Market Overview: US Inflation & ECB Rates

Hello, traders! A new trading week begins, and E8 brings you a comprehensive Market Overview, detailing key economic happenings and insights to navigate the FX Market. Stay informed about market trends with our fundamental analysis.

Key Events of the Week Include:

- Consumer Confidence: Gauging consumer sentiment in Australia and Japan on Tuesday.

- Central Bank Decisions: RBNZ, BoC, and ECB all set their interest rates (Wednesday & Thursday) with the potential for clues on future monetary policy.

- Inflation Updates: The US and China release their Consumer and Producer Price Index figures (Wednesday & Thursday), offering insights into inflation trends.

- FOMC Minutes: Scrutinize the Federal Open Market Committee’s latest commentary on economic developments (Wednesday).

- UK Growth: The UK’s GDP growth rate for February lands on Friday.

Monday, April 8th, 2024

The European economic calendar starts slowly on April 8th. Switzerland’s unemployment held steady in March at 2.4% (non-seasonally adjusted), with a slight drop in unemployment figures (down 3,286 to 108,593).

However, Germany’s trade data tells a different story. The country’s February trade surplus narrowed to EUR 21.4 billion, falling below expectations and hitting its lowest level since October 2023. This decline is due to a combination of weaker exports and increased imports.

While the rest of the day holds no major releases, the focus shifts to central bankers later this afternoon. SNB Governor Thomas Jordan and BoE board member Sarah Breeden will discuss “Towards the future of the monetary system.” Their insights, while unlikely to cause immediate market shifts, will be valuable for understanding central bank perspectives.

Tuesday, April 9th, 2024

The second day of the week remains quiet, with only minor releases from Australia and Japan after midnight.

Starting in Australia at 1:30 am, the Westpac Banking Corporation and Melbourne Institute will release Consumer Confidence data. March saw a dip to 84.4, down 1.8% from February, due to economic and financial concerns. Analysts anticipate a slight rebound to 84.8, but no clear market consensus exists.

An hour later, the focus shifts to the NAB Business Confidence Index. Recent figures were below the long-run average, with retail struggling against high borrowing costs and inflation. While there’s no market consensus, economists expect a further decline to -3, indicating a negative outlook for Australia.

Japan releases its Consumer Confidence data at 6:00 am. February saw a rise to 39.1, marking six consecutive months of improvement. Forecasts suggest further optimism, signaling growing positivity among Japanese consumers.

The rest of the day holds no major economic releases. However, Martin Schlegel of the SNB will speak at 6:30 pm on “Interest rates and foreign exchange interventions: Achieving price stability in challenging times.” His insights may be worth noting.

Wednesday, April 10th, 2024

Wednesday starts with Japan’s Producer Price Index at 12:50 am, but the main focus will be on the RBNZ Interest Rate Decision. New Zealand’s central bank kept its official cash rate (OCR) unchanged at 5.5% in its first 2024 policy meeting, aligning with market expectations. While acknowledging easing core inflation and more balanced inflation risks, the RBNZ remains concerned about headline inflation exceeding its 1-3% target. The bank anticipates the need for restrictive rates for some time, despite slightly lowering its peak rate projection to 5.6%. Monetary easing is still expected to begin in mid-2025. Recent economic data has been mixed, and global factors, including China’s weak outlook and persistent global inflationary pressure, contribute to uncertainty. December 2023 saw New Zealand’s inflation ease to 4.7% (core to 4.4%), with housing costs as the main driver. Next week’s Q1 2024 data might influence the RBNZ’s stance, particularly regarding the timing of monetary easing.

The afternoon promises to be just as significant, with the U.S. Bureau of Labor Statistics releasing the latest inflation data and the Bank of Canada announcing its interest rate decision. Let’s dive into the CPI figures from the U.S., due out at 1:30 pm.

The Federal Reserve maintained the fed funds rate at a 23-year high of 5.25%-5.5% in March 2024, aligning with market expectations. Policymakers still project three interest rate cuts this year, consistent with December forecasts. They also anticipate three cuts in 2025 (one fewer than previously estimated) and three more in 2026. However, rate cuts hinge on inflation declining in line with the Fed’s forecast.

