Fundamental Analysis: Unpacking the Dollar’s Rally

The US dollar is on an absolute tear, racking up gains for the fourth consecutive week. This impressive rally has left many market participants wondering: what’s fueling this surge, and can anything stop it? In this fundamental analysis, we’ll break down the key factors contributing to the dollar’s strength and explore the economic events that could shape its trajectory in the week ahead.

The Dollar’s Winning Streak: A Confluence of Factors

The dollar’s recent dominance can be attributed to a perfect storm of favorable conditions. First and foremost, the US economy continues to outperform expectations, demonstrating remarkable resilience in the face of global headwinds. This strength is evident in the robust labor market, with consistent job creation and low unemployment figures. Furthermore, consumer spending remains healthy, indicating continued confidence in the economy.

Adding to the dollar’s appeal, inflation, while moderating, remains stubbornly above the Federal Reserve’s (Fed) 2% target. This persistent inflation reinforces the Fed’s hawkish stance, making it less likely that they will aggressively cut interest rates anytime soon. Higher interest rates in the US attract foreign investment seeking better returns, further bolstering the dollar’s value.

Finally, escalating geopolitical tensions, particularly in the Middle East, have fueled safe-haven demand for the dollar. As a global reserve currency, the dollar is often seen as a safe bet during times of uncertainty. The ongoing conflict between Israel and Hamas, with its potential to destabilize the region and disrupt global energy markets, has heightened risk aversion and driven investors towards the perceived safety of the US dollar.

Technical Confirmation: A Bullish Outlook

The dollar’s strength is not only reflected in the fundamentals but also in the technical picture. The US Dollar Index (DXY), which measures the greenback against a basket of major currencies, has broken through key resistance levels, signaling further upside potential. The clean breakouts and strong momentum observed on various timeframes reinforce the bullish outlook for the dollar.

The dollar’s bullish momentum has helped the DXY break above the 104.00 resistance, which now acts as a key support level. If this momentum persists, the DXY could soon target the 105.00 mark.

Key Economic Events to Watch This Week

This week is packed with crucial economic data releases and central bank meetings that could significantly impact the dollar’s trajectory. Here’s a breakdown of the key events to watch:

US Labor Market Data

The US labor market will be in the spotlight this week, with several important data releases scheduled. The JOLTs job openings report will provide insights into labor demand, while the ADP employment change report will offer a glimpse into private-sector job creation. The highlight, however, will be the nonfarm payrolls report, which is expected to show continued strength in the labor market. Strong labor market data could further solidify the Fed’s hawkish stance and support the dollar’s upward momentum.

US Core PCE Inflation

The Federal Reserve’s preferred measure of inflation, the Core Personal Consumption Expenditures (PCE) Price Index, will also be released this week. This data point will be closely watched for signs of persistent inflationary pressures. If the Core PCE reading comes in above expectations, it could reinforce the Fed’s hawkish stance and provide further support for the dollar.

ECB Economic Bulletin and Eurozone Data

This week, the European Central Bank (ECB) will release its Economic Bulletin, providing insights into economic and monetary developments in the Eurozone. Crucially, the Eurozone will also release its GDP growth rate and flash inflation figures. These data points will be key in assessing the health of the Eurozone economy and the potential path of future ECB policy.

With the ECB currently maintaining a dovish stance, the upcoming data releases will be crucial in determining whether there is room for the central bank to continue easing monetary policy or if there is a need for a more hawkish approach. The euro’s trajectory will likely be heavily influenced by these data releases and the market’s interpretation of their implications for ECB policy.

EUR/USD has reached the critical 1.0800 support level we highlighted in our previous analysis. With the dollar’s strength and potential for weak Eurozone data, a break below 1.0800 could trigger a sharp move towards 1.0700. However, if Eurozone inflation surprises to the upside, we might see a bounce back towards 1.0900.

Bank of Japan (BOJ) Monetary Policy Meeting

The BOJ is also scheduled to announce its monetary policy decision this week. With the recent Japanese elections and the potential for a change in government policy, the BOJ’s decision and communication will be closely scrutinized for any shifts in its stance. The market will be particularly interested in any comments regarding the yen’s recent weakness and the potential for intervention to stabilize the currency.

The Japanese yen is weakening, and the Bank of Japan (BOJ) holds the key to its fate. Unless the BOJ signals a hawkish shift in its monetary policy this week, the yen’s decline is likely to continue. With the recent break above 150.00 in USD/JPY, the next target for the pair could be 155.00.

