Fundamental Analysis: US Dollar, RBNZ, & CAD

The US dollar has staged an impressive comeback, defying recent weakness and surging higher. This was fueled by a combination of factors, including stronger-than-expected economic data and safe-haven demand amid escalating geopolitical tensions in the Middle East. This fundamental analysis examines the drivers behind the dollar’s renewed strength and explores the potential implications for forex markets, with a particular focus on the upcoming US CPI figures, RBNZ rate decision, and Canadian labor market data.

From Weakness to Strength: A Shift in Sentiment

Just weeks ago, the dollar was on a losing streak, weighed down by softening economic data and expectations of further Fed rate cuts. However, recent data releases have painted a more optimistic picture of the US economy. The labor market, in particular, has shown surprising resilience, with strong job growth and rising wages. This has led to a reassessment of the Fed’s policy trajectory, with markets now scaling back expectations for aggressive rate cuts.

Adding to the dollar’s appeal, geopolitical risks have flared up, particularly in the Middle East. The escalating conflict between Israel and Hamas has triggered a flight to safety, boosting demand for the greenback as a safe-haven asset. This combination of positive economic data and geopolitical concerns has fueled a powerful rally in the dollar, leaving many wondering if this is the start of a new uptrend.

Labor Market Resilience: A Key Driver

The recent labor market data has been a major catalyst for the dollar’s resurgence. The JOLTs job openings report, ADP private payrolls, and the official Nonfarm Payrolls report all exceeded expectations, pointing to a robust labor market. Average hourly earnings also jumped higher, signaling continued wage pressures. This strong labor market performance has challenged the narrative of a weakening US economy, supporting the dollar’s rebound.

The strong labor market data also has implications for inflation. Rising wages and robust job growth could contribute to persistent inflationary pressures, making it more difficult for the Fed to ease monetary policy aggressively. While inflation has shown signs of cooling, it remains above the Fed’s target. The upcoming CPI data will be closely watched for further clues about the inflation trajectory and its potential impact on Fed policy.

Thursday [London Time]:

- 01:30 PM – Core Inflation Rate

- 01:30 PM – Inflation Rate

Friday [London Time]:

- 01:30 PM – Producer Price Inflation (PPI)

If US inflation meets market expectations (2.5% headline, 3.8% core) or exceeds them, the dollar’s current bullish momentum is likely to continue. However, a sharper-than-expected drop in inflation could create uncertainty, making it harder to predict the Fed’s next move on interest rates.

Technical Outlook: Breaking the Downtrend

From a technical perspective, the dollar has broken out of its recent downtrend, signaling a potential shift in momentum. The US Dollar Index (DXY) has surged higher, clearing key resistance levels. If the dollar can maintain this upward momentum, further gains are likely. Traders will be watching for a sustained break above the 103 level, which could open the door for a more significant rally.

RBNZ Rate Decision: Weighing on the Kiwi

The New Zealand dollar is facing significant pressure due to the upcoming RBNZ rate decision. The central bank is widely expected to cut rates by 50 basis points, which could further weigh on the NZD. The key question is whether the RBNZ will signal further easing, which could exacerbate the NZD’s decline. Traders will be closely analyzing the RBNZ’s policy statement for clues about the future path of interest rates.

Wednesday [London Time]:

- 02:00 AM – RBNZ Interest Rate Decision

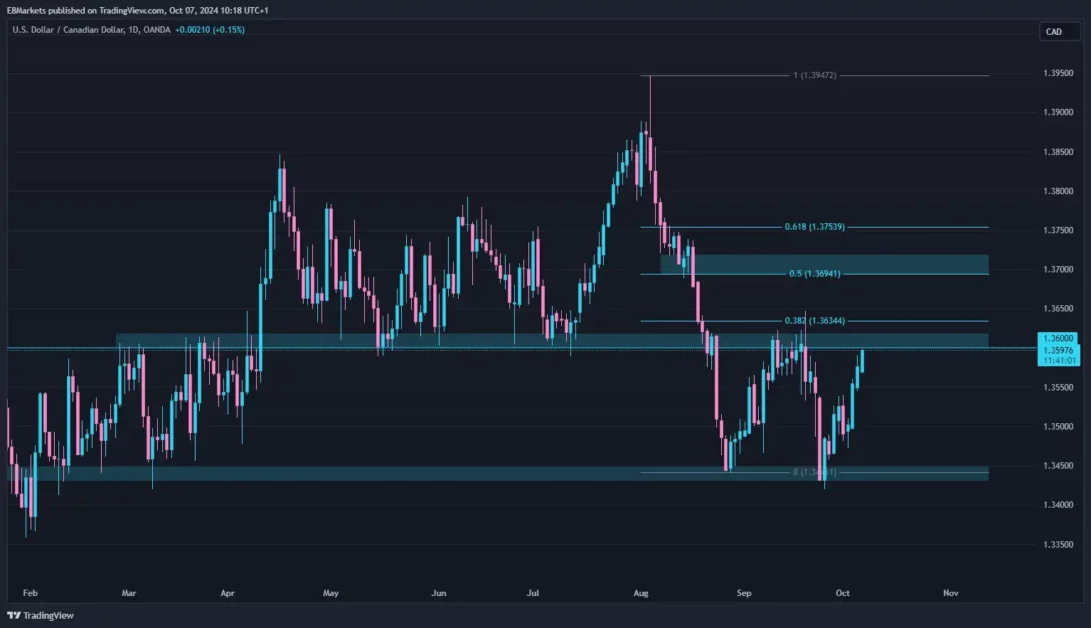

Canadian Labor Market Data: A Test for the Loonie

The Canadian dollar is also vulnerable to dollar strength, especially with the release of Canadian labor market data on Friday. A weak report, with rising unemployment and slowing job growth, could reinforce the Bank of Canada’s dovish stance and weigh on the CAD. Conversely, a strong report could provide some support for the loonie.

Friday [London Time]:

- 01:30 PM – Unemployment Rate

- 01:30 PM – Employment Change

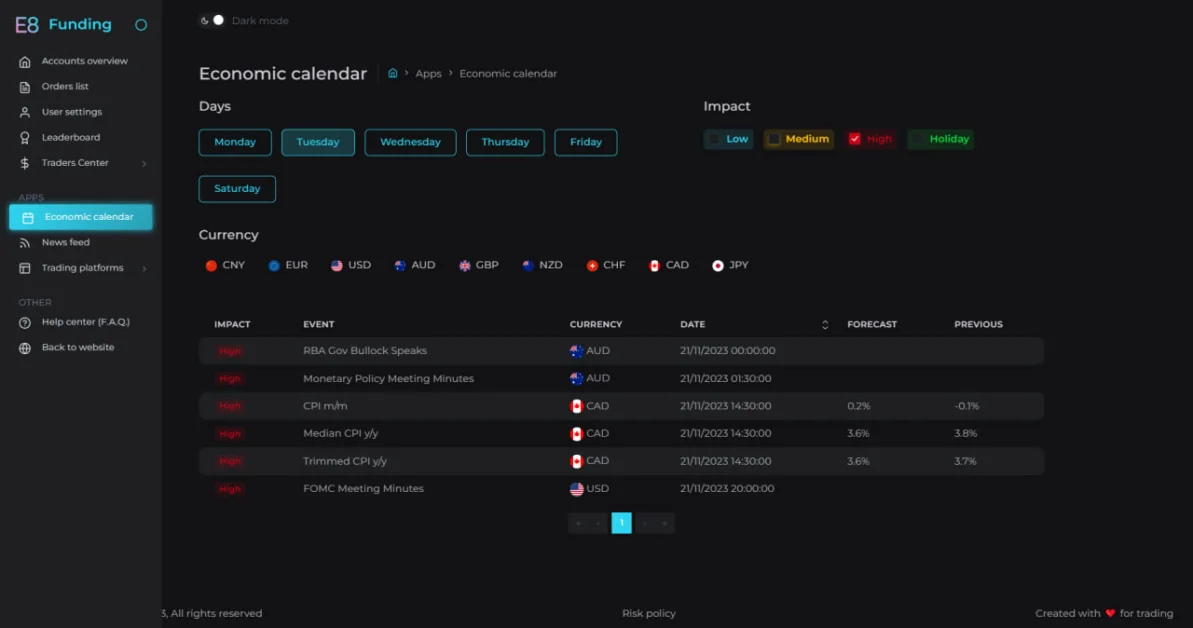

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.