Wednesday’s CPI data is crucial, as the CME FedWatch Tool shows a 50/50 split on whether the Fed will cut rates or hold them steady at its July 12th meeting. Traders will scrutinize the inflation figures for clues about the Fed’s likely path. Currently, the market expects CPI YoY at 3.4% (up from February’s 3.2%) and a potential decline in the Core Inflation Rate from 3.8% to 3.7%.

The Bank of Canada will hold its monetary meeting at 2:45 pm. At the last meeting, the bank held its target for the overnight rate at 5% during its March meeting and pledged to continue normalizing the Bank’s balance sheet, as policymakers remained concerned about risks to the outlook for inflation. The bank stated that it will persist in its policy of quantitative tightening until it observes further and sustained easing in core inflation. Policymakers project inflation to remain close to 3% during the first half of this year before gradually easing. The bank also noted that GDP growth remained weak and below potential, while employment continues to rise more slowly than the population amid signs that wage pressures may be easing. During a press conference, Governor Macklem said it was too early to consider lowering rates as more time was needed to ensure inflation fell toward the 2% target. Even considering that the annual inflation rate in Canada slowed further to 2.8% in February from 2.9% in January 2024 and marking the lowest reading since June 2023, the bank will keep its Interest Rate unchanged continuing with the bank’s plan to start monetary loosening in the second half of the year. Even more information and clues will be delivered at the bank’s press conference just 45 minutes after the rate decision and monetary policy report.

The day concludes at 7 pm with FOMC commentary on recent economic developments. With major inflation data and the Bank of Canada decision earlier in the day, Wednesday promises significant volatility for USD pairs, particularly USD/CAD. Traders should manage positions carefully in the lead-up to the afternoon announcements.

Speeches:

- 07:00 AM – BoJ FGovernor Kazuo Ueda

- 01.:45 PM – FED Michelle Bowman

- 06:45 PM – FED Austan Goolsbee

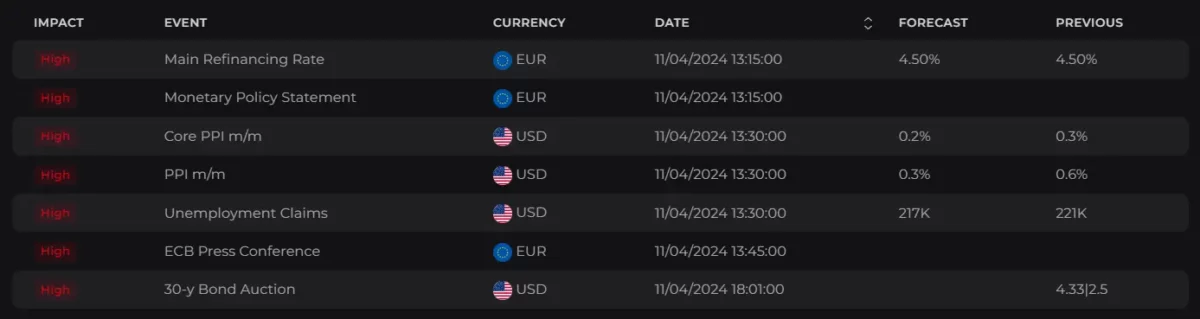

Thursday, April 11th, 2024

Thursday kicks off with China’s latest CPI and PPI figures. In a surprising turnaround, February’s consumer prices rose 0.7% year-over-year (YoY), exceeding market expectations (0.3%) and reversing January’s 14-year low (-0.8%). This marks the first inflation increase since August 2023, driven by strong Lunar New Year spending. However, analysts anticipate a slight decline in Thursday’s data, with a consensus forecast of 0.4% YoY growth.

Meanwhile, China’s producer prices continued their downward trend, falling 2.7% in February. This marks the 17th consecutive month of decline, highlighting ongoing economic challenges despite Beijing’s support measures.