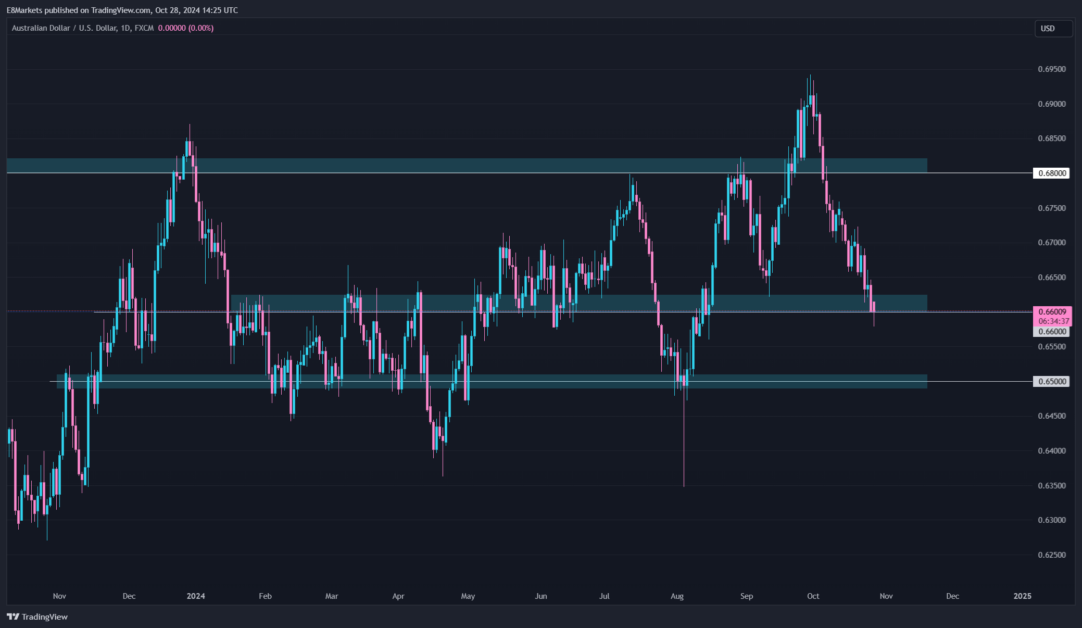

Australian CPI Data

Inflation data from Australia will be important for assessing the outlook for the Australian dollar. Weaker-than-expected inflation could fuel expectations for policy easing by the Reserve Bank of Australia (RBA), potentially weighing on the Aussie dollar. Conversely, if inflation proves to be more resilient than anticipated, it could provide some support for the Australian dollar.

The Australian dollar, like the Japanese yen, is looking for a catalyst to reverse its recent weakness. Upcoming inflation data holds the key. A hotter-than-expected CPI print could spark a bounce from the current 0.6600 level in AUD/USD. However, if inflation cools as the RBA anticipates, a break below 0.6600 is likely, with 0.6500 as the next major support.

Navigating the Dollar-Dominated Landscape

The dollar’s persistent strength presents both challenges and opportunities for traders. While the dollar’s uptrend may continue, it is essential to remain vigilant and monitor key economic data releases and central bank decisions. Any signs of a shift in the Fed’s policy stance or a deterioration in the US economic outlook could trigger a reversal in the dollar’s fortunes.

By staying informed and adapting to the evolving market dynamics, traders can navigate the dollar-dominated landscape and capitalize on potential opportunities.

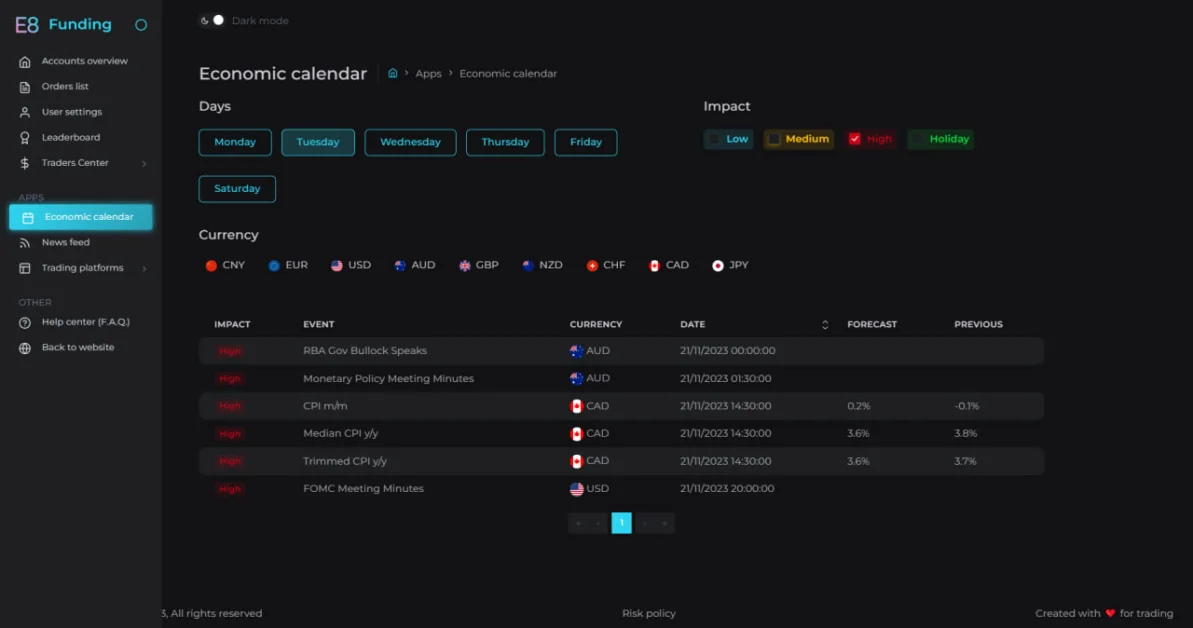

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.