Fundamental Analysis: Dollar’s Resilience & US Election

The US dollar continues in its remarkable resilience, maintaining an upward trajectory despite a backdrop of global uncertainty and a pivotal week for the US economy. This fundamental analysis delves into the factors supporting the dollar’s strength, explores the potential implications of the upcoming US elections, and examines the key economic events and central bank decisions that could shape its path in the days to come.

Dollar’s Underlying Strength: A Recap

The dollar’s recent dominance can be attributed to a confluence of supportive factors:

- Robust US Economy: The US economy continues to outperform expectations, with strong labor market data and resilient consumer spending. This underlying strength makes the US dollar an attractive investment compared to currencies of economies facing more significant headwinds.

- Sticky Inflation: While inflation has shown signs of cooling, it remains stubbornly above the Federal Reserve’s (Fed) 2% target. This persistent inflation suggests that the Fed may not be as aggressive with interest rate cuts as the market initially anticipated, which is supportive of the dollar.

- Geopolitical Tensions: Escalating conflicts and tensions in various parts of the world have fueled safe-haven demand for the dollar. As a global reserve currency, the dollar is often seen as a safe bet during times of uncertainty.

Technical Picture: A Bullish Outlook

The dollar’s strength is not only reflected in the fundamentals but also in the technical picture. The US Dollar Index (DXY), which measures the greenback against a basket of major currencies, has broken through key resistance levels, signaling further upside potential. The clean breakouts and strong momentum observed on various timeframes reinforce the bullish outlook for the dollar.

The US Dollar Index (DXY) is currently hovering around the recently surpassed 104.00 level, establishing a trading range in anticipation of a crucial week filled with significant data releases and economic events. A breakout from this range, coupled with a break of the immediate resistance at 105.00, could ignite a powerful bullish trend for the dollar.

US Election Commentary: Potential Implications for the Dollar

The upcoming US elections are adding another layer of complexity to the dollar’s outlook. While we refrain from making any political predictions or offering investment advice based on election outcomes, it’s important to acknowledge the potential market implications.

As mentioned in the video script, a victory for Donald Trump could lead to a “relief rally” for the dollar. This is because the market perceives some of Trump’s potential policies, such as tax cuts and tariffs, as inflationary. If inflation expectations rise, it could put pressure on the Fed to slow down its rate-cutting cycle, which would be supportive of the dollar.

On the other hand, a victory for Kamala Harris and the Democrats could lead to different market reactions, depending on their proposed policies and their potential impact on the US economy and inflation.

It’s important to emphasize that these are just potential scenarios, and the actual market reaction to the election outcome could vary depending on a multitude of factors.

Further discussion about the US Election and its impact on the Forex market will be available in our upcoming article.

Navigating the Week Ahead: Key Economic Events

This week is packed with crucial economic data releases and central bank meetings that could significantly impact the dollar’s trajectory. Here’s a breakdown of the key events to watch:

1. Federal Open Market Committee (FOMC) Interest Rate Decision

The FOMC will announce its latest interest rate decision this week. While a 25 basis point rate cut is largely priced in, the market will be focusing on the Fed’s communication and forward guidance. Any surprises in the Fed’s statement or press conference could trigger significant volatility in the dollar. The Fed’s assessment of the US economy and its outlook for inflation will be closely scrutinized by market participants.

The EURUSD pair recently tested the 1.0900 level, and traders are now anticipating the next move. A decisive break above this level could propel the pair towards 1.1000. Conversely, a bounce off 1.0900 may signal a potential return to October’s low of 1.0800.

2. Bank of England (BOE) Interest Rate Decision

The BOE will also announce its interest rate decision this week. With inflation cooling in the UK, a rate cut is widely anticipated. However, the market will be watching for clues about the BOE’s future policy path and its assessment of the UK economy. A more dovish than expected stance could weigh on the British pound. The BOE’s decision and its accompanying statement will be crucial for understanding the central bank’s outlook on the UK economy and its potential implications for the pound.