The European Central Bank (ECB) will also make its interest rate and monetary policy decision this week at 1:15 pm. In March, the ECB held rates steady at historically high levels, citing a delicate balance between recession fears and persistent inflation. The main refinancing rate remains at a 22-year high of 4.5%, with the deposit facility rate at 4%. While the ECB projects 2024 inflation to average 2.3% (core inflation at 2.6%), current data shows signs of easing. March 2024’s Euro Area inflation rate fell to 2.4% year-on-year, while the core rate slipped to 2.9%. Despite nearing the ECB’s 2% target, economic uncertainty and the risk of resurgent inflation make immediate rate cuts unlikely. However, cuts could begin as early as June 2024. The bank’s press conference 30 minutes after the meeting will provide further insights.

At 1:30 pm, the focus shifts to the US with the release of the latest Producer Price Index (PPI) and labor market data. Both the PPI and its core measure are forecast to show a decline, signaling potential relief for US consumers. Should producers face lower costs, they may be less likely to pass on price increases.

The number of Americans filing new unemployment claims unexpectedly jumped by 11,000 to 221,000 for the week ending March 30th. This marks a two-month high and significantly exceeds market expectations of 214,000. The increase suggests a potential softening of the tight US labor market, possibly due to the delayed effects of higher interest rates. Analysts predict a slight decrease to 215K for this week.

NZD traders should keep an eye on the Business PMI release 30 minutes before the market closes.

Speeches:

- 01:45 PM – FED John Williams

- 05:00 PM – FED Susan M. Collins

- 05:30 PM – BoE Megan Greene

- 06:30 PM – FED Raphael Bostic

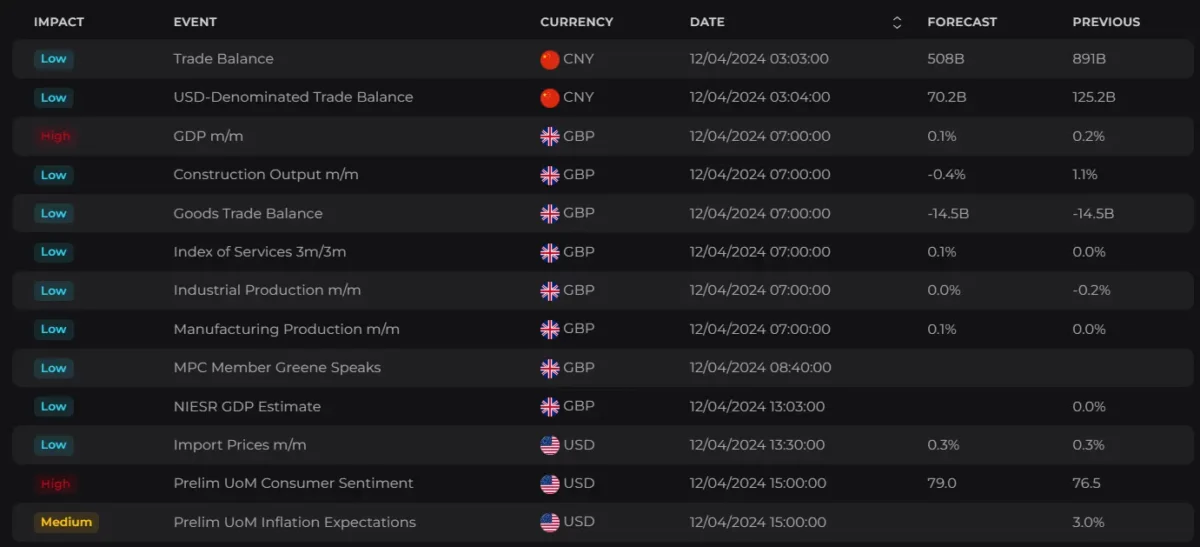

Friday, April 12th, 2024

China kicks off Friday’s data releases with its international trade figures. The country’s trade surplus grew significantly in January-February 2024, reaching USD 125.16 billion. This surpassed market expectations (USD 103.7 billion) and marked an increase from USD 103.8 billion in the same period last year. The growth is attributed to a rise in exports exceeding import growth. However, analysts forecast a significant decline in the surplus for March, predicting a value of only USD 69.55 billion, roughly half of what China recorded in Jan-Feb.

The UK releases key economic data early, including GDP Growth Rate, Balance of Trade, and Industrial and Manufacturing Production figures. Economists forecast a modest 0.1% GDP expansion in February, following 0.2% growth in January. This rebound came after a technical recession in the second half of 2023, largely driven by strength in the services sector, particularly retail trade.

The week wraps up with the release of the Michigan Consumer Sentiment Index at 3 pm. This important index gauges how optimistic consumers feel about their finances and the overall economy, both in the short and long term.

Speeches:

- 07:00 AM – BoE Megan Greene

- 12:00 PM – ECB Frank Elderson

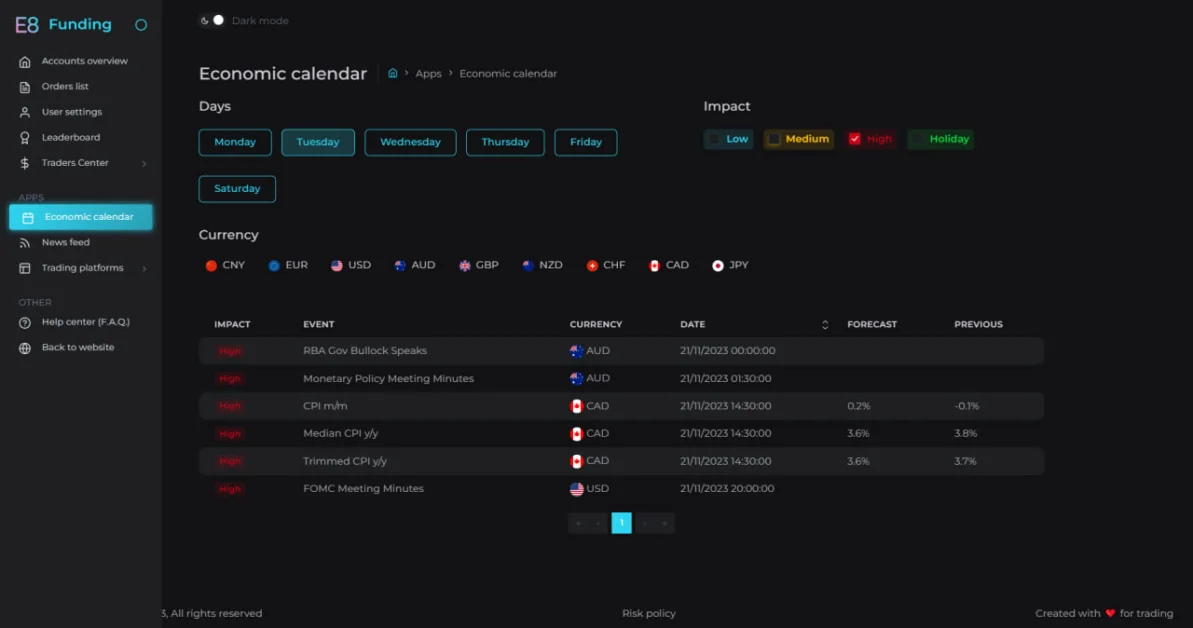

E8X Dashboard

If you’re new to our Economic Calendar, explore our detailed guide to learn more!

The Trader’s Toolbox: Mastering the Economic Calendar

Stay ahead of key economic events and data releases with our E8X Dashboard. It’s all there under the Economic Calendar tab, offering a user-friendly interface for your convenience.

Article topics

Trade with E8 Markets

Start our evaluation and get opportunity to manage our capitalDisclaimer

The information provided on this website is for informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We do not endorse or promote any specific investments, and any decisions you make are at your own risk. This website and its content are not responsible for any financial losses or gains you may experience.

Please consult with a legal professional to ensure this disclaimer complies with any applicable laws and regulations in your jurisdiction.