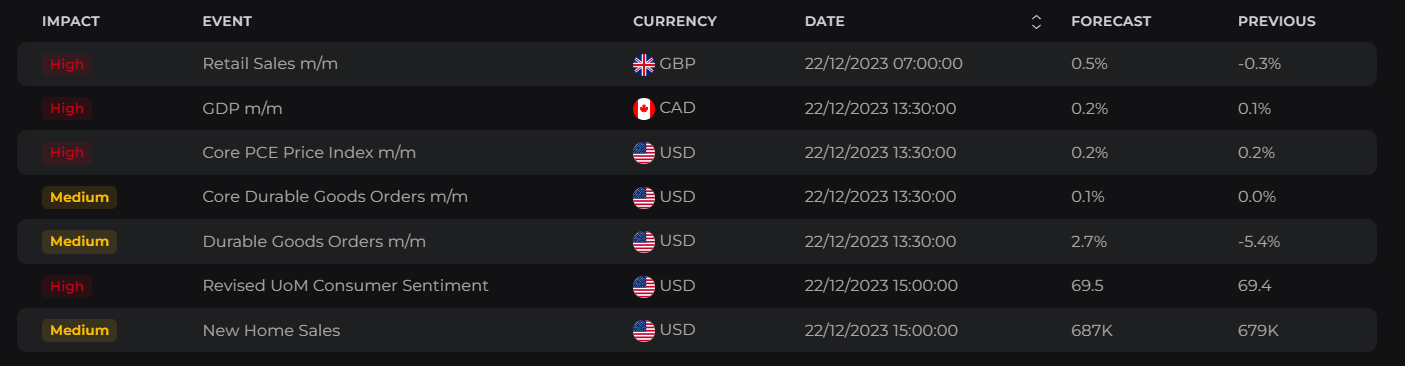

Friday’s economic calendar begins in the UK with the release of retail sales figures. In October, there was a 0.3% month-over-month decrease, following a revised 1.1% drop in September, a result that fell below the anticipated 0.3% growth. For November’s figures, the market consensus is set at a 0.4% increase. However, with retailers reporting more cautious consumer spending, these expectations might not be met.

At 1:30 pm, Statistics Canada will disclose the economic growth data for October on a month-over-month basis, along with expectations for November.

Simultaneously, the United States will release several key data points to conclude the week. This includes the Core Personal Consumption Expenditures (PCE) Price Index, Durable Goods Orders, and crucially, Personal Income and Spending reports. These latter data sets offer valuable insights into the consumer situation in the world’s largest economy.

E8X Dashboard

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.