Fundamental Analysis: FED Dovishness & Poor NFP Data

E8 traders, it’s time for our weekly deep dive into the fundamentals shaping the foreign exchange market. We’ll unpack the economic events and data that shaped the FX market last week, and analyze what lies ahead. Join us as we explore how these developments could influence your trading strategies and potentially trigger significant momentum.

Last Week’s Highlight

The foreign exchange market experienced a dramatic shift last week, with the US dollar taking a significant hit. The greenback fell over 2%, hitting five-month lows, as a wave of dovish sentiment washed over the Federal Reserve and poor NFP data.

Just a week ago, the market consensus was leaning towards the Federal Reserve implementing a single rate cut in the coming months. However, the landscape changed drastically on Wednesday when Federal Reserve Chairman Jerome Powell struck a notably dovish tone during his press conference. Powell’s remarks, which hinted at a more cautious approach to monetary policy tightening, sparked a reevaluation of future rate expectations.

The dollar’s woes were compounded on Friday when the U.S. Bureau of Labor Statistics released the July Non-Farm Payrolls report. The data revealed that the US economy added a mere 114,000 jobs, significantly below the downwardly revised 179,000 jobs added in June and the market forecast of 175,000. This figure represents the lowest job growth in three months and falls short of the average monthly gain of 215,000 over the prior 12 months. The report also showed a tick higher in unemployment claims and a cooling of wage growth, further solidifying the narrative of a softening labor market.

The combination of Powell’s dovish rhetoric and the lackluster jobs report ignited a wave of selling in the dollar, as market participants began to price in the possibility of multiple rate cuts before the end of the year. The CME FedWatch Tool, which tracks market expectations for Fed policy, is now signaling a potential rate cut at each of the remaining Federal Open Market Committee (FOMC) meetings in 2024. This dramatic shift in expectations has cast doubt on the Fed’s ability to achieve a “soft landing” – a scenario where inflation is tamed without triggering a recession.

- 18th of September: 80.5% chance of a rate cut to 475-500 bps

- 7th of November: 76.8% chance of a rate cut to 425-450 bps

- 18th of December: 52.3% chance of a rate cut to 400-425 bps

In contrast to the dollar’s struggles, the euro enjoyed a relatively positive week, buoyed by better-than-expected economic data. Preliminary estimates showed that the Euro Area’s GDP expanded by 0.3% in the second quarter, surpassing market forecasts of 0.2%. Additionally, the annual inflation rate unexpectedly edged up to 2.6% in July, defying expectations of a slowdown to 2.4%. This resilience in economic growth and inflation could lead the European Central Bank (ECB) to maintain its current monetary policy stance, opting for a wait-and-see approach before considering any further easing measures.

The euro’s strength against the dollar has propelled the EUR/USD pair close to its January highs, opening the door for potential further upside momentum.

RBA Interest Rate Decision

Undoubtedly, the Reserve Bank of Australia’s (RBA) Interest Rate Decision is poised to be the most impactful event of the week, with the potential to trigger significant volatility in AUD currency pairs. In June, the RBA maintained its cash rate at 4.35%, marking the fifth consecutive hold since November 2023, a decision that aligned with market expectations. However, the central bank expressed caution regarding inflation, noting that it remained above the target range, primarily due to persistent high service costs. Despite this, recent economic indicators, including easing GDP growth, rising unemployment, and subdued wage growth, suggest a potential softening of economic activity.

In light of this mixed economic picture, the RBA has maintained a data-dependent approach, leaving the door open for both tightening and easing measures in the future. Notably, since the June meeting, there has been a slight decrease in Australian prices, suggesting that the RBA may not adopt a more hawkish stance than previously anticipated. The market has largely priced in the possibility of a dovish RBA, as evidenced by the Australian dollar’s depreciation since the middle of last month when the prospect of a rate hike was removed from market expectations.

Traders will be keenly focused on the tone adopted by RBA Governor Michele Bullock, particularly for any indications of potential easing measures later this year. As of now, the prevailing expectation is that the cash rate will remain at 4.35% until there is further evidence of easing inflation in Australia.

Labro Market Data from New Zealand & Canada

On the same day as the RBA rate decision, attention will also turn to New Zealand, where labor market data will be released. The unemployment rate, a key indicator of economic health, is expected to rise from 4.3% to 4.7%. If this forecast proves accurate, it could signal a disinflationary trend, potentially leading the RBNZ to adopt a more dovish stance in its monetary policy. This, in turn, could trigger further weakness in the New Zealand dollar.

The week will end with the release of Canadian labor market data, which will be instrumental in shaping expectations for the Bank of Canada’s next move. If the unemployment rate remains elevated, as currently anticipated, the chances of a third rate cut this year will increase, potentially adding downward pressure on the Canadian dollar.

E8X Dashboard

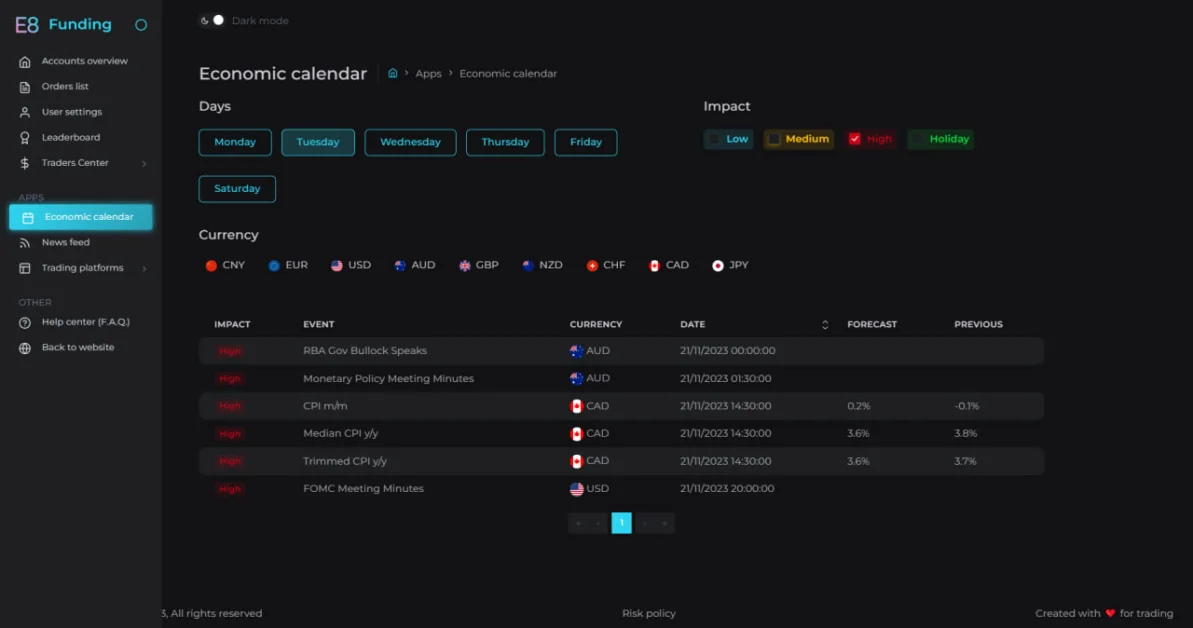

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.