Should the Bank of England (BOE) adopt a dovish stance, the GBPUSD pair is likely to retreat to the 1.285 level, with a significant possibility of breaking below this support.

3. Reserve Bank of Australia (RBA) Monetary Policy Meeting

The RBA is scheduled to hold its monetary policy meeting this week. While no change in policy is expected, the market will be looking for any shifts in the RBA’s tone and forward guidance. Recent cooling in Australian inflation could prompt a more dovish stance from the RBA, potentially weighing on the Australian dollar. The RBA’s assessment of the Australian economy and its outlook for inflation will be key factors to watch.

Despite opening the week above 0.6600, the AUDUSD pair faces strong bearish pressure, suggesting a likely continuation of the downward trend. A break below the minor support at 0.6550 could pave the way for a decline towards 0.6500.

Positioning for Volatility and Opportunity

This week promises to be a volatile one for the forex market, with key economic data releases and central bank decisions occurring against the backdrop of the US elections. While the dollar has been on a strong uptrend, traders should remain vigilant and monitor these events closely. Any surprises could trigger sharp moves in currency markets.

Navigating the Dollar-Dominated Landscape

The dollar’s persistent strength presents both challenges and opportunities for traders. While the dollar’s uptrend may continue, it is essential to remain vigilant and monitor key economic data releases and central bank decisions. Any signs of a shift in the Fed’s policy stance or in the US economic outlook could trigger a reversal in the dollar’s fortunes.

E8X Dashboard

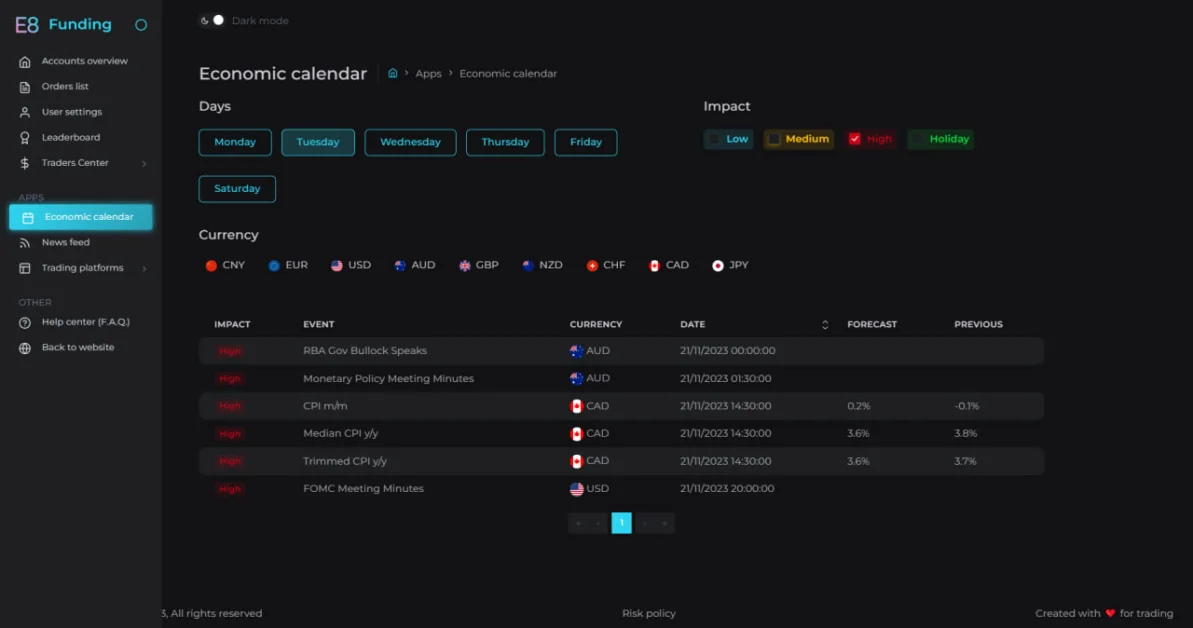

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Trade with E8 Markets

Start our evaluation and get opportunity to start earning.Suggested Articles:

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.