Fundamental Analysis: Dollar Weakness & Key Data

The US dollar is teetering on the edge. After three consecutive months of losses, the greenback is showing signs of exhaustion. This week, all eyes are on the critical Nonfarm Payrolls report, which could deliver the final blow and send the dollar tumbling to new 2023 lows. But it’s not just US economic data that’s in focus. The Eurozone CPI and Chinese Manufacturing PMI will also play a crucial role in shaping the currency markets this week.

The Dollar’s Decline: A Confluence of Factors

The dollar’s recent weakness can be attributed to a combination of factors. Firstly, economic data has been softening, painting a less optimistic picture of the US economy. This has led to a shift in Federal Reserve policy, with markets now pricing in a higher probability of rate cuts in the coming months. Adding to the pressure, inflation has been steadily cooling, as evidenced by the recent core PCE data. This disinflationary trend further supports the case for a less aggressive Fed.

Nonfarm Payrolls: A Critical Juncture

The upcoming Nonfarm Payrolls report will be a crucial test for the dollar. Average hourly earnings are expected to cool, signaling continued disinflation. Job growth is also anticipated to slow, with economists forecasting only 144,000 jobs added to the economy. While the unemployment rate is expected to remain steady at 4.2%, the overall picture points to a cooling labor market. If the data comes in weaker than expected, it could further solidify the case for a Fed rate cut, potentially pushing the dollar down to those 2023 lows.

Eurozone CPI: Will Inflation Warrant Further ECB Cuts?

Across the Atlantic, the Eurozone CPI data will be closely watched. Inflation in Germany is expected to remain subdued, while Eurozone inflation is forecast to cool on an annualized basis. This data will be critical in shaping expectations for future ECB policy. With the Eurozone economy showing signs of fragility, further rate cuts may be necessary if inflation continues to fall. A weaker-than-expected CPI print could weigh on the euro, while a stronger reading could provide some support.

China’s Economic Slowdown and its Impact on the Antipodes

The world’s second-largest economy is also facing headwinds. China’s recent stimulus measures, including significant rate cuts, highlight the growing concerns about economic slowdown. PMI data has been consistently weak, and disinflationary pressures are mounting. Furthermore, there’s a growing reluctance among Chinese consumers to take on more debt, which could further dampen economic activity. These developments have implications for the Australian and New Zealand dollars, given their close trade ties with China. The upcoming Chinese Manufacturing PMI will provide further insights into the health of the Chinese economy and its potential impact on the AUD and NZD.

Technical Outlook: Key Levels to Watch

From a technical perspective, several key levels are worth monitoring. The EUR/USD has recently broken above a significant resistance zone, opening the door for further upside potential. Similarly, both AUD/USD and NZD/USD have shown strong monthly performances, breaking through key resistance levels. However, some near-term resistance levels remain, and a break above these levels could signal further gains for these currency pairs.

Navigating the Week Ahead

This week promises to be another action-packed one for the currency markets. The Nonfarm Payrolls report, Eurozone CPI, and Chinese Manufacturing PMI will be the key data releases to watch. Traders should also keep a close eye on the technical levels highlighted above. With the dollar showing signs of vulnerability, the potential for further declines is high. However, surprises in the data could lead to unexpected market movements. As always, staying informed and adapting to the evolving market dynamics will be crucial for success.

Don’t miss our next fundamental analysis update! Subscribe to our newsletter and follow us on social media for more market insights and trading opportunities.

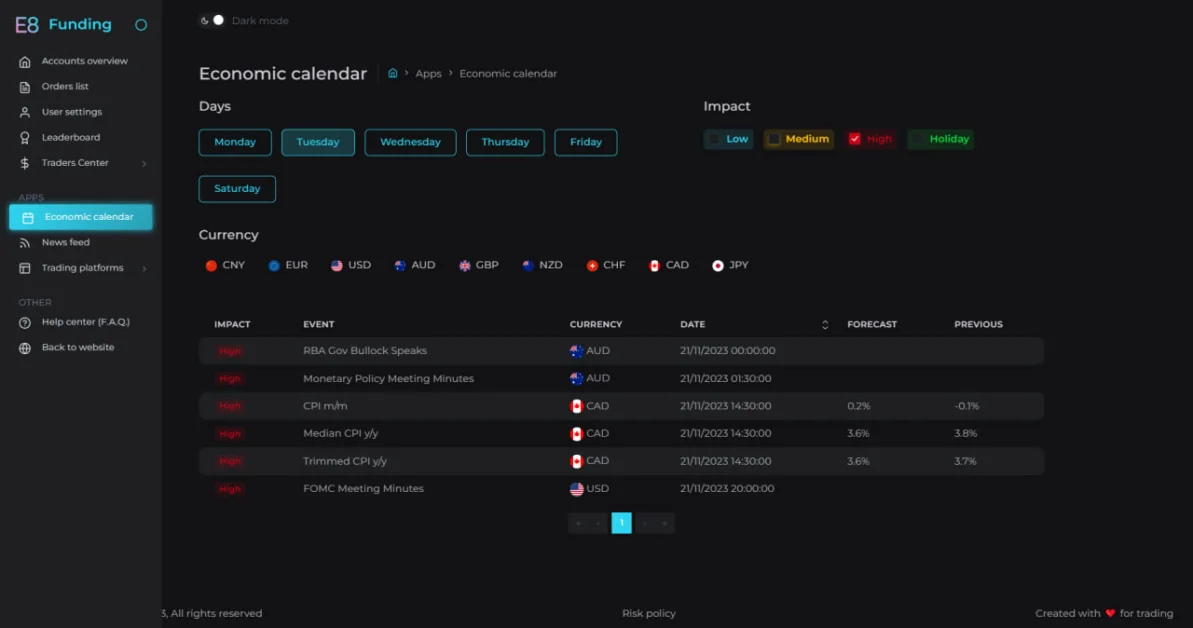

